Navigation: Loans > Loan Screens > Account Information Screen Group > Signature Loan Details Screen > Amortizing Fees tab >

Fee/Cost Information field group

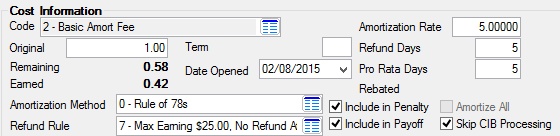

Use this field group (on the Amortizing Fees tab of the Loans > Account Information > Signature Loan Details screen) to view and edit amortizing fee (or cost) information about the customer signature loan (payment method 16).

See help for the Loans > Account Information > Amortizing Fees And Costs screen to learn more about amortization.

Most fees are set up during loan origination. Generally, you should not use this tab to set up fees; only to view fee information or to set up information for loan patterns (as discussed on the Loans > System Setup Screens > Loan Pattern Setup screen). See the Amortizing Fees tab help for more information.

The fields in this field group are as follows:

Field |

Description |

||

|

Mnemonic: F1FEEC |

This field indicates the code number of the fee (or cost). Amortizing fee codes must first be set up on the Loans > System Setup Screens > Amortization Descriptions screen before they can be selected in this field.

Most fees are set up during loan origination. Generally, you should not use this tab to set up fees; only to view fee information or to set up information for loan patterns (as discussed on the Loans > System Setup Screens > Loan Pattern Setup screen). See the Amortizing Fees tab help for more information. |

||

|

Mnemonic: F1FORG |

Use this field to indicate the original amount of the fee (or cost) to apply to the customer signature loan. This amount is the total fee, not the monthly amortized amount.

There must be a value in this field before the Earned field in the General Ledger Information field group can be edited.

Most fees are set up during loan origination. Generally, you should not use this tab to set up fees; only to view fee information or to set up information for loan patterns (as discussed on the Loans > System Setup Screens > Loan Pattern Setup screen). See the Amortizing Fees tab help for more information. |

||

|

Mnemonic: N/A |

This field displays the remaining amount of the Original fee (or cost) that has yet to be paid by the customer as of the current date. This field is calculated according to the Amortization Method (see below).

If the customer were to pay off the loan on the current date, the value in this field would be the fee amount that would be refunded. |

||

|

Mnemonic: N/A |

This field displays the amount of the fee (or cost) that has been earned by your institution. This field is updated when the customer pays their monthly loan payment, including any amortized fees or costs included in the payment.

The value in this field is the difference between the values in the Original and Remaining fields above. |

||

|

Mnemonic: F1FMET |

Use this field to indicate the amortization method for fee (or cost) refunds in the event the loan is paid off early or canceled. The amortization method of how to refund fees or costs upon early payoff or cancellation is usually applied when the loan is originated; however, you can make changes to this field.

The Refund Rule and Refund Days fields below may affect whether customers are eligible for any refund of the fee amount.

The system generally amortizes fees and costs to the applicable General Ledger at monthend. The amortization method for the General Ledger is selected in the General Ledger Information field group.

See the Amortization Methods help page to learn more about the possible selections in this field. See Section 36.3 in DocsOnWeb for step-by-step instructions for establishing a new amortization fee or cost. See help for the Loans > Account Information > Amortizing Fees And Costs screen to learn more about amortization. |

||

|

Mnemonic: F1RULE |

Use this field to indicate the refund method used to determine whether the customer is eligible for any refund of fees (or costs) incurred since the loan was opened. This field is used in conjunction with the Refund Days field below. See Refund Rule codes for more information. |

||

|

Mnemonic: F1TERM |

Use this field to indicate the term (in months) that the Original fee (or cost) amount will be amortized on the loan. In most instances, the value in this field should match the value in the Term in Months field. |

||

|

Mnemonic: F1DTOP |

Use this field to indicate the date the fee (or cost) Code was set up on the customer signature loan. Usually this is the same day as the loan was opened. Occasionally, however, you may need to set up an amortizing fee after the loan is funded. In that case, See Section 36.3 in DocsOnWeb for step-by-step instructions for establishing a new amortization fee or cost. |

||

|

Mnemonic: F1DART |

Use this field to indicate the amortization rate for the loan. This field is only used when the Amortization Method field above is set to "2–Level Yield."

This value is usually the difference between the Original APR and the Interest Rate. |

||

|

Mnemonic: F1RDYS |

Use this field to indicate the number of days before or after an early payoff or cancellation in which a refund of the fee (or cost) will be issued to the customer. See below for more information.

|

||

|

Mnemonic: F1PRDY |

Use this field to indicate the number of days used in pro rata calculation for the amortizing fee (or cost). This field only works if the Amortization Method field above is set to "8 - Daily Pro Rata."

For example, if your institution has set up a fee that will only be amortized for the first 180 days after the loan is opened, enter "180" in this field. Then, if the loan is paid off before 180 days has passed, a portion of the Remaining value (see above) will be returned to the customer (depending on when the loan was paid off and the amount entered in this field). If the loan is paid off after 180 days, none of the remaining fees or costs will be returned. |

||

|

Mnemonic: F1FRBT |

This field displays the amount (if any) that was refunded to the customer at the loan's payoff. Payoff transactions are processed on the Loans > Payoff screen. |

||

|

Mnemonic: F1PNTY |

Use this field to indicate whether the amortization fee (or cost) being created/edited should be included in the 5% rule calculation for Georgia GILA loans. For more information about GILA refunds, see the GILA Refunds help page. |

||

|

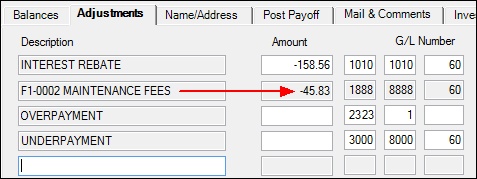

Mnemonic: F1PYOF |

Use this field to indicate whether funds should be rebated to the customer during the loan payoff. Additionally, the Refund Rule and Refund Days fields above affect whether the customer is eligible for a refund at payoff. If the customer is eligible for a refund at payoff, the amount of the refund will be displayed on the Adjustments tab of the Loans > Payoff screen (as shown below).

|

||

|

Mnemonic: F1TALL |

Use this field to indicate whether the total of all remaining fees (or costs) should be taken to income or expense (based on your institution's G/L Autopost settings) or continue to amortize normally when the loan is paid off. Mark this field to indicate that the system should take fees to income/expense at payoff. Leave this field blank to indicate that the system should amortize normally.

If this field is marked, funds will be taken to income/expense at the end of the fee cycle (generally at monthend), not on the date the loan is paid off.

Payoff transactions are processed on the Loans > Payoff screen. |

||

|

Mnemonic: F1CIBS |

Use this field to indicate whether the fee (or cost) being created/edited should be excluded from being refunded if the loan is converted from precomputed to interest-bearing (through the Convert Precomputed to Simple tab). Customers will still be responsible for paying amortizing fees and costs if this field is marked.

If this field is left blank, the fee (or cost) will be refunded to the customer after the loan is converted from precomputed to interest-bearing. |