Navigation: Loans > Loan Screens > Inter-Office Move Screen >

Apply Inter-Office Loan Move(s) field group

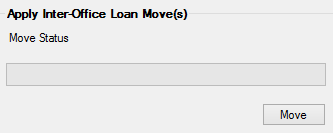

Once you have entered the desired account number(s) to be moved (see Selection Criteria field group), click <Move>. This will begin the process. The Move Status box will display the status as it completes the various steps. If any exceptions/errors occur during this process, a message will be displayed in message column of the table. The message will summarize the error and will need to be resolved before continuing.

After the move is performed, the “old” Account will remain in the old branch but will be identified as released. The system also places a Hold Code 39 (No annual statement or reported to IRS) and an Action Code 104 (Loan released—awaiting deconvert), as well as the an Action Date of the date of move, on the old account number.

Records moved in addition to the Loan Record are as follows:

CFLN, FPNT, FPML, CFDH, CFLI, CFLM, CFLT, CFPO, CSOT, CSPP, CSSI, F2QH, F2VN, FPAC, FPAD, FPAV, FPBK, FPBU, FPC0, FPC1, FPC3, FPFC, FPF1, FPFO, FPIL, FPIN, FPIP, FPL1, FPLA, FPLH, FPLS, FPLX, FPMB, FPMR, FPNI, FPNP, FPP5, FPPI, FPPL, FPPN, FPQA, FPQI, FPQP, FPRB, FPRD, FPSR, FPUF, FPVR, FPAU, CSRE, FPBF, FPBN, FPBY, FPHH, FPHL, FPL3, FPVH, FPVD, FPCK, FPDX, FPPN.