Navigation: Loans > Loan Screens > Account Information Screen Group > Account Detail Screen > Account tab > Payment and Classification field group > Payment Method 0: Conventional Loans >

Your institution needs Update Function 84 set up in order to direct funds from the Partial Payments field to the P/I Constant field or Principal Balance field as described in this help topic. Your institution's GOLDPoint Systems account manager should have set Update Function 84 when you first acquired conventional (payment method 0) loans.

Update Function 84 runs tran code 2600-08 to make a payment by moving funds from Partial Payments. Tran code 2600-08 requires that the loan have a Due Date equal to or less than the date Update Function 84 runs. When Update Function 84 runs, a 600 payment transaction is run for the regular payment amount and a Partial Payment Decrease (tran code 500-33) is run for the same amount to decrease Partial Payments.

|

Note: Tran code 2600-08 is a system transaction and cannot be found in teller transactions in GOLDTeller. |

|---|

Update Function 84 can be run daily, weekly, or monthly.

To qualify for this function, the loan must meet the following conditions:

•The loan must be a payment method 0, 4, or 7 loan.

•The loan cannot have any holds that cannot be overridden. (For instance, the loan cannot have a hold code 7—legal hold/foreclosure.)

•The loan cannot be "locked in" for a payoff or payment reversal.

•There must be enough funds in the Partial Payments field to post at least a full payment (Next Payment Due).

•The Due Date must be equal to or less than the run date (the date Update Function 84 runs). (Refer to option OPPP PPPA below.)

This process functions as follows:

With Update Function 84 set, assuming none of the relevant institution options are set, the system will compare the loan payment (Next Payment Due) with the amount in Partial Payments during the afterhours. If there is enough money in Partial Payments to post a full payment, the system will post a loan payment (tran code 2600-08, which shows as tran code 600 in History) and then debits Partial Payments by the Next Payment Due amount (tran code 500-33).

If the amount in Partial Payments adds up to more than the Next Payment Due amount, the system will subtract the amount of the full payment from Partial Payments when Update 84 function runs, and the remainder of funds will stay in Partial Payments (unless institution option PPPC is set, in which case extra funds will go toward reducing the Principal Balance (curtailment)).

If the amount in Partial Payments does not add up to a full payment amount, the amount will remain in Partial Payments until payoff or until your institution manually handles those funds. The Partial Payments field should be used as a collection device to encourage the borrower to make a full payment, or enough of a payment to clear out Partial Payments.

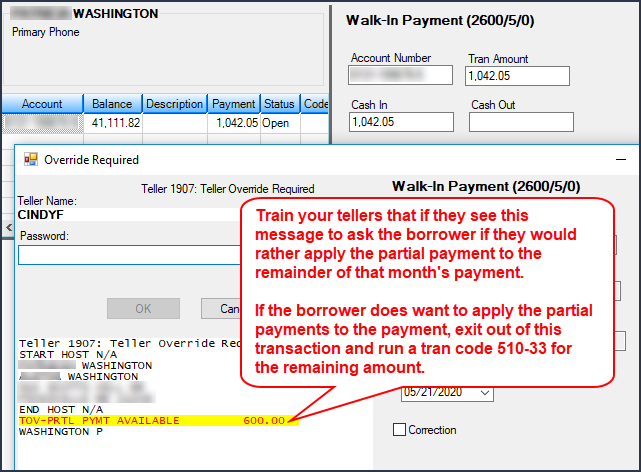

In fact, a message will appear in GOLDTeller any time an account has Partial Payments, as shown below:

When tellers see that message, it's a prompt for them to ask the borrower questions, such as: "You still have funds from a previous payment. Would you like to pay the remainder to make a full payment?"

If the borrower does want to make a payment for the remaining amount owed that month, the teller could do one of two things:

1.Calculate the remainder of funds necessary to make a full payment (subtract the current Partial Payments amount from the Next Payment Due), then run another Partial Payment Increase (tran code 510-33) for the remaining amount (either Check In or Cash In) and let the afterhours apply the full payment (assuming the Due Date is less than today’s date and Update Function 84 is running daily).

2.The second method tellers could use to process partial payments isn’t recommended, as it takes balancing journals and the Due Date does not advance. However, if the customer wants to apply the Partial Payment to the Principal Balance, this option is available. You should only allow this method if the loan is current (the Due Date is in the future):

a.Start by running a Partial Payment transaction for the remaining amount of the loan payment (subtract the current Partial Payments amount from the Next Payment Due). You can only use GOLDTeller to process this payment, because you need to balance the account with the next two journal transactions, and ACH and debit/credit cards wouldn’t work because the system would require a full payment amount.

