Navigation: Loans > Loan Screens > Transactions Screen Group > Payment Adjustment Screen >

Use this tab to manually reverse or insert payments on a customer loan account. Note that this screen cannot be used to adjust payment on line-of-credit loans.

Payment reversals and insertions are generally used to correct errors. For example:

•A reversal could be used to remove a duplicate payment accidentally processed on an account.

•An insertion could be used to retroactively apply a payment to a customer's account if that customer's dropbox payment was initially misplaced and later recovered by your institution.

System history of corrected transactions and their effects on the customer account can be viewed on the History Analysis tab of this screen.

There are two actions that can be performed using the small sub-tabs on the left side of this tab: Payment Removal (reversal) and payment Insertion. See below for more information about each of these actions. Remember that all payments reversed and inserted using this screen are subject to the distribution hierarchy indicated by the Payment Application field group.

The list view on the right side of this screen displays all payment transactions on record for the selected account.

Use the small Remove sub-tab on the left side of this tab to reverse payments previously run on the account.

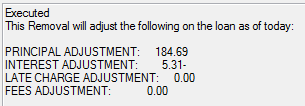

To reverse a payment, select the desired payment in the list view and click <Execute Remove>. If there are no errors that the payment reversal would cause (for example, a payment reversal can't take the amount of interest due negative), the reversal will be processed and the text box at the bottom of the screen will display the effect the payment reversal had on the Principal, Interest, Late Charge, and Fees amounts, as shown in the example below:

When a payment reversal is run on this screen, the system performs the following actions:

1.Reverses the payment as of the current date.

2.Offsets the transaction to the proper General Ledger account at your institution, unless the reversed payment was made in cash (in which case it must be reversed by cash).

3.Runs adjustment transactions to bring amortizations and interest accruals to the proper values. These adjustments will affect the Year-to-Date Interest, Interest Accrued To, Date Interest Paid To, and Interest Accrued information on the account.

4.Runs NSF assessments based on the NSF options used by your institution (see help for the NSF Fields on the Loans > Account Information > Account Detail screen for more information).

|

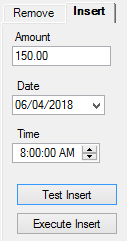

Use the small Insert sub-tab on the left side of this tab (shown below) to manually add a payment transaction to the account.

To insert a payment, use the fields on this tab to indicate the payment Amount and the Date/Time for which the system should record the inserted payment as having taken place. Note that all payments inserted using this screen must be indicated as having taken place on a Date/Time prior to the most recent transaction on the account. Once all information in this field group is in order, click <Execute Insert>.

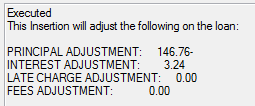

The insertion will be processed and the text box at the bottom of the screen will display the effect the payment insertion had on the Principal, Interest, Late Charge, and Fees amounts, as shown in the example below:

|