Navigation: Loans > Loan Screens > Loan Initialization Screen >

What is a Loan Pattern?

A loan pattern is an institution-defined setting that can be selected at loan origination. When a loan pattern is used during loan origination, certain fields are automatically entered for the loan based on the loan pattern. For example, you can set up a loan pattern to determine the payment method of a loan, the interest rate, loan frequency, and other fields.

Creating a loan pattern on the Loans > System Setup Screens > Loan Pattern Setup screen involves entering information in fields on a template that correspond directly to fields on basic loan screens in CIM GOLD.

Your institution can create as many loan patterns (for as many different loan types) as necessary.

Why Use Loan Patterns?

Although a loan cannot actually be "opened" until an opening transaction is processed in GOLDTeller or funded through GOLDTrak, many fields can be populated at the time the loan is opened using loan patterns. Loan patterns are used to store field defaults for various types of loans.

Once patterns have been created (on the Loan Pattern Setup screen), they can be used in GOLDTrak PC or the Loans > Loan Initialization screen when setting up new loans. If the Loan Initialization screen is used to create new loans from a pattern, the loan is automatically opened using the Open Loan transaction (tran code 680). Additionally, your institution's Autopost (which automatically directs transaction debits and credits into your institution's applicable general ledger accounts) must be set up accordingly.

Using loan patterns cuts down on the amount of time it takes to enter data for new loans. In addition, the possibility of data entry errors is reduced for those fields whose values are established by a loan pattern.

What is Loan Initialization?

Loan initialization is the process of applying a previously created loan pattern to an unopened customer loan account. This can be done using the Loan Initialization screen, but is more commonly done through GOLDTrak PC, eGOLDTrak, or GOLDAcquire Plus. See Loan Initialization with GOLDTrak PC for more information.

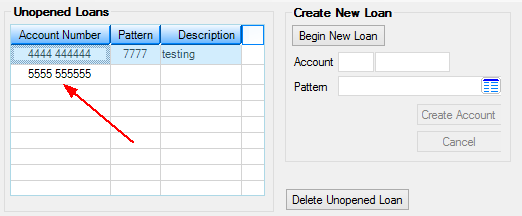

Once a loan has been initialized and opened, the information that was defaulted into fields can easily be edited if necessary. Initialized loans are displayed in the Unopened Loans list view, as shown below. After a loan is opened, it will automatically be removed from the list view.

Loan initialization is part of a three-step process of setting up a loan before it is funded:

Step 1: |

Create loan pattern defaults using the Loan Pattern Setup screen. |

||

Step 2: |

Insert the loan pattern defaults into an unopened account using the Loan Initialization screen (or GOLDTrak PC) and edit any defaults if necessary. |

||

Step 3: |

Use GOLDTeller to open the loan.

|

See the following help topics for more information about the loan initialization process:

Loan Initialization Screen fields