Navigation: Deposit Screens > Definitions Screen Group > Rate Tiers Screen >

Next Tiers field group

Mnemonics: TRNXTR, TRNXRT, TRDTEF

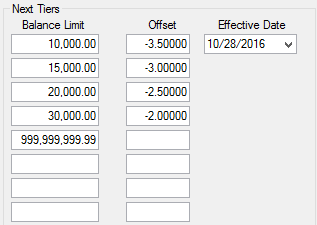

The Next Tiers field group on the Rate Tiers screen is used to enter the balance limits and rate offsets of the next interest tiers. Enter a date in the Effective Date field, and these next rates will move to the Current Tiers field group in the afterhours of the Effective Date. Therefore, all accounts with this product code and an account balance that falls within the Balance Limit (mnemonic TRNXTR) will automatically be updated with the new rate.

For example, a product code is set up with a Current Rate of 3.0 with a rate Offset (mnemonic TRNXRT) of -1.0 for balances less than $2,000.00. In two months, your institution wants to eliminate the rate offset for accounts with less than $2,000.00 for these types of product codes. Therefore in the Next Tiers field group, you would enter the Balance Limit of $2,000.00 and enter “0” in the Offset field. Then you would set the Effective Date (mnemonic TRDTEF) for two months away. When the two months are up, the Balance Limit and Offset amounts in the Next Tiers field group will move into the Current Tiers field group, and all accounts with less than $2,000.00 and matching this product code will increase their interest rate by 1 percent (eliminating the -1.0 offset, thereby making the interest rate be 3.0 percent instead of 2.0 percent).

The Offset percentage can be negative or positive. For negative Offsets, enter a minus sign before the number. For positive Offsets, just enter the number. The Offset field takes up to five decimal points. If you enter less than five decimal places, the system back fills the percentage with zeros after you move out of the field. If you leave the Offset fields blank, the system assumes it is zero percent. See the example below.

If the When Entering Tier Offsets as Rates Enter Base Rate Here field is in use, the Offset fields will be reclassified as Rate fields and any designated Offsets will be added to the value in that field and automatically converted to Rate values. See help for that field to learn more about entering tier levels as rates rather than offsets.

Setting up an Offset-Based Rate Tier

Use the Balance Limit fields to indicate the maximum customer account balances for the tier levels. Offsets correspond to their adjacent Balance Limit range. The account’s Base Rate, Tier Offset, and other interest rate set on the Deposits > Account Information > Interest Fields screen, factor into the calculation of the account’s interest rate when the account balance falls within the range.

The first tier level will automatically be set as a range from $0.00 to the dollar value entered in the first Balance Limit field. Subsequent tier levels will be set as a range from the value entered in the previous Balance Limit field to the value entered in that tier level's Balance Limit field.

For example, if the customer account's Base Rate is 1.5% and your institution does not want the account to calculate interest if its balance is below $100.00, then the first Balance Limit field should be set to 99.99 with a corresponding Offset of -1.5. In this example, the rate on the account for balances under $100.00 will be zero. The next Balance Limit field could then be set to any dollar amount greater than 99.99 and Offset greater than -1.5 (200 and -1.0, for example).

Interest features for individual customer accounts can be adjusted on the Deposits > Account Information > Interest Fields screen as well as the Interest Fields field group on the Deposits > Account Information > Account Information screen (if you have the proper security). Simple rate pointers can also be set up using the Deposits > Definitions > Rate Table screen.

See also: