Navigation: Loans > Loan Screens > Marketing and Collections Screen > CIF tab >

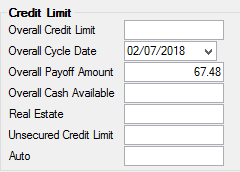

The fields in the Credit Limit field group on the CIF tab of the Marketing and Collections screen display the credit limit for this account owner.

The fields in this field group are as follows:

Field |

Description |

||||||||||||||

|

Mnemonic: CIOVCL |

This is the overall amount for which the borrower has been approved. All loans for which the borrower is responsible should not exceed this amount. |

||||||||||||||

|

Mnemonic: CIOVCD |

This is the date of the overall payoff and cash available calculation. If the date is blank, that means there has been activity and the system will recalculate the overall payoff and cash available in the afterhours.

The following teller transactions will clear the Overall Cycle Date, which triggers it to update during the afterhours.

The payment transactions will only clear the date if the transaction is run online; batch payments (run during the afterhours) will not clear the date. |

||||||||||||||

|

Mnemonic: CIOVPO |

This is the sum of the payoffs for that Social Security number, as of the overall cycle date. Multiple accounts can be tied to one SSN, so it is the sum of all payoffs on all accounts tied to that SSN. |

||||||||||||||

|

Mnemonic: CIOVCA |

This figure is calculated by subtracting the Overall Payoff Amount from the Overall Credit Limit. If the calculation results in a negative number, the Overall Cash Available will be zero. This is the remaining amount of money this account owner is allowed to borrow from your institution. |

||||||||||||||

|

Mnemonic: CIRECL |

This is the maximum dollar amount this account owner can borrow for a real estate loan, as approved by your institution. |

||||||||||||||

|

Mnemonic: CIUSCL |

This is the maximum dollar amount this borrower has been approved for in regards to unsecured debt–debt not secured by an underlying asset or collateral. |

||||||||||||||

|

Mnemonic: CIAUCL |

This is the maximum dollar amount this account owner can borrow for an auto loan, as approved by your institution. |