Navigation: Loans > Loan Screens > Account Information Screen Group > Account Detail Screen > Account tab > Payment and Classification field group > Payment Method 0: Conventional Loans >

Generally speaking, the Due Date (LNDUDT) for conventional loans (payment method 0) cannot be changed once the loan has been originated. However, your institution’s policies may allow for limited Due Date changes, such as a borrower needing their payment to be due three days later.

Loan documents should clarify if and when Due Date changes are possible. For example, some institutions may allow one Due Date change, but only within the same month of payment, such as moving from a Due Date at the beginning of the month to the end of the month. Another requirement might be that the loan is current (Due Date is today or in the future).

If your institution does allow limited Due Date changes, this help topic explains how. The Due Date should only be changed within a given payment period (Date Last Accrued to Due Date). Because interest is accrued monthly, changing the Due Date should not affect the amount of interest due as long as the Due Date is changed within the payment period.

To successfully change the Due Date, first change the Interest Due To field (LNDLAC) to the day of the month that will become the new Due Date. This field is only file maintainable on the Interest Detail tab of the Loans > Account Information > Account Detail screen. After changing that field, the Due Date can be changed to correspond appropriately by file maintaining the Due Date field on the Account tab of the same screen.

|

Note: These instructions assume the user has proper security to change these fields. |

|---|

For example: The Date Last Accrued (otherwise known as Interest Due To) is 06/02/2020 and the borrower would like the Due Date to be moved to the 15th because that’s their payday. The user would change the Interest Due To to 06/15/2020, as well as the Due Date to 07/15/2020, then click <Save Changes>.

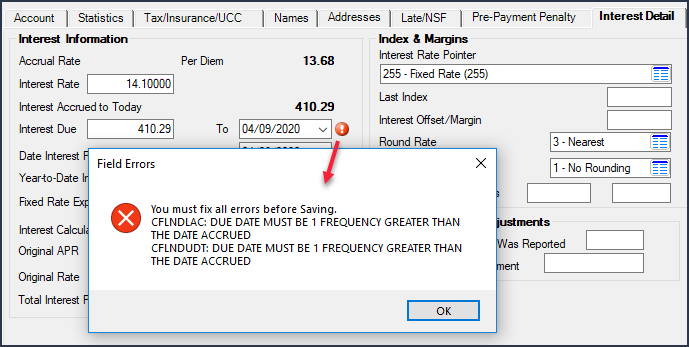

If you attempt to change either field without changing the other field and you click <Save Changes>, the following error message will be displayed: