Navigation: Loans > Loan Screens > Marketing and Collections Screen > Delinquent Payments tab >

Bankruptcy/Delinquency fields

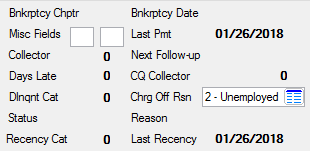

The fields in this unlabeled field group on the Delinquent Payments tab are explained in the table below.

Field |

Description |

||||

|

Mnemonic: BKCHAP |

If this account is in bankruptcy, this field will display the type of bankruptcy this account owner has filed known by the title of the Chapter of the Federal Bankruptcy Act. A loan is flagged as bankrupt using the Loans > Bankruptcy screen in CIM GOLD. See below for a list of possible bankruptcy chapters.

|

||||

|

Mnemonic: BKFILD |

This field is used if the borrower has filed for bankruptcy. This is the date the bankruptcy was filed in the Courts. This information is entered on the Loans > Bankruptcy and Foreclosure > Bankruptcy screen. |

||||

|

Mnemonic: QAHOLD |

These file-maintainable user-defined fields are only available for collection purposes. They can be used as selection criteria for variable Collection Queue setups or for whatever purpose your company wants. |

||||

|

Mnemonic: LNDTLP |

This field shows the date that the last payment was posted. If a payment reversal occurs, the system will look in the collection history for the previous last payment date and enter that date in this field. The last payment date is reported to the Credit Bureau during the Credit Reporting process. This field is not file maintainable. It is updated as payment activity occurs on the loan.

|

||||

|

Mnemonic: LNCTOR |

This field contains the collector number assigned to the loan. The number represents a collector within your company. Collectors are assigned when you access the Contact tab of this screen.

To set up which queues collectors are responsible for, your administrator must set up the Queues > Collection > Collector Queue Setup screen. |

||||

|

Mnemonic: N/A |

This is the date when an employee at your institution has scheduled to follow-up with this account owner to bring the loan current, as entered by employees on the Contact tab. |

||||

|

Mnemonic: CLXLO2 |

This field shows the number of days the account is past due. The field is calculated by subtracting the loan due date from the current day. The day of the due date is not included.

Example: On 4-17 the loan had a due date of 3-1. The Days Late field would display 47; that is 30 days in March and 17 days in April. March 1st is not counted. This is calculated online; therefore, it is not file maintainable and it cannot be used in reports via GOLDWriter.

See the Delinquency radio buttons help for information on how the number in this field may be effected by delinquency grading. |

||||

|

Mnemonic: QICTOR |

This field displays the collection queue to which the account was assigned during the last afterhours processing. Each night during the afterhours processing, the system determines which collection queue the loan will appear in based on the queue setup criteria. Based on the queue criteria, a loan may be in one queue number today and a different one tomorrow, etc. The queue number is not an actual field on the loan record; therefore, it is not file maintainable and it cannot be included in GOLDWriter reports.

For more information on how to set up queues and how employees access queues, see the Collection Queue Administration section and Collection Queues section in the CIM GOLD User's Guide. |

||||

|

Mnemonic: LNDCAT |

This field holds the delinquent category of the loan. See below for more information.

|

||||

|

Mnemonic: N/A |

This is the reason why part or all of this loan was charged off, if applicable. Loans are charged off using the Loans > Transactions > Charge Off Transactions screen or through GOLDTeller with transaction code 2022-01 (full write-offs use transaction code 2510-05). When a loan is charged off, a reason for the charge off can be entered in the Charge Off Reason field on the transaction. If a reason is entered in that field, then the reason will also appear in this field.

|

||||

|

Mnemonic: QADSCD |

In this field, the system enters a code to indicate the status of the delinquent loan. The code and status are reported to FNMA or other associated companies. The number that is entered in this field comes from an entry made by the collector in the Comment Code field on the Contact tab of this screen. |

||||

|

Mnemonic: QADRCD |

This is the FNMA-defined delinquency reason codes stored in the Collection system. This field will only be populated for delinquent loans. |

||||

|

Mnemonic: MRRDCC |

This is the recency category code. See Recency Cat for more information. |

||||

|

Mnemonic: MRDLRD |

This is the date of the last recency. Recency refers to the last full payment on the loan. If the first full payment has not been made on a loan, the system will use the date the loan was opened as the Last Recency date. If institution option UORC is set, the Recency Date will be the monthend of the month the Open Loan transaction (tran code 680) was processed. If the first full payment was made and then retracted, the Last Recency date will revert back to the date the loan was opened as the Last Recency date.

Loans that have a calculated recency date that is greater than or equal to the run date of the Daily Detail Delinquency Report (FPSRP274) will not have a recency status and will not be included in the Recency Delinquency totals.

|