Navigation: Loans > Loan Screens > Transactions Screen Group > CP2 Screen > CP2 tab >

Account Adjustment field group

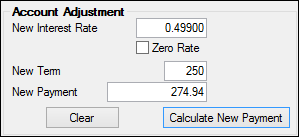

Use this field group to calculate and/or establish a new loan payment based on a new term, interest rate, or both. Use this field group to estimate how much a loan payment and loan amount would increase or decrease if the customer refinanced their loan to a different rate or a different term. This calculation is made using the Current Balance on the loan, not the original balance.

Your institution determines which loans qualify for a modified payment schedule. See the Payment Schedule tab for more information. See the New Payment Recalculation help page to learn how to modify loan payments and apply them to the loan.

Modified payment schedules cannot be set up at the same time as deferments on this screen.

The fields in this field group are as follows:

Field |

Description |

|

Mnemonic: D1RATE |

Use this field to indicate a potential new interest rate on the loan. |

|

Mnemonic: D1ZRAT |

Use this field to set the current interest rate to zero. |

|

Mnemonic: D1TERM |

Use this field to indicate the new term for the loan. |

|

Mnemonic: D1PICN |

This field displays the new loan payment amount when <Calculate New Payment> is clicked. |

|

Note: If your institution uses any of the OPCO institution options and you make changes to the New Interest Rate, New Term, or New Payment, the system will apply Special Comment Code "CO" (account adjustment) on the account during monthend credit reporting. See the OPCO options description in the Institution Options manual on DocsOnWeb for more information. |

|---|