Navigation: Loans > Loan Screens > Transactions Screen Group > Make Loan Payment Screen >

Loan Fields field group

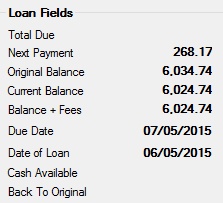

The Loan Fields field group displays loan information important to this loan. It displays the total amount due on the next payment date, the amount of the loan's original balance, the current balance on the loan, the loan's balance plus any fees, the due date of the next loan payment, the date the loan was opened, any remaining cash available on the loan, and the amount that would bring the account back to the original lending amount.

The fields in this field group are as follows:

Field |

Description |

|

Mnemonic: TOTAMT |

This field shows the total amount due on the loan to bring it to a current status. It is the sum of all payments due on the loan plus late charges and fees minus partial payments made.

|

|

Mnemonic: LNPICN |

This is the amount of the next regular payment due. It the portion of the regular payment that is divided between the amount to interest and amount to principal, if the account is paying interest. This field is calculated by the system. |

|

Mnemonic: LNOBAL |

This field shows the original balance of the loan. This amount is entered automatically by the system when the loan is opened. This field can only be file maintained through GOLDTrak PC or GOLDTeller transactions. |

|

Mnemonic: LNPBAL |

This field displays the unpaid principal balance of the loan. It can only be entered, changed, or otherwise affected by teller transactions, which means it cannot be file maintained through this screen. Depending on the kind of loan, a transaction may either reduce or increase this balance. |

|

Mnemonic: LNWXFEER |

This field contains the current balance of the loan plus any fees assessed against the loan. |

|

Mnemonic: LNDUDT |

This is the date the next regular payment is due. This information is pulled from the Due Date field on the Loans > Account Information > Account Detail screen. |

|

Mnemonic: LNOPND |

This is the date the loan was first opened or funded. The system automatically supplies this information when the loan is originated. |

|

Mnemonic: CIOVCA |

This figure is calculated by subtracting the Overall Payoff Amount from the Overall Credit Limit. If the calculation results in a negative number, the Cash Available is zero. This is the remaining amount of money this account owner is allowed to borrow from your institution. |

|

Mnemonic: OTBORG |

Some institutions use the Back to Original value for marketing purposes. This amount can give users the lending authority to lend customers additional funds back to the original amount without needing approval. If this value is calculated as negative, it will be displayed as 0 unless Institution Option NBTA is enabled. If Institution Option BOTL is used by your institution, this value will only display if it is less than or equal to the value specified by the option. The Back to Original column is calculated as follows:

This field is calculated as follows:

•If the loan is not a precomputed loan (payment method 3): Original Balance - Payoff Amount - Prepaid Interest - Insurance Premiums - Reserve Coverage Amount - Total Fees = Back To Original

•If the loan is a precomputed loan: Total Payment - Original Interest Add-on - Interest on Insurance - Payoff Amount - Prepaid Interest - Insurance Premiums - Reserve Coverage Amount - Total Fees = Back To Original (If the loan is a Tennessee loan, also subtract Extension Interest). |