Navigation: Loans > Loan Screens > Account Information Screen Group > Account Detail Screen > Statistics tab > Current & Prior Year-to-Date tab >

IRS Special Conditions field group

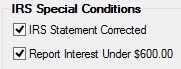

The IRS Special Conditions field group on the Current & Prior Year-to-Date tab displays two checkboxes for IRS statements and reports.

The IRS Statement Corrected field (mnemonic LNIRSC) is used to indicate whether or not a correction has been made to the IRS statement. The default is a blank box (no). After making corrections to the IRS statement in the IRS GOLD system, you can also use the Loans > Account Information > Notepad screen to enter comments describing what corrections were made.

If the Report Interest Under $600.00 box (mnemonic LNSKCK) is checked, interest will be reported to the IRS even if it is less than $600 (subject to applicable general category, etc.). GOLDPoint Systems only reports 1098 information for loans with general categories or collateral codes outlined in section 1.03 of the Loan Year-end User's Guide. Only accounts paying $600 or more of interest and/or points are included, unless this box is checked or the Institution Option SKCK option is set (as explained below). Note: There are two ways to report interest if it is less than $600. The first is by using this field which allows you to control, loan by loan, whether or not to report it. The second is by using Institution Option SKCK. This option reports interest of less than $600 for all loans. If you would like the second option, please submit a work order to GOLDPoint Systems.

See also: