Navigation: Loans > Loan Screens > Insurance Screen Group > Adjustments Screen >

Use the Loans > Insurance > Adjustments screen to make adjustments for insurance policies established at loan origination. You would use this screen if you wanted to adjust an insurance policy linked to a collateral's depreciation. For example, if this was a car loan, and the borrower opted for insurance, you could adjust the insurance after a set number of months, so the insurance was for a smaller coverage amount (value of the car went down).

|

WARNING: You must be logged on to GOLDTeller before processing these steps. If using CIM GOLDTeller, the system will automatically bring up CIM GOLDTeller and have you log on. Additionally, you must have the following transactions set up in your transactions menu:

Adjust Insurance Premium Ck transaction (tran code 2940-02) Cancel VSI Insurance transaction (tran code 2890-00) Commission Adjustment transaction (tran code 461) Remove Homegard Insurance transaction (tran code 2890-07) Remove Flood Insurance transaction (tran code 2890-08) Remove Fire Insurance transaction (tran code 2890-09) Remove LPD Insurance transaction (tran code 2890-71) Cancel Other Insurance transaction (tran code 2910-00) Cancel Other Insurance Ck transaction (tran code 2910-02)

For more information on how to set up transactions on your transactions menu, see the following help:

CIM GOLDTeller: Functions > Administrator Options > Menu Design screen

GOLDTeller: Utilities menu > Transaction Selection Design screen |

|---|

To adjust insurance premiums using the account balance:

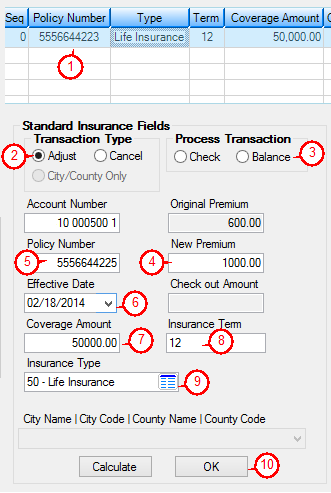

1.After accessing and selecting an account, click the insurance policy you want to adjust from the top list view on the Adjustments screen. The fields below the list view are populated with that insurance policy information.

2.Make sure the Adjust radio button is selected. This is the default selection. (See Cancel Insurance Policies for how to cancel.)

3.If you do not select either the Check or Balance radio buttons in the Process Transaction field group, the system defaults to Balance, meaning the adjustment will be subtracted from the principal balance on the loan. See Calculate New Insurance Premiums with Check if the borrower would rather have a check for the difference.

4.Enter the new premium amount in the New Premium field.

5.If the policy number has changed, you can enter the new policy number in the Policy Number field.

6.Select the new Effective Date, if needed.

7.Enter a new Coverage Amount. This amount must be less than the original coverage amount. If you only want to adjust the coverage amount and not change the premium, then use the Loans > Insurance > Policy Detail screen to change the Coverage Amount.

8.Enter the new Insurance Term, if needed.

9.Select the new Insurance Type, if needed.

10.Click <OK>.

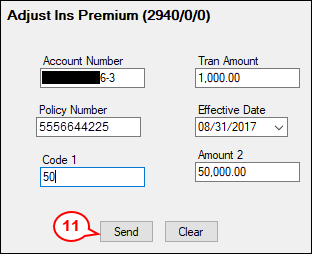

GOLDTeller opens with the Adjust Insurance Premium transaction (tran code 2940) displayed, as shown below.

All the information that was entered on the Adjustment screen is transferred onto the transaction.

| 11. | Click <Send>. If the transaction processed correctly, the insurance policy coverage will be adjusted accordingly. |

Because the new premium was applied to the principal balance, the next principal and interest payment (LNPINX) will be adjusted for the increase or decrease of the premium.

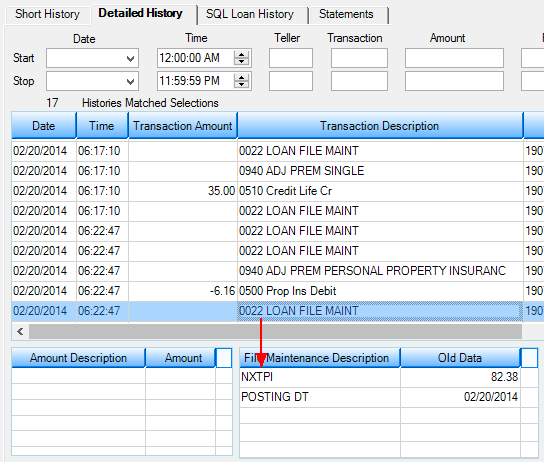

The Loan > History screen records all the fields that were changed due to this adjustment, as shown below. Clicking on the 022 LOAN FILE MAINT descriptions will show the details of the fields that were changed.

For details of how this transaction affects the loan, see the Adjust Insurance Premium (tran code 2940-00) topic.

See also: