Navigation: Loans > Loan Screens > System Setup Screens > Loan Funding Transactions Screen >

This help page describes the most common transactions used when loans are boarded (opened) into CIM GOLD.

The table below displays the transaction Code number, the transaction Mnemonic, a brief Description of the transaction code (often containing a link to DocsOnWeb for more information), whether the transaction code uses a Transaction Origination Code (TORC) number, the affected Amount Fields, and the Correction Code necessary to reverse the transaction.

CODE |

MNEMONIC |

DESCRIPTION |

TORC |

AMOUNT FIELDS |

CORRECTION CODE |

|---|---|---|---|---|---|

430 |

DBL |

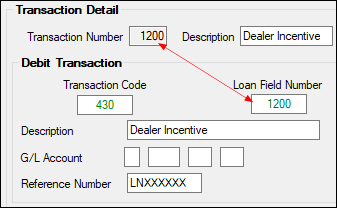

LIP Disbursement: Even though the description for this is LIP Disbursement, it is really just disbursement of any type, not just LIP. Disbursement codes are set up on the Loans > System Setup Screens > Construction Budget Descriptions screen. When setting up tran code 430, you should set up the Transaction Number to be the same as the Loan Field Number (which should also match the disbursement code set up on the Construction Budget Description screen), as shown below:

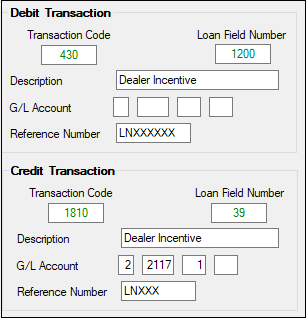

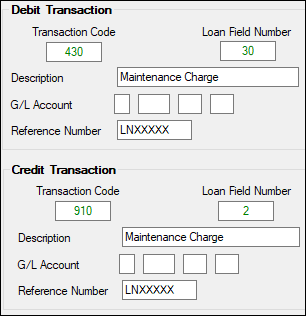

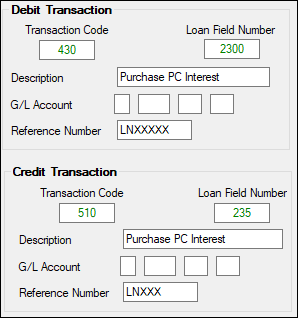

This transaction is almost always a Debit Transaction (tran code 430) with an offsetting Credit Transaction using either:

•a G/L Credit transaction (tran code 1810) to a General Ledger account •Amortizing Fee Credit (tran code 910) to an amortizing code, or •Field Credit (tran code 510) to a specific field (see Loan Field Numbers), as shown below:

Example 1

Example 2

Example 3

For more information on the fields in these field groups, see the Debit and Credit Transaction field group descriptions. |

