Navigation: Loans > Loan Screens > Transactions Screen Group > Make Loan Payment Screen > Payment Selection field group >

Reverse NSF

Click the Reverse NSF radio button in the Payment Selection field group if you want to reverse a non-sufficient fund. Non-sufficient funds can be applied to accounts manually using the NSF transaction (tran code 2608-01) or running a corrected payment transaction with the NSF Fee? box checked (see the Walk-in Payment transaction, Corrections, for more information).

This transaction is used to reverse payments for non-sufficient funds by journal and offset the journal amount to the G/L account located on the GOLD Services > General Ledger > G/L Account By Loan Type screen in CIM GOLD (Bank Account (NSF Check/Allotment Pmt) field).

This transaction does the following:

•Processes an account payment correction by journal (correction code 608 for payments and 858 for miscellaneous fees).

•Processes an Account Miscellaneous Fee transaction (tran code 660) using fee code 9 (non-sufficient fee). The transaction will first use the amount in the NSF Fee Amount field or, if blank, it will use the NSF Fee Percent to calculate the percent of the fee. This amount in one of these fields will be used for the Journal Out amount on the transaction.

If there is an NSF Fee Maximum amount present when calculating the percent, it will not let the NSF fee be larger than the maximum.

Conversely, if there is an NSF Fee Minimum amount present when calculating the percent, it will not let the NSF fee be less than the minimum. If there is no NSF Fee Amount and no NSF Fee Percent, then the transaction uses the default amount stored in Institution Option LNFA. If the NSF Fee Not Allowed box is checked, no fee will be assessed.

•Processes a G/L credit (tran code 1810) to the Bank Account (NSF Check/Allotment Pmt) field found on the GOLD Services > General Ledger > G/L Account By Loan Type screen in CIM GOLD for the particular office the transaction is set to run for.

The Originating Branch field on the transaction plays an important role for those companies that handle non-sufficient funds rejects at a central location instead of the individual branch. If the originating office number is left blank on the transaction, the system will use the G/L account tied to the office that the teller is currently signed onto. (For those companies that allow the branches to handle their own NSF payments, the field can be hidden in GOLDTeller. See the Transaction Design section of the GOLDTeller User's Guide for information about how to hide fields. For CIM GOLDTeller, see the CIM GOLDTeller Screen Details > Functions > Administrator Options > Transaction Design > Field Properties Screen.)

If the originating office number is populated with a legitimate office number that has a G/L tied to it, the system will post the offset to the G/L tied to the entered office.

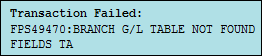

The NSF Payment Reversal transaction verifies that a prior payment existed before running the transaction. It also verifies that the G/L account and office number exist on the G/L Account By Loan Type screen prior to running. If a G/L number is not found for this loan type in the Bank Account (NSF Check/Allotment Pmt) field, the following error message will be displayed:

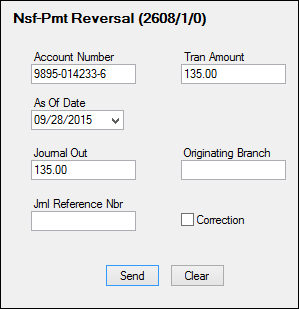

Once you enter information in the Transaction Information field group and click <OK>, CIM GOLDTeller launches with the NSF-Payment Reversal transaction displayed, as shown below:

Make any changes to the fields on this transaction, and then click ![]() to process.

to process.

See also: