Navigation: Loans > Loan Screens > Investor Reporting Screen Group > Sell Loan To Investor Screen >

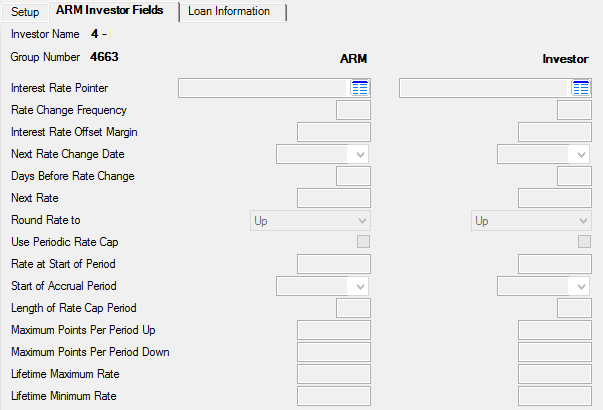

When selling an ARM loan, you can use this tab to enter and transfer additional fields to the Loans > Investor Reporting > Loan Investor Fields screen that are part of the individualized loan record.

|

WARNING: If the loan being sold is an ARM (payment method 7 or payment method 6 with the User ARM fields marked) then complete this tab before completing the Setup tab. If this tab is accessed for any type of loan besides ARM, the system will display the message “MUST BE AN ARM LOAN." |

|---|

Loans > Investor Reporting > Sell Loan To Investor Screen, ARM Investor Fields tab

The Investor Name tied to the account (as set up on the Loans > Investor Reporting > Investor Master screen) as well as the investor master and Group Number (as pulled from the Loans > Investor Reporting > Investor Group screen) are displayed at the top-left of this screen.

Transferring Information

Every field on this tab appears twice. In the ARM column, the system displays ARM fields as they appear on the Loans > Account Information > ARM Information screen. When <Transfer and Save> is pressed, the system will transfer all field information shown in the ARM column to the corresponding fields in the Investor column. That information will then be transferred by the system to the Loan Investor Fields screen.

Changing Information

Information in the ARM column fields can be changed on this tab as needed. This will not change the information found on the ARM Information screen. However, this feature allows you to pass different data to the Loan Investor Fields screen rapidly.

Service Fee Adjustments

Some fields that have the potential for being adjusted by the service fee rate on the loan are Interest Rate Offset Margin, Next Rate, Rate at Start of Period, Lifetime Maximum Rate, and Lifetime Minimum Rate (see table below). For example: If the Interest Rate Offset Margin is 3.50% and the service fee rate on the loan is .250%, then you would adjust this field to 3.25%. If any of the five fields mentioned above are blank in the ARM column, they should not be adjusted by the service fee rate on the loan.

The fields on this tab are as follows:

Field |

Description |

||

|

Mnemonic: LNAMPT |

This field displays the index rate pointer used on the account as indicated on the Loans > Account Information > ARM Information screen. Index rate pointers and descriptions are institution-defined and created/edited on the Loans > System Setup Screens > Interest Rate Table screen. |

||

|

Mnemonic: LNAMFQ |

This field displays the rate change frequency for the loan as indicated on the Loans > Account Information > ARM Information screen. |

||

|

Mnemonic: LNAMOF |

This field is used in conjunction with the rate pointer (see above) and the rate tables system. It displays the interest rate offset margin as indicated on the Loans > Account Information > ARM Information screen. This value can be either positive or negative to allow points above or below the rate indicated by the rate index. |

||

|

Mnemonic: LNAMDT |

This field displays the next rate change date on the loan as indicated on the Loans > Account Information > ARM Information screen. |

||

|

Mnemonic: LNAMAD |

This field displays the number of days before the next rate change as indicated on the Loans > Account Information > ARM Information screen. |

||

|

Mnemonic: LNAMNA |

This field displays the next rate to be used for the loan as indicated on the Loans > Account Information > ARM Information screen. This rate will become effective with the payment due on the Next Rate Change Date (see above). The system can only accept prepayments up to the installment associated with the Next Rate Change Date.

|

||

|

Mnemonic: LNRRND, LNRRTQ, LNNRRS, LNRR10 |

This field displays how the interest rate will be rounded as indicated on the Loans > Account Information > ARM Information screen. Possible entries are eighths (1/8), quarters (1/4), sixteenths (1/16), or tenths (1/10). |

||

|

Mnemonic: LNRCAP |

Use this field to indicate whether the account uses a periodic rate cap. See below for more information.

|

||

|

Mnemonic: LNAMSY |

If the Use Periodic Rate Cap field above is marked, this field displays the rate as it existed at the start of the rate cap period. Maximum and minimum points upward or downward will key off this rate for the rate cap period. This information is pulled from the Loans > Account Information > ARM Information screen. |

||

|

Mnemonic: LNAMPD |

If the Use Periodic Rate Cap field above is marked, this field displays the starting date of the current rate cap period on the loan. This field is automatically updated based on the Length of Rate Cap Period field below. See below for more information.

|

||

|

Mnemonic: LNAMLP |

If the Use Periodic Rate Cap field above is marked, this field indicates the length of the rate cap period in months. This number is typically the same as the rate change frequency, but not always. This information is pulled from the Loans > Account Information > ARM Information screen. See below for an example.

|

||

Maximum Points Per Period Up/Down

Mnemonic: LNAMRU, LNAMRD |

If the Use Periodic Rate Cap field above is marked, these fields indicate the maximum and minimum points per period that the loan accrual rate can be increased by. This information is pulled from the Loans > Account Information > ARM Information screen. |

||

|

Mnemonic: LNAMHI, LNAMLO |

These fields display the lifetime minimum and maximum rates that are allowed on the loan as indicated on the Loans > Account Information > ARM Information screen. These numbers should be entered as a rate, e.g., 17.00000. |