Navigation: Loans > Loan Screens > Cards and Promotions Screen > Finance Charge tab >

Accrual fields

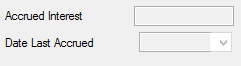

The Accrued Interest field (LNACIN) on the Finance Charge tab displays the amount of accrued interest on the customer card loan account. This amount includes unpaid interest up to but not including the Date Last Accrued (LNDLAC). On payment method 6 or 7 loans, the accrued interest is usually 0. On payment method 0 loans, a new loan tran 680 will place the interest in this field. This value does not move from GOLDTrak. The only time there will be a balance in this field is when the loan is amortizing negatively and interest deferring based on the rate change frequency. This occurs when the Defer Interest At field on the Loans > Account Information > ARM Information screen is set to "Never Defer Interest" or "Rate Roll."

A GOLDWriter report and variable screen mnemonic (LNACRINT) are available that will accrue loan interest either to or through the present day.

|

WARNING: This mnemonic does not use the payoff record. If you have already created a payoff record in the loan payoff system and you run a report using this mnemonic, but the present day is not the "payoff date," the accrued interest will be different. |

|---|

The Date Last Accrued field displays the most recent date interest was accrued on the customer card loan account. For most loans, this date should be one frequency of payment before the Due Date. Interest for a payment is usually calculated from this date to the Due Date (unless the Interest Calculation Method on the Loans > Account Information > Account Detail screen is 101, 102, or 103). Daily accrual loans (payment method 6) accrue interest from the date last accrued to, but not including, the date a payment is applied. Precomputed loans accrue from the date last accrued to the next month. Such accrual is performed in batch processing only. Loans with an LIP method of 1 or 101 will accrue to the current date each time an LIP disbursement is made, or the LIP interest rate is changed.