Navigation: Loans > Loan Screens > Bankruptcy and Foreclosure Screen Group > Bankruptcy Screen >

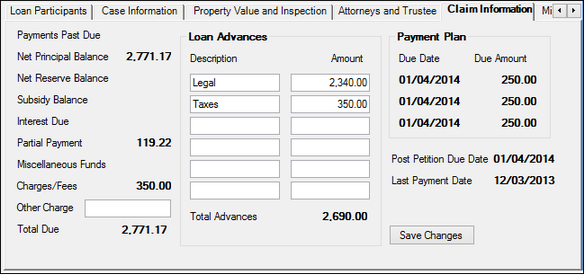

Use this tab to view and edit information about claims on the customer loan account.

Loans > Bankruptcy and Foreclosure > Bankruptcy Screen, Claim Information Tab

The fields on this tab are as follows:

Field |

Description |

|

Mnemonic: BCNBPD |

This field displays the number of loan payments past due on the customer loan account prior to the filing date of the bankruptcy. |

|

Mnemonic: BCPBAL |

This field displays the net principal balance on the customer loan account as of the Filing date. This amount does not include any Interest Due (see below). |

|

Mnemonic: BCNETR |

This field displays the net reserve balance on the customer loan account as of the Filing date. The reserve balance is pulled from the Loans > Account Information > Reserves > Account Reserve Detail screen for those loans that require a reserve (mortgages, insurance payments, etc.). This balance is calculated by simply adding the balance of Reserve 1 and Reserve 2. |

|

Mnemonic: LNSBAL |

This field displays the subsidy balance of the customer loan account as of the Filing date. |

|

Mnemonic: BCACIN |

This field displays the accrued interest from the date last accrued to the bankruptcy Filing date on the customer loan account. This amount does not include the Net Principal Balance. When making payments to an account after the Bankruptcy Transaction is run, any amount paid will first go toward interest due. |

Applied to Payment/Partial Payment

Mnemonic: LNPRTL |

See Applied to Payment/Partial Payment details for more information. |

|

Mnemonic: LNMISC |

This field displays the amount in miscellaneous funds on the customer loan account as of the Filing date. This information is pulled from the Miscellaneous Funds field on the Loans > Account Information > Additional Loan Fields screen. |

|

Mnemonic: LNLATE |

This field displays the amount in late charges and loan fees on the customer loan account as of the Filing date. Your institution can set up late charge fees using the Late/NSF tab of the Loans > Account Information > Account Detail screen. You can also manually assess late charges to an account using the Assess Late Charge transaction (tran code 560) in GOLDTeller, if you have the proper security clearance.

Loan fees can be assessed from the Delinquent Payments tab of the Loans > Marketing and Collections screen, then clicking <Assess Fee> on the bottom half of that tab. |

|

Mnemonic: BKOCHR |

Use this field to indicate any other charge amount your institution wants to collect on the customer loan account. Example: You have attorney fees which have not been disbursed from the reserves. The amount entered in this field will be included in the Total Due below. |

|

Mnemonic: BCTOT8 |

This field displays the total of the Net Principal Balance, Net Reserve Balance, Subsidy Balance, and Interest Due fields above. |

|

Mnemonic: BKADV1-6 |

Use these fields to indicate the dates and amounts of any advances your institution has made on the loan (legal fees, taxes, etc). This information does not affect the Net Principal Balance above.

The total amount of advances is displayed at the bottom of this field group. |

This field group displays the Due Date and Due Amount of the next three scheduled Repayment Plan tab payments that have not yet been paid on the customer loan account.

See the help pages linked on the Bankruptcy main screen help to learn more about how bankruptcy filing functions. |

|

|

Mnemonic: BCDT07 |

This field displays the date the next post-petition payment is due on the customer loan account. This information is pulled from the Repayment Plan tab. |

|

Mnemonic: BCDT08 |

This field displays the most recent date a repayment plan payment was made on the customer loan account. This information is pulled from the Repayment Plan tab. |