Navigation: Loans > Loan Screens > Insurance Screen Group > Policy Detail Screen > Policy Information tab >

Insurance Information field group

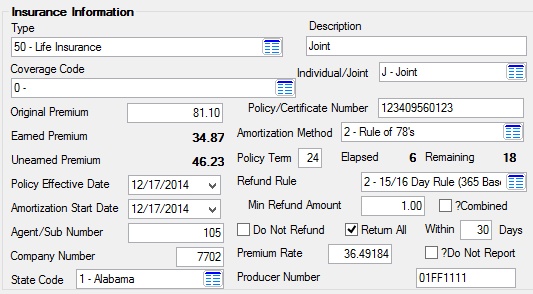

The Insurance Information field group on the Policy Detail screen shows insurance policy details. Insurance policies are secured during loan origination.

The fields in this field group are as follows:

Field |

Description |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Mnemonic: INTYPC |

Use this field to indicate the type of insurance policy being used on the customer loan account. See below for more information.

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Mnemonic: INDESC |

Use this field to indicate a brief description of the selected insurance policy. This field is required for payoff purposes. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Mnemonic: INCOV |

Use this field to indicate the coverage code for the Type (see above) and company of the selected insurance policy.

Coverage codes are specific to each individual insurance company. The possible selections in this field depend on the indicated Type. New coverage codes for insurance companies can be set up on the Loans > System Setup Screens > Insurance Coverage Codes screen.

This field can be included in GOLDWriter reports. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Mnemonic: INJORI |

Use this field to indicate whether the selected insurance policy is for joint persons or an individual. "C-Co-borrower" is another choice, which indicates a co-borrower purchased the involuntary unemployment (IUI) insurance policy. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Mnemonic: INOBAL |

Use this field to indicate the add-on insurance premium amount on the customer loan account. This field is used in calculating the Earned and Unearned premium amounts (see below).

When a loan is originated and an insurance policy purchased, the system divides this amount by the insurance policy term and adds the amount to the P/I Constant. For example, if the account owner purchased GAP insurance of $240 (with a policy term of 12 months) at the time the loan was originated, the system would divide 240 by 12 to get $20. If the P/I Constant was $200, the system would add $20/month until the insurance term was over, making the P/I Constant $220 per month.

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Mnemonic: INPLCY |

Use this field to indicate the policy or certificate number for the selected insurance policy. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Mnemonic: INWAAMT |

Use this field to indicate the amount of the original premium that has been collected since the date the selected insurance policy was opened.

This field is typically calculated with monthly loan payments. This value is the difference between the Original Premium (see above) and Unearned Premium (see below) amounts. In order for this field to properly calculate, the following fields in this field group must contain information: Original Premium, Policy Term, Policy Effective Date, and Amortization Method. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Mnemonic: INAMOR |

Use this field to indicate the method used for refunding any premium amount back to the customer due to an early cancellation of the selected insurance policy (or early payoff). See Amortization Methods for more information. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Mnemonic: INWUAMT |

Use this field to indicate the amount of premium to be rebated back to the customer if a loan payoff or policy cancellation occurs as of the current day.

This field is calculated by the system each time the screen is accessed. In order for this field to properly calculate, the following fields in this field group must contain information: Original Premium, Policy Term, Policy Effective Date, and Amortization Method.

This amount field appears on the Adjustments tab of the Loans > Payoff screen and is subtracted from the payoff amount. When the Payoff transaction is processed, this amount will be sent as a debit to the Unearned Interest (Payoff/Force Place Ins) General Ledger account set up on the GOLD Services > General Ledger > GL Account By Loan Type screen. Note: This field will only appear on the Payoff screen if information is entered in the Description field above.

See the Refund Rule, Min Refund Amount, Do Not Refund, Return All, and Return All/Within Days fields in this field group to learn about options that may affect whether or not a customer is eligible for insurance premium refunds. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Mnemonic: INTERM |

Use this field to indicate the term of the selected insurance policy in months. The number of months entered here is added to the Policy Effective Date field below to determine the ending date of the amortization period. This field is required for all calculations. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Mnemonic: INWETERM |

This field displays the number of months that have elapsed since the selected policy's effective date. This field is affected by the Refund Rule field below. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Mnemonic: INWRTERM |

This field displays the remaining term of the selected policy and is used for all Amortization calculations. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Mnemonic: INOPND |

Use this field to indicate the date the selected insurance policy took effect. This field is required in all calculations. This field is used with the Policy Term field above to calculate the amortization period in regards to refunds.

The actual day of the month is used in amortization calculation for refunds. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Mnemonic: INRULE |

Use this field to indicate how refunds are calculated on the selected insurance policy. See Refund Rules for more information. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Mnemonic: INDLAC |

Use this field to indicate the date amortization of the selected insurance policy begins. This is usually the beginning date of the insurance policy. The actual amortization period begins with this date and ends with a date that is calculated by adding the months in the Policy Term field above to the date in the Policy Effective Date field above.

This is a required field when calculating a refund based on the Amortization Method. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Mnemonic: INMINR |

Use this field to indicate the minimum refund amount your institution is required to issue the customer if the loan pays off early or is canceled. For example, if "10" is entered in this field, and the customer is due $5 for a refund, no refund is issued to the customer.

The amount in the Unearned Premium field above is compared against the amount in this field to determine whether the refund is under the minimum refund amount regulated by state law. If the Unearned Premium is equal to or above the value in this field, it is refunded to the customer. If the Unearned Premium is below the the value in this field, the Unearned Premