Navigation: Deposit Screens > Account Information Screen Group > Funds Holds Screen >

When a deposit transaction has an amount entered in the Check In field in GOLDTeller, holds can be put in uncollected funds (UCF) for the total or a portion of the check-in amount. There are fields on the screen for each category of UCF (Local, Non-local, and Unspecified).

Enter the desired amount of funds holds in the appropriate categories on the Deposit transaction screen. When the transaction is processed, the system will use options on both the institution and account levels to calculate how long the hold will remain on the funds before the funds become available to the customer.

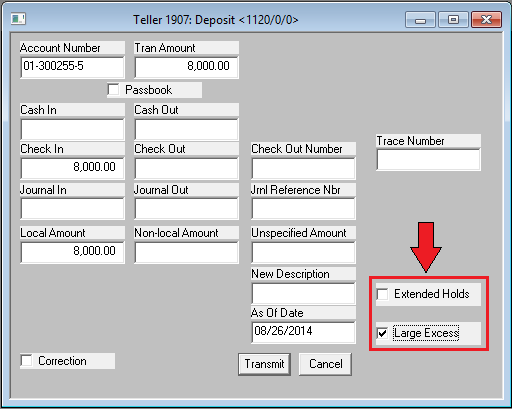

Once the transaction is processed, the CIM GOLD Funds Holds screen displays the holds and their expiration date. However, the teller can also determine any additional hold days to apply to a check deposit transaction. Two options can be placed on the Deposit transaction: Extended Hold and Large Excess. An example GOLDTeller screen showing these fields is below, followed by a description of each option:

Extended Holds |

This is the same option as the Extend Uncollected Fund Holds field on the Deposits > Account Information > Additional Fields screen in CIM GOLD, but applied to a single transaction. By enabling this feature, you can apply holds on a transaction (case-by-case) basis rather than setting automatic holds for every transaction on the customer account.

The system defaults to leaving this field blank so that transactions will normally run without any extended holds.

If this field is marked, the system uses the extended hold days based on your system's institution options for Next Day (Local) Extended Days and Second Day (Non-local) Extended Days options. For more information on those options, see the Deposit Funds Holds Options help page.

This feature is useful if your institution is trying to protect against fraud, bounced checks, etc. |

Large Excess |

If your institution would like to determine on a case-by-case basis whether or not to hold large checks before releasing the funds to the customer, you would use this option. If your institution aggregates, you must enter a checkmark on all checks you want combined for the day.

If a checkmark is entered, the check deposit will be verified for a large excess hold. If the check deposit exceeds the limit (set up in institution option LGEA or LGXA), the system will place the check deposit minus the limit as a large excess hold. Large excess holds are held for the same amount as the Next Day (Local) Extended Days or Second Day (Non-local) Extended Days. See the Deposit Funds Holds Options for more information.

If you are aggregating check deposits, you will need to place a checkmark in this field for all check deposits you want to be aggregated together.

If unchecked, the check deposit amount will not be considered for a large excess hold. When check deposits are aggregated, an unchecked field tells the system not to include this check deposit as part of the aggregated amount.

For example, your institution has the Large Check Amount option (LGEA) set to $5,000. The Next Day Hold Days option (LCAD) is set to 2 days, and the Next Day Extended Days option (LCED) is set to seven days. A customer deposits a local check for $8,000. The system would place $5,000 in the Next Day Amount field on the Funds Holds screen, with an expiration date for two days from the date it was deposited (based on LCAD), and the excess amount of $3,000 will be placed in the Excess field with an expiration date seven days from the date it was deposited. |

If these options do not appear on the Deposit transaction in GOLDTeller, and your institution wants to use them, see the Enabling Transaction-level Options in GOLDTeller help page.

Some of these account options have ties to transaction conditions or override warnings. Transaction conditions are institution-level options that are maintained by each institution. They are found on the Deposits > Definitions > Transaction Options screen. These conditions and warnings are explained further on the Transaction Conditions and Override Levels help page.