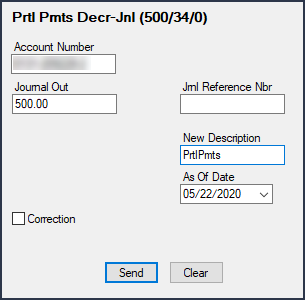

b.Next, run a Partial Payment Decrease by Journal (tran code 500-34) for the amount in Partial Payments. See below:

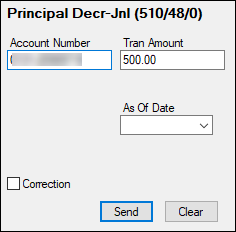

c.Finally, run a Principal Decrease by Journal (tran code 510-48) for the amount in Partial Payments. See below:

These transactions will show on the Loans > History screen.

|

Note

Partial payments are not allowed for ACH or card payments. Only full payments are allowed with those payment types because they require a transmission. Currently, there is no way to send only a partial payment through such transmissions for conventional loans. Users with the proper security can perform some minor manipulation with the P/I Constant to reduce it by the amount the borrower wants to pay and then change the P/I Constant back after the payment, but that option is not recommended as your institution may miss out on some interest. |

|---|

Example

The Next Payment Due on a loan is $500. A collector calls the borrower about a missed payment. The borrower says they could make a $300 payment now but don’t have enough for the full $500. The collector takes the $300 payment (via Check In) and runs a tran code 510-33 that puts the $300 in the Partial Payments field. Later that month or next month, a full payment has still not been made. A collector talks to the borrower and encourages the borrower to make at least a $200 payment to avoid late charges for that month. The borrower makes the $200 payment, and the teller runs another tran code 510-33 for the $200 amount. In the afterhours, the system will move the $500 amount in the Partial Payments and apply it as a payment. The Due Date will move ahead one month.

Holiday Payment Example

A teller could use Partial Payments to skip a payment in December during the holiday season. To do this, customers would need to pay a small additional amount each month. But tellers shouldn’t run the full amount of the payment through a regular payment transaction. Instead, they should run a payment for the full amount (Next Payment Due), but then they should use the Partial Payments Increase transaction (tran code 510-33) to apply any extra amount to Partial Payments. They should do this each month with the payment. Then, when Partial Payments has enough funds to make a full payment, the system will run Update Function 84, apply the payment, and roll the Due Date, allowing the customer to essentially skip a payment.

Institution Options

Three institution options pertaining to paying late charges and miscellaneous fees, allowing the loan to be paid in the future, and processing excess funds as a curtailment are also available in relation to Partial Payments. See the Partial Payment Options help topic for more information.

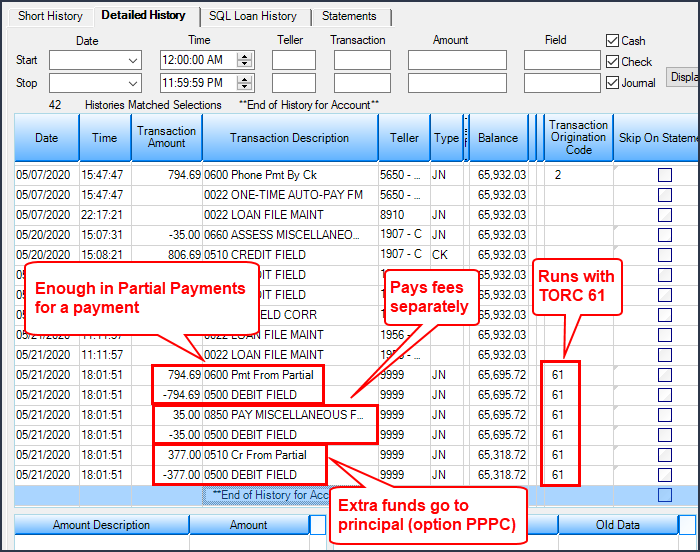

History

All transactions are posted with a TORC 61 (partial payments). They are identified in Loan History as a payment from partial payments (tran code 600), except if any loan miscellaneous fees are involved with the Partial Payment transaction. Those are recorded separately in History. See the example below:

All transactions will appear in the Transaction Journal by Tran Origination Code Report (FPSRP041). Any transactions that fail will appear on the Afterhours Processing Exceptions Listing (FPSRP013).

If the Partial Payments field never adds up to a full payment amount, the funds will stay in Partial Payments until payoff when the system balances the totals and applies the payment.

The Partial Payments Report (FPSRP198) shows all loans with Partial Payment funds.

|

WARNING: Prior to using this function, please contact the GOLDPoint Systems financial team, as your Autopost may need to be adjusted for TORC 61. |

|---|