Navigation: Loans > Loan Screens > Insurance Screen Group > Adjustments Screen > Processing transactions >

The Adjust Insurance Premium transaction is used to perform an adjustment to the account when an insurance premium must be changed. Several aspects of the account are affected. The adjustment is reported at the end of the month with regular insurance reporting.

See the Calculating new insurance premiums with a check help page for step-by-step instructions on how to process this transaction.

If Institution Option BTAP is enabled, this transaction will not require a teller override (TOV) whenever the P/I Constant or the Next P/I Constant changes.

On the original insurance record, processing this transaction does the following (these fields are found on the Loans > Insurance > Policy Detail screen):

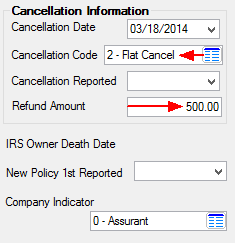

| 1. | A Cancellation Code of 2 (flat cancel) is entered on the insurance policy with the cancellation date as the Policy Effective Date. |

| 2. | The original premium amount is entered in the Refund Amount field. |

Insurance Policy Detail screen, Policy Information tab

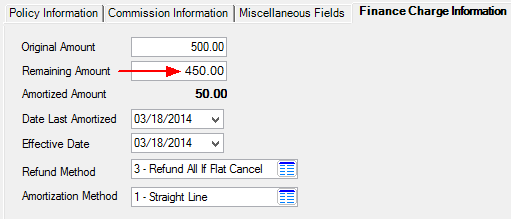

| 3. | The remaining amounts of costs, commissions, and finance charges are cleared out to prevent the original policy from further amortizing. |

A new insurance record is created with the following information:

| • | Clears out the date the policy was first reported so the new policy can be created. |

| • | The premium is adjusted by the change between the old premium and the new one. The new premium will be equal to the Tran Amount entered on the Calculating new insurance premiums with a check section. |

| • | A finance charge is incurred on the loan if the amount of change in the premium meets all the following criteria: |

1.Precomputed loan (payment method 3)

2.Loans with a policy type equal to 90-99.

3.Institution Option IVSI is enabled.

4.Loans with an existing finance charge.

| • | New original costs and commissions are calculated based on the new premium using the information entered on the GOLD Services > General Ledger > Setup G/L and Commissions screen. In addition, remaining costs and commissions will also be adjusted by the change in premium. |

| • | The Remaining Amount of costs and commissions are amortized (or unamortized) to reflect the change in premium with tran codes 461 (Insurance Commission-Debit), 462 (Insurance Commission-Credit), 761 (Insurance Costs-Debit), and 762 (Insurance Costs-Credit). |

| • | In General Ledger, the old finance charge is removed with a tran code 1800 (General Ledger debit) using the Unearned Interest G/L account found on the GOLD Services > General Ledger > GL Account By Loan Type screen. Then the new finance charge amount based on the new premium is booked with a tran code 1810 (General Ledger credit) to the same G/L account. |

| • | On precomputed loans (payment method 3) with a policy type of 90-99, Institution Option IVSI enabled, and an existing finance charge, the Remaining Amount of the finance charge will be amortized (or unamortized) to reflect the change in premium with tran codes 532 (Amortize Insurance Finance Charge) and 534 (Unamortize Insurance Finance Charge). |

Insurance Policy Detail screen, Finance Charge tab

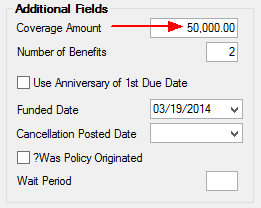

| • | Replaces the Coverage Amount on the Policy Detail screen with the new coverage amount entered on the transaction screen. If the new coverage amount is zero (0) or blank, information in the Coverage Amount field will not be replaced. |

On insurance reports (FPSRP204–Insurance-New and Canceled VSI Insurance, FPSRP205–Insurance-Credit Life, Accident & Health, and Unemployment, and FPSRP207–Insurance-New and Canceled Property Insurance), the old policy shows as canceled and the new insurance record with the changes shows as a new policy.