Navigation: Loans > Loan Screens > Cards and Promotions Screen >

The Finance Charge tab on the Cards and Promotions screen shows finance charge information, as well as fields used in calculating the Minimum Payment Due. These are loan-level fields, not promotion-level fields.

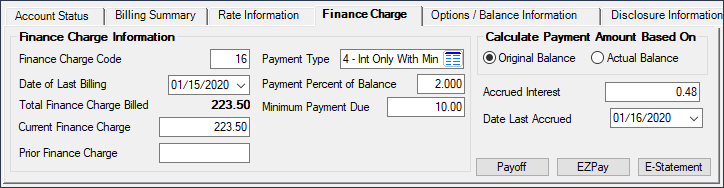

See the following example, followed by field descriptions:

Loans > Cards and Promotions Screen > Finance Charge Tab

Field |

Description |

||||||||

|

Mnemonic: LNRLFC |

This field is technically two fields. This code is entered in XYY format, where X tells the system the balance on which finance charges (interest) should be calculated, and YY tells the system the number of days prior to the Due Date the next billing should be created. When charging periodic interest, the YY code also indicates how many days prior to the Due Date finance charges should be assessed.

This code also controls and automatically enters the Coupon & Billing Cycle field.

For the first part of this field, possible codes entered in this field are as follows:

The second part of the Finance Charge Code determines when the Billing Date is processed, as well as when to calculate that month's billing information (Minimum Payment Due and Finance Charges). If this is set to "25," for example, the Billing Date will run 25 days prior to the Due Date. If set to "26," the Billing Date will process 26 days prior to the Due Date, etc. The Bill and Receipt Statement (FPSRP322) will be sent to customers after the Billing Date is processed, notifying them of that month's Minimum Payment Due amount. Many institutions use "25" in this field.

Users should not change the information in this field. However, if you have security and you understand the ramifications of changing this field, you can make adjustments to this information. We suggest changing it within a day or two after the Date of Last Billing.

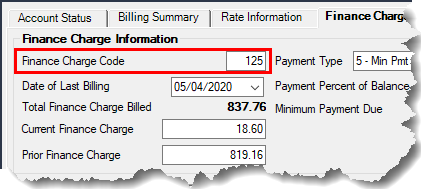

Example:

If this field is entered like this:

This indicates the system will calculate the finance charges for that month using the high balance on the loan that month in the finance charge calculation, and the Billing Date (billing record) will occur 25 days before the Due Date.

For more information on how the finance charge is calculated, see the Billing Date and Calculation Finance Charges topic. |

||||||||

|

Mnemonic: LNRLFD |

This field displays the ending date of the most recent billing cycle on the customer card loan account. |

||||||||

|

Mnemonic: N/A |

This field displays the sum of the Current Finance Charge and Prior Finance Charge (see below) to indicate the amount of interest due with the next payment on the customer card loan account. |

||||||||

|

Mnemonic: LNRLCC |

This field displays the amount of interest billed on the Date of Last Billing (see above). Each time interest is billed, any unpaid interest remaining in this field is added to the Prior Finance Charge (see below).

When reversing a payment, if there was not a billing between the payment and the reversal, the system will replace this amount with its value prior to the payment being reversed. If there was a billing between the payment and the reversal, the system will add the reversed finance charges to the Prior Finance Charge amount and increase the Total Finance Charge Billed field above by that amount. This field will remain the same.

If the Roll Charges into Balance field is marked, this field will be disabled. |

||||||||

|

Mnemonic: LNRLPC |

This field displays the sum of all finance charges owed prior to the Date of Last Billing above. If the Roll Charges into Balance field is marked, this field will be disabled. |

||||||||

|

Mnemonic: LNRLPT |

Use this field to indicate how payments on the customer card loan account should be calculated by the system. See Payment Type codes for a list of possible selections in this field. |

||||||||

|

Mnemonic: LNRLPB |

Use this field to indicate the percentage that will be multiplied by the original balance to calculate the Minimum Payment Due below. |

||||||||

|

Mnemonic: LNRLMD |

This field should not be mistaken for the Minimum Payment Due on the Account Status tab. This field shows the Minimum Payment Due if using the following Payment Type codes:

3 - Min Pmt or % of Total 4 - Int Only With Min 5 - Min Pmt or % of Balance 6 - Min Pmt or % of Total 7 - Min or FCT % of Balance

See the Payment Type Code topic for more information. |

||||||||

Calculate Payment Amount Based On... Original Balance/Actual Balance

Mnemonic: LNOORA |

This selection is only used with certain Payment Type codes (see above). If the specific Payment Type code used does not require a calculation of the balance, this selection will be ignored.

The Payment Type codes that use this field in the calculation are:

5 - Min Pmt or % of Balance 7 - Min or FCT % of Balance

See the Payment Type Code topic for more information. |

||||||||

|

Mnemonic: LNACIN |

This field displays the amount of accrued interest on this account from the Date Last Accrued to today.

|

||||||||

|

Mnemonic: LNDLAC |

The Date Last Accrued field displays the most recent date interest was accrued on the account. This field is updated to the current date any time interest changes, the balance is increased or decreased, or a paymnet is made.

Interest for a payment is calculated from this date to the Due Date (unless the Interest Calculation Method on the Loans > Account Information > Account Detail screen is 101, 102, or 103). |