|

2, 3, 16, 17 |

438 |

500 |

FDR |

Yes* |

All |

508 |

|

510 |

FCR |

Yes* |

All |

518 |

|

510 02 |

LAI |

LIP Accrued Increase |

Yes* |

All |

518 |

510 03 |

LAI |

LIP Accrued Interest Increase - Journal |

Yes* |

All |

518 |

510 07 |

SBI |

Subsidy Balance Increase |

Yes* |

All |

518 |

510 08 |

SBI |

Subsidy Balance Increase - Journal |

Yes* |

All |

518 |

510 31 |

RMD |

Remaining MSR Decrease |

Yes* |

All |

518 |

510 32 |

RMD |

Remaining MSR Decrease - Journal |

Yes* |

All |

518 |

510 33 |

PPI |

Partial Payments Increase |

Yes* |

All |

518 |

510 34 |

PPI |

Partial Payments Increase - Journal |

Yes* |

All |

518 |

510 35 |

RFI |

Yes* |

All |

518 |

|

510 36 |

RFI |

Yes* |

All |

518 |

|

510 37 |

RDI |

Yes* |

All |

518 |

|

510 38 |

RDI |

Yes* |

All |

518 |

|

510 39 |

RPD |

Remaining Premiums Decrease |

Yes* |

All |

518 |

510 40 |

RPD |

Remaining Premiums Decrease - Journal |

Yes* |

All |

518 |

510 42 |

MFI |

Misc Funds Increase |

Yes* |

All |

518 |

510 43 |

MFI |

Misc Funds Increase - Journal |

Yes* |

All |

518 |

510 45 |

RCD |

Remaining Cost Decrease |

Yes* |

All |

518 |

510 46 |

RCD |

Remaining Cost Decrease - Journal |

Yes* |

All |

518 |

510 47 |

PBD |

Principal Decrease |

Yes* |

All |

518 |

510 48 |

PBD |

Principal Decrease - Journal |

Yes* |

All |

518 |

510 53 |

AII |

Interest YTD Increase - Payment Method 1, 5, 6, & 8 |

Yes* |

All |

518 |

510 54 |

IDI |

Interest YTD Increase |

Yes* |

All |

518 |

510 55 |

DID |

Deferred Interest Decrease |

Yes* |

All |

518 |

510 56 |

AII |

YTD Interest Increase - Payment Method 1, 5, 6, & 8 |

Yes* |

All |

518 |

510 57 |

IDI |

YTD Interest Increase - Journal |

Yes* |

All |

518 |

510 58 |

DID |

Deferred Interest Decrease - Journal |

Yes* |

All |

518 |

510 62 |

R1I |

Reserve 1 Increase |

Yes* |

All |

518 |

510 63 |

R1I |

Reserve 1 Increase - Journal |

Yes* |

All |

518 |

510 71 |

R2I |

Reserve 2 Increase |

Yes* |

All |

518 |

510 72 |

R2I |

Reserve 2 Increase - Journal |

Yes* |

All |

518 |

510 96 |

LUI |

LIP Undisbursed Increase - Journal |

Yes* |

All |

518 |

510 97 |

LCI |

LIP Customer Balance Increase - Journal |

Yes* |

All |

518 |

510 98 |

LUI |

LIP Undisbursed Increase |

Yes* |

All |

518 |

510 99 |

LCI |

LIP Customer Balance Increase |

Yes* |

All |

518 |

520 |

AFG |

Assess/Correct Finance Charge |

|

|

528 |

530 |

AIN |

Accrued Interest |

Yes |

|

538 |

531 01 |

AGI |

Amortize Precomputed G/L Interest |

Yes |

3, 5 |

|

532 01 |

AFG |

Amortize Insurance Finance Charge |

Yes |

3, 5 |

|

533 |

API? |

Unamortize Precomputed Interest to G/L |

Yes |

35 |

|

534 |

API? |

Unamortize Insurance Finance Charge |

Yes |

3, 5 |

|

535 |

CI4 |

Capitalize Interest on Payment Method 4 Loans |

Yes |

|

|

540 |

AOR |

Add-On Loan Rebate |

* |

1-4 (possibly 11, 111, 211) |

548 |

550 |

PLC |

Pay Late Charge |

|

1-3, 8 |

558 |

550 01 |

PLJ |

Pay Late Charge - Journal |

|

1-3, 8 |

558 |

560 |

LTC |

Assess Late Charge |

Yes |

NP 3 & 8 |

568 |

570 |

WVL |

Waive Late Charge |

|

NP 3 & 8 |

578 |

580 |

POF |

Loan Payoff |

* |

All except 14, 22, 23 |

588 |

580 01 |

POF |

Loan Payoff - Journal |

* |

All except 14, 22, 23 |

588 |

583 |

LSN |

Loan Set Non-Accrual |

|

|

|

584 |

CLN |

Clear Loan Non-Accrual |

|

