Navigation: Loans > Loan Screens > Bankruptcy and Foreclosure Screen Group >

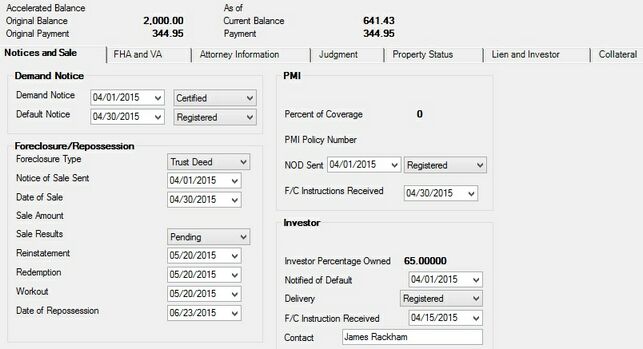

The Foreclosure, Repossession and Judgment screen is used to store information about and track foreclosures. This information can be used by GOLDWriter to create special foreclosure tracking reports.

Loans > Bankruptcy and Foreclosure > Foreclosure, Repossession and Judgment Information Screen

As a loan begins the foreclosure process, you may want to assign it to a special collection queue, given a label such as "Foreclosures" or something similar (using the Queues > Collection system in CIM GOLD). This would allow you to keep all foreclosures in a separate collector queue and on separate reports. Also, the Comment Code field on the Loans > Marketing and Collections screen should be set to "DS43 (Foreclosure)" for each loan account in foreclosure.

If any information is changed on this screen, it will appear on the Loans > History screen.

Certain transactions will also affect this screen. See the following links in DocsOnWeb for those transactions:

The tabs on this screen are as follows:

The fields visible at the top of this screen (regardless of which tab is selected) are as follows:

Field |

Description |

|

Mnemonic: N/A |

The Accelerated Balance is the balance still owed by the account owner under foreclosure. This amount could include more amounts than just the principal balance, such as fees and additional charges. The Sale of Security transaction may also cause this balance to be decreased. |

|

Mnemonic: N/A |

This is the date the Accelerated Balance above was last calculated. |

|

Mnemonic: LNOBAL |

This field contains the original amount of the loan. On loans with precomputed interest (payment method 3), this amount will include the loan principal plus the add-on amounts. This field is originally entered during loan origination. |

|

Mnemonic: LNPBAL |

This field displays the unpaid principal balance of the loan. It can only be entered, changed, or otherwise affected by teller transactions, which means it cannot be file maintained through this screen. Depending on the kind of loan, a transaction may either reduce or increase this balance. |

|

Mnemonic: LNOPIC |

This field contains the original amount of the principal and interest monthly payment on the loan. This field is originally entered when the loan is initially set up. |

|

Mnemonic: ASBANXTPAY |

This field displays the current loan payment amount due in the current month (or according to the payment frequency). This field displays the portion of the regular payment that is divided between the amount to interest and amount to principal. This field is calculated by the system. |

|

Record Identification: The fields on this screen are stored in the FPLN and FPFC records (Loan Master, Foreclosure). You can run reports for these records through GOLDMiner or GOLDWriter. See FPLN and FPFC in the Mnemonic Dictionary for a list of all available fields in these records. Also see field descriptions in this help manual for mnemonics to include in reports. |

|---|

In order to use this screen, your institution must:

•Subscribe to it on the Security > Subscribe To Mini-Applications screen.

•Set up employees and/or profiles with either Inquire (read-only) or Maintain (edit) security for it on the CIM GOLD tab of the Security > Setup screen.

•Set up the desired field level security in the FPFC records on the Field Level Security screen/tab. |