Navigation: Loans > Loan Screens > Investor Reporting Screen Group > Loan Investor Fields Screen > Rate Change Information tab >

Guaranteed Rate field group

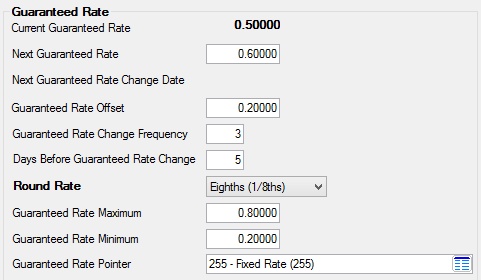

Use this field group to view and edit investor rate information for the selected customer loan account.

The fields in this field group are as follows:

Field |

Description |

||||||||||||

|

Mnemonic: LNIGRT |

This field displays the rate (yield) guaranteed to the investor for the selected customer loan account.

For payment method 0, 5, 9, 10 (fixed or rate-sensitive), or 6 (fixed or rate-sensitive) loans, this field is file maintainable. For payment method 5, 9, 10 (rate-sensitive,) or 6 (rate-sensitive) loans, this field will automatically be updated the night of the loan rate roll. This rate will be calculated by subtracting the Service fee from the interest rate.

The loan must be indicated as Sold and include valid Investor numbers in order for this field to be updated. If the loan is indicated as Pledged, the guaranteed rate does not change.

|

||||||||||||

|

Mnemonic: LNIGNX |

Use this field to indicate the next Guaranteed Rate that will be used for the selected customer loan account (and become effective on the Next Guaranteed Rate Change Date below).

When the system calculates this field, it first looks at the rate in the rate table, and then adds or subtracts the Guaranteed Rate Offset (see below). Then, if the Use Guaranteed Rate Cap field is marked, the system compares the new rate to the rate increase/decrease per period. This determines if the rate change is within the limit. It will only change the rate within the bounds of the limit fields. Next, the system checks the Guaranteed Rate Maximum/Minimum fields below. If the new rate is higher than the maximum rate or lower than the minimum rate, it will use the rate in the maximum/minimum field for the new rate. |

||||||||||||

Next Guaranteed Rate Change Date

Mnemonic: LNICDT |

This field displays the date of the next Guaranteed Rate change on the selected customer loan account. This field is updated in accordance with the loan's specified effective date and rate change frequency. |

||||||||||||

|

Mnemonic: LNIGOF |

Use this field to indicate an offset to the Guaranteed Rate for the selected customer loan account. This field is used in conjunction with your institution's rate pointers and rate tables. The value entered in this field may be either positive or negative. |

||||||||||||

Guaranteed Rate Change Frequency

Mnemonic: LNIFRQ |

Use this field to indicate the frequency (in number of months) at which the guaranteed rate to the investor will change on the selected customer loan account. |

||||||||||||

Days Before Guaranteed Rate Change

Mnemonic: LNIDYS |

Use this field to indicate how many days prior to a Guaranteed Rate Change that the new rate should be calculated. The system uses this field to determine when to calculate the value for the Next Guaranteed Rate field above. |

||||||||||||

|

Mnemonic: N/A |

Use this field to indicate the degree to round the Guaranteed Rate each time it changes on the selected customer loan account. Possible selections in this field are as follows:

See Round Rate on the ARM Information screen for more information. |

||||||||||||

Guaranteed Rate Maximum/Minimum

Mnemonic: LNIMAX, LNIMIN |

Use this field to indicate the maximum and minimum amounts that are allowed for the Current Guaranteed Rate above. |

||||||||||||

|

Mnemonic: LNIPTR |

Use this field to indicate a rate pointer to use each time the Guaranteed Rate is adjusted. Rate pointers are used to allow rate changes on selected customer loan accounts. Rate pointers are institution-defined on the Loans > System Setup Screens > Interest Rate Table screen.

“255-Fixed Rate” in this field indicates that the interest rate should never change. |