|

|

590 |

CLI |

Charge LIP Interest |

Yes |

3, 16, 18 |

598 |

599 |

LPU |

Loan Passbook Update |

|

|

|

600 |

PMT |

Loan Regular Payment |

Yes* |

|

608 |

600 01 |

PMT |

Loan Regular Payment |

Yes* |

|

608 |

600 50 |

MLP |

Mass Loan Payments |

|

|

|

601 01 |

PFP |

Payment from Partial |

|

|

|

610 |

R1I |

Post Reserve 1 Interest |

Yes* |

3, 6 |

618 |

620 |

R2I |

Post Reserve 2 Interest |

Yes* |

3, 7 |

628 |

630 |

SBI |

Post Subsidy Interest |

Yes* |

3, 13 |

638 |

640 |

R2D |

Reserve 2 Disbursement |

Yes* |

2, 3, 7 |

648 |

640 01 |

R2D |

Reserve 2 Disbursement - Journal |

Yes* |

2, 3, 7 |

648 |

650 |

PPD |

Loan Prepaid Interest |

|

1-3, 5, 12 |

658 |

650 01 |

LPI |

Loan Prepaid Interest - Journal |

|

1-3, 5, 12 |

658 |

660 |

LMF |

Assess Loan Misc Fee |

Yes |

NP 3 & 23 or Post L-3 (income) & L-23 Receivable |

668 |

661 |

INQ |

Release Teller Totals |

|

|

|

664 |

INQ |

Active Teller Totals |

|

|

|

665 |

INQ |

Reset Teller Totals |

|

|

|

666 |

INQ |

Teller Totals Inquiries |

|

|

|

670 |

WMF |

Waive Loan Misc Fee |

Yes |

NP 3 & 23 or Post L-3 (income) & L-23 Receivable |

678 |

680 |

OPN |

Open New Loan Account |

* |

1-4 (possibly 11, 111, 211 if sold prior to open transaction) |

688 |

680 01 |

OPJ |

Open Loan - Journal |

* |

1-4 (possibly 11, 111, 211 if sold prior to open transaction) |

688 |

690 |

SPR |

Teller Spread Payment |

* |

1-6, 9, 209, 10, 11, 111, 211, 12, 20, 220, 21, 121, 221 |

698 |

690 01 |

SPR |

Teller Spread Payment |

* |

1-6, 9, 209, 10, 11, 111, 211, 12, 20, 220, 21, 121, 221 |

698 |

700 |

RTN |

Return Loan LOC Check from Reject Handler |

Yes |

30 |

708 |

760 01 |

ICA |

Insurance Commission Cost Amortization |

Yes |

3, 23 |

768 |

761 |

ICA |

Amortization Adjustment of Insurance Costs Debit - Sub-Tran of 2910 |

Yes |

3, 23 |

|

762 |

ICA |

Amortization Adjustment of Insurance Costs Credit - Sub-Tran of 2910 |

Yes |

3, 23 |

|

790 01 |

ICR |

Insurance Commission Cost Rebate |

Yes |

3, 23 |

798 |

810 |

R1C |

Charge Interest on Negative Reserve 1 |

Yes |

3, 26 |

818 |

810 01 |

R1C |

Charge Interest on Negative Reserve 1 - Journal |

Yes |

3, 26 |

818 |

815 |

INQ |

Negative Reserve Interest Inquiry |

|

|

|

820 |

R2C |

Charge Interest on Negative Reserve 2 |

Yes |

3, 26 |

828 |

820 01 |

R2C |

Charge Interest on Negative Reserve 2 - Journal |

Yes |

3, 26 |

828 |

830 |

PMT |

Pay LOC Loans to Zero |

Yes |

1-3, 4, 5, 8 |

838 |

830 01 |

PMT |

Pay LOC Loans to Zero - Journal |

Yes |

1-3, 4, 5, 8 |

838 |

840 |

ALM |

Amortize Deferred Mortgage Servicing Rights |

Yes |

3, 23 |

848 |

850 |

PLF |

Pay Loan Fees |

Yes |

1-3, 23 |

858 |

850 01 |

PLF |

Pay Loan Fees - Journal |

Yes |

1-3, 23 |

858 |

860 |

PCO |

Partial Charge-Off Transaction |

Yes |

3, 4 |

868 |

870 |

VSI |

Force Place VSI Insurance with Finance Charge |

|

|

878 |

871 |

VPR |

End of VSI Force Place Insurance |

|

|

|

888 |

INQ |

Change Terminal to Access Test File |

|

|

|

890 |

CVI |

Cancel VSI Force Place Insurance |

|

|

|

900 01 |

DAF |

Amortizing Fee Debit |

|

3, 22 |

908 |

910 01 |

CAF |

Amortizing Fee Credit |

|

3, 22 |

918 |

920 |

CMI |

Cancel Miscellaneous Insurance |

|

|

|

940 |

AIP |

Adjust Premium |

|

|

|

999 |

INQ |

Change Terminal To Access Live File |

|

|

|