Navigation: Loans > Loan Screens > System Setup Screens >

The Loans Interest Rate Table is used by your institution to set up and maintain interest rates pertaining to the loan servicing and loan origination systems.

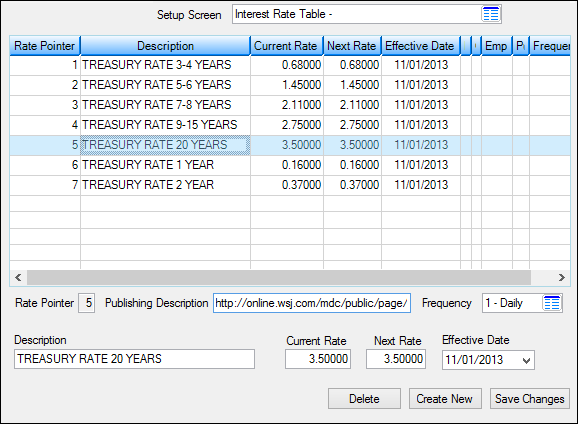

Loans > System Setup Screen > Interest Rate Table Screen

You can define rate pointer numbers and descriptions that identify what index the pointers represent. For example, you can define rate pointer 1 to be the 6-month T-bill. This pointer number is then tied to all loan accounts for that index during loan origination or through file maintenance of the Interest Rate Pointer field on the Loans > Account Information > Account Detail screen or the Index Rate Pointer on the Loans > Account Information > ARM Information screen (depending on the payment method).

In addition to the rate pointer and description, your institution can enter the current rate. As the index changes, you can enter a new rate and the effective date. During the afterhours process, each loan looks at the Interest Rate Table and determines if the loan rate should change. If so, it pulls the correct rate from this table, eliminating the need for you to change the loan rate manually.

Both rate-sensitive and adjustable-rate loans use the loan Interest Rate Table in System Setup. Rate sensitive means that a rate on a loan will change any time the index changes. For example, if the rate index changes twice in a month, the loan rate would also change at the same time. Adjustable-rate loans (ARMs) indicate that the loan rate will change based on a determined date (e.g., every 6 months, yearly). Note that LIP (construction) loans also use the Rate Table.

For ARM loans, fields set up on the loan account ARM Information screen indicate to the system when to check the rate table, margins, etc., for the loan. For both ARM loans and rate-sensitive loans, margins can also be set up on the loan records. In addition, LIP loans can be either rate sensitive or have predetermined change dates.

The GOLDTrak® PC system also uses this table to determine the rate to be used for a loan in the origination process. The rates are used in APR calculations, preparing documents, etc. Loan interest record retention periods can be set for your institution on the Deposits > Definitions > System History Retention screen.

Update Functions: Institution update functions 38 (perform floating rate rolls) and 39 (perform fixed-term rate rolls) must be set to “daily.” Update function 63 (moves the next rate into the Current Rate field in the Rate Table) must be set to “daily.”

This is an administration screen and access to it should be limited. (See warning below.)

Reports: Changes will also appear in the System File Maintenance Report (FPSDR055). This is a deposit report that is run daily in the afterhours.

System History: Changes to fields on this screen do write to system history as type RT.

|

WARNING: Once a rate pointer description has been assigned, it should not be changed. When a rate pointer is assigned to a loan, that rate pointer is stored on the loan record but the description is not stored. When a screen is accessed, the program uses this table to look up the description. If the description has been changed, incorrect descriptions would be displayed. |

|---|

Notifying Customers of Rate Changes

Due to new Truth-in-Lending (Reg Z) changes, your institution is required to include rate publishing information on ARM rate change notifications. Rate publishing information does not need to be set up for all rate pointers (indexes); for example, line-of-credit or auto loans. However, it must be set up for all ARM mortgage loans as this information is displayed on ARM rate change notifications (event letters (events 1-4, 6-8, 10, 11, 17-20, 37, 38, and 40) and the Initial Rate Change Notices (FPSRP314)).

You can add the publishing fields to your ARM event letters by using the following merge fields from the Data Source Control file that is downloaded from GOLD EventLetters:

Field |

Description |

<<ARM NAME OF RATE INDEX>> |

This is the index publishing description (e.g., Treasury Rate 3-4 years). |

<<ARM SOURCE OF RATE INDEX>> |

This is where the index is published (e.g., Wall Street Journal). |

<<ARM INDEX PUBLISHING FREQUENCY>> |

This is the publishing frequency (e.g., daily, weekly). |

See the GOLD EventLetters User's Guide, Appendix A - Merge Field Descriptions, for a list of all possible ARM event numbers and their respective merge fields.

