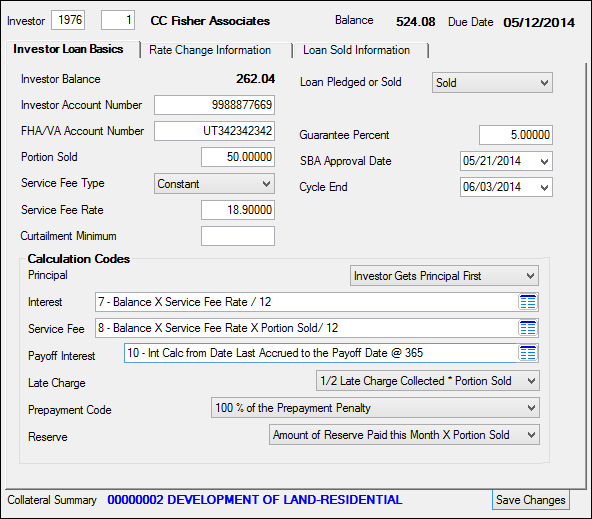

Navigation: Loans > Loan Screens > Investor Reporting Screen Group > Loan Investor Fields Screen >

Use this tab to view and edit investor loan calculation information for the selected customer loan account.

Investors are set up for your institution on the Loans > Investor Reporting > Investor Master screen and organized into groups on the Loans > Investor Reporting > Investor Group screen. Assign an investor and group to the customer account using the Investor fields at the top of the screen.

Loans > Investor Reporting > Loan Investor Fields Screen, Investor Loan Basics Tab

The system will automatically enter information on this tab from the Investor Master and Investor Group screens. Information entered on this screen overrides information entered in other Loans > Investor Reporting screens.

The fields on this tab are as follows:

Field |

Description |

||

|

Mnemonic: LNWORK |

This field displays the investor’s portion of the customer loan account's principal balance. If the loan has an LIP Method Code greater than zero, the investor's portion of the disbursed balance is displayed.

This amount is a calculated amount using the principal balance (or the disbursed balance) multiplied by the percent sold. |

||

|

Mnemonic: LNIACT |

Use this field to indicate the account number by which investors refer to the customer loan on their system.

If "FNMA" or “FHLMC" is entered in the Investor Identifier field on the Investor Master screen, the system will display an online error message if a valid investor account number does not exist for this loan (or if the investor loan number is an incorrect size). |

||

|

Mnemonic: LNFVNO |

Use this field to indicate the FHA or VA number assigned to the customer loan account.

|

||

|

Mnemonic: LNISLD |

Use this field to indicate the percentage of the customer loan that has been sold to the investor. This information is copied from from the Portion Sold field on the Investor Group screen (if valid information is entered in the Investor fields). The value entered in this field overrides any value entered in the Portion Sold field on the Investor Group screen for the customer loan. |

||

|

Mnemonic: LNISFC, LNISFM |

Use this field to indicate a service fee type guaranteed rate roll option. Possible selections in this field are "Constant," "Minimum," or left blank.

•"Constant" indicates that the service fee is constant. When the loan rate is calculated, the next guaranteed rate is also calculated by subtracting the service fee from the next loan accrued rate.

•"Minimum" indicates that the service fee will be the lowest amount assessed. After the next loan accrued rate and next guaranteed rate are calculated, the difference between the two rates is determined. If the difference is less than the minimum service fee, the next guaranteed rate is recalculated by subtracting the minimum service fee from the next accrued rate. If the "minimum" option is selected, a service fee code of “9” or “10” must be entered in the Service Fee field on this screen. |

||

|

Mnemonic: LNISVC |

Use this field to indicate the rate charged to the investor for servicing the customer loan account. This information is copied from from the Service Fee Rate field on the Loans > Investor Reporting > Investor Group screen (if valid information is entered in the Investor fields). The value entered in this field overrides any value entered in the Service Fee Rate field on the Investor Group screen for the customer loan.

See help for the Service Fee field to learn more about service fee calculation. |

||

|

Mnemonic: LNICMN |

Use this field to indicate the minimum curtailment (extra principal payment) acceptable by the investor (or by your institution) for unsold loans. If this field is left blank, any curtailment amount is accepted. If a negative number is entered in this field, no curtailment amount is accepted.

This information is copied from from the Curtailment Minimum field on the Loans > Investor Reporting > Investor Group screen (if valid information is entered in the Investor fields). The value entered in this field overrides any value entered in the Curtailment Minimum field on the Investor Group screen for the customer loan.

|

||

|

Mnemonic: LNPLDG |

Use this field to indicate whether the customer loan account has been pledged or sold to the investor. Leave this field blank to indicate that the customer loan is still owned by your institution.

•If "Sold" is selected, the loan's investor information on this screen will be entered automatically when the loan is Service Released.

•If “Pledged” is selected, the loan investor information may be changed on this screen, but the loan will not appear on any investor reports until its status is changed to "Sold." The Investor Collection Report (FPSRP046) and the LIP Investor Collection Report (FPSRP072) have options to include pledged loans.

•SBA loans (as indicated in the Investor Identifier field on the Investor Master screen) that are not sold should have "Pledged" selected in this field.

For more information, see help for the Pledged for Collateral field on the Loans > Account Information > Additional Loan Fields screen. |

||

|

Mnemonic: MRGRTE |

Use this field to indicate the percentage of the customer loan guaranteed by SBA. This field is only used for unsold SBA loans (as indicated in the Loan Pledged or Sold field above and the Investor Identifier field on the Loans > Investor Reporting > Investor Master screen). |

||

|

Mnemonic: MRAPPD |

Use this field to indicate the date the customer loan was approved by SBA (if the loan has an SBA identifier as indicated in the Investor Identifier field on the Loans > Investor Reporting > Investor Master screen).

When the run date of the SBA Monthend Report (FPSRP020) is more than 90 days after the date in this field, the loan is reported as a status code 9 if no disbursements have been made on the loan (identified by action code 69). This applies to loans in process (LIP) and line-of-credit loans (payment method 5, 9, or 10) that have not yet advanced funds on the loan. |

||

|

Mnemonic: MRDLC |

Use this field to indicate the current cycle end date. This field is updated in the afterhours through the Norwest Scheduled/Scheduled Investor Report (FPSRP032). This field will not be updated when an interim report is created. It is only updated at cutoff. |

||

Calculation Codes field group |

See Calculation Codes field group for more information. |