Navigation: Loans > Loan Screens > Account Information Screen Group > Signature Loan Details Screen > Amortizing Fees tab >

General Ledger Information field group

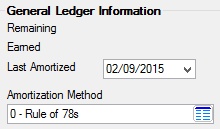

Use this field group (on the Amortizing Fees tab of the Loans > Account Information > Signature Loan Details screen) to view and edit General Ledger information about amortized fees on the customer signature loan (payment method 16).

See help for the Loans > Account Information > Amortizing Fees And Costs screen to learn more about amortization.

The fields in this field group allow your institution to post the amortized fee (or cost) being created/edited to the General Ledger on a monthly basis. These fields are as follows:

Field |

Description |

|

Mnemonic: F1GREM |

This field displays the remaining amount of the Original fee (or cost) that has yet to be paid by the customer as of the current date. This field is calculated according to the G/L Amortization Method. |

|

Mnemonic: N/A |

This field displays the amount of the fee (or cost) that has been earned by your institution. This field is updated when the customer pays their monthly loan payment, including any amortized fees or costs included in the payment. The value in this field is the difference between the values in the Original and Remaining fields. |

|

Mnemonic: F1FDLA |

Use this field to indicate the date the fee (or cost) was last amortized to the General Ledger. This field is updated each time the amortization is processed, which is usually in the afterhours at monthend. This field is for reference purposes and does not affect amortization. |

|

Mnemonic: F1GMET |

Use this field to indicate the amortization method to use when calculating the fee (or cost) amount earned by your institution and sent to the General Ledger. This field determines how much is amortized into the General Ledger each month.

This method can be different from the Amortization Method used when calculating fee (or cost) refunds in the event the loan is paid off early or canceled. When the customer pays off the loan, the difference between the amount refunded and the amount amortized to the General Ledger is finalized (a G/L transaction is run to account for the difference).

The G/L account associated with the amortization of this fee or cost is set up when the fee (or cost) is created using the Loans > System Setup Screens > Amortization Descriptions screen. |