Field Descriptions

Field |

Description |

||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

|

This list view displays rate pointers, their descriptions, their current rates, next dates, and effective dates, as well as the date the description was set up or changed, and the employee number and name of the employee who made the last change to that description. It also displays the rate publishing description and the publishing frequency.

To set up a new rate pointer description:

•To change information for an item on the list, highlight the item and then change the information in the fields below. •To delete an item from the list, highlight it and click <Delete>. •To delete a range of items at once, press <Shift> while highlighting the range. •To delete multiple non-consecutive items at once, press <Ctrl> while selecting the items. |

||||||||||||||

|

Mnemonic: RTPTR |

This field is used to enter a new rate pointer number. Rate pointer numbers can be 1 through 255 and are user-defined. All rate pointers you enter from this screen will be displayed in the list on the pointers represent. For example, you can define rate pointer 1 to be the 6-month T-bill. This pointer number is then tied to all loan accounts for that index during loan origination or through file maintenance of the Interest Rate Pointer field on the Loans > Account Information > Account Detail screen or the Index Rate Pointer on the Loans > Account Information > ARM Information screen (depending on the payment method). |

||||||||||||||

|

Mnemonic: RTPBDS |

This field is used to enter a new description of where the rate information is published (such as the Wall Street Journal) or to edit an existing one. Note: This information should be included in ARM adjustment notices generated through the Initial Rate Change Notices (FPSRP314) or GOLD EventLetters (events 1-4, 6-8, 10, 11, 17-20, 37, 38, and 40). Be sure the spelling is correct.

You can also enter a URL address of where the rate is published on the Internet, such as "http://online.wsj.com/mdc/public/page/moneyrate.html."

Your institution is responsible for adding the merge fields to your event letters. You can add the publishing fields to your ARM event letters by using the merge fields discussed in the Notifying Customers of Rate Changes section above.

See the GOLD EventLetters User's Guide, Appendix A - Merge Field Descriptions, for a list of all possible ARM event numbers and their respective merge fields.

|

||||||||||||||

|

Mnemonic: RTPBFQ |

Use the drop-down list to select the frequency that the rate information is published. Choices are annually, daily, monthly, quarterly, or weekly. |

||||||||||||||

|

Mnemonic: RTCL34 |

This field is used to enter a description for a new rate pointer. For example, you could enter "Treasury Rate 1-2 Years" or "12 Mth T Bill." To update changes to this field, click <Save Changes>.

This information can be included on ARM event letters by including the merge field <<ARM NAME OF RATE>> into the letter you create using Microsoft® Word. See Tying Data Source Files Using Word 2010 from the Other > GOLD EventLetters manual in DocsOnWeb.

|

||||||||||||||

|

Mnemonic: RTRATE |

This field contains the rate that is currently in use for that rate pointer. To update changes to this field, click <Save Changes>. |

||||||||||||||

|

Mnemonic: RTRTNX |

This field is used to enter the new rate that will replace the one currently in use for that rate pointer. To update changes to this field, click <Save Changes>. |

||||||||||||||

|

Mnemonic: RTDTEF |

This field is used to enter the date the new rate will become effective on accounts using this rate pointer. This date must be equal to or greater than today's date for loans. Rates will change in the afterhours, so the new rate will show on the account the morning after the effective date.

Example for rate-sensitive loans: The effective date in the rate table is 7-1. During the afterhours process the night of 7-1, the loan will accrue interest up to 7-1 at the old rate and then change the loan rate to be the new rate. The morning of 7-2, you will see the new rate on the loan. If the loan is set up to use margins or rounding, the new rate will be calculated using those fields.

To update changes to this field, click <Save Changes>. |

|

Record Identification: The fields on this screen are stored in the FPRT record (Rate Table Record Loans). You can run reports for this record through GOLDMiner or GOLDWriter. See FPRT in the Mnemonic Dictionary for a list of all available fields in this record. Also see field descriptions in this help manual for mnemonics to include in reports. |

|---|

In order to use this screen, your institution must:

•Subscribe to System Setup Screens on the Security > Subscribe To Mini-Applications screen.

•Set up employees and/or profiles with either Inquire (read-only) or Maintain (edit) security for System Setup Screens on the CIM GOLD tab of the Security > Setup screen. |