Navigation: Deposits > Deposit Screens > Definitions Screen Group >

Deposit Event Letters are used to notify your customers of a variety of events that have occurred or are about to occur on deposit accounts, such as certificate maturities, new accounts, interest postings, retirement distributions, address changes, and much more.

Features and options must be set up by your institution before any event letters can be processed. You can print event letters using GOLD EventLetters™ and Microsoft® Word. Letters are available for printing for seven days. They cannot be recreated after seven days.

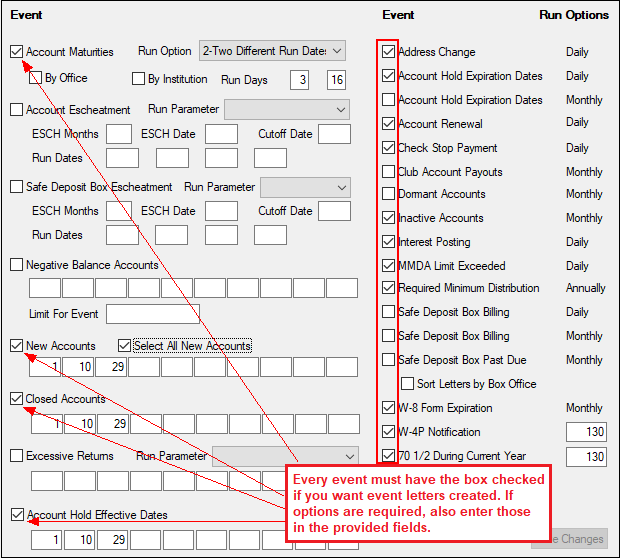

Each event is preceded by a checkbox to select to indicate that you want to use the event. Only the events selected will create letters, as shown in the screen example below:

Deposit > Definitions > Event Setup Screen

|

Note: Every checkbox field on this screen uses the mnemonic IEUSEV. |

|---|

For selected events, enter the appropriate run options. Each event has run options based on the nature of the event. In addition, each event also has a system-defined event number. If different options are available based on account criteria, a four-digit event letter number is also listed. When there are different event letter numbers available, you can create different event letters in your Microsoft Word file. The event descriptions are explained in detail in this help file.

An option is available that will split out the "No Mail" letters to their own event. The system will add 100 to the original event number, and all "No Mail" letters (Mail Codes: 20 = Do Not Mail, 30 = Bad Address, 40 = Institution Attention, 50 = Statement Top Sort) will appear for that event (for example, no mail 1040 events will become 1140). These new events will need to be attached to a letter before they can be printed. If your institution would like to use this feature, you will need to tie the appropriate event numbers to your event letters, then submit a work order to have the option (Miscellaneous Option 1) set for the Event Letter Generation Report (FPSDR500). See Tying Data Source Files in the GOLD EventLetters User's Guide for more information. |

The first table below lists events ordered by event number. The second table below list events as they appear on this screen (a left column and an alphabetically-ordered right column). Follow the links in the tables below to learn more about each event.

Event # |

Description |

|---|---|

1050

|

1 - Safe Deposit Box Billing (not in use) 2 - Safe Deposit Box Billing (not in use |

1051 1052 |

Safe Deposit Box Billing, office sort (not in use) Safe Deposit Box Billing, office sort (not in use) |

1060 |

Safe Deposit Box Past Due (not in use) |

4030 |

Safe Deposit Box Escheatment (not in use) |

Left Column |

Right Column |

Safe Deposit Box Escheatment (not in use) |

|

Safe Deposit Box Billing (not in use) |

|

|

Record Identification: The fields on this screen are stored in the FPHC record (Hold Code Definition). You can run reports for this record through GOLDMiner or GOLDWriter. See FPIE in the Mnemonic Dictionary for a list of all available fields in this record. Also see field descriptions in this help manual for mnemonics to include in reports. |

|---|

In order to use this screen, your institution must:

•Subscribe to it on the Security > Subscribe To Mini-Applications screen.

•Set up employees and/or profiles with either Inquire (read-only) or Maintain (edit) security for it on the CIM GOLD tab of the Security > Setup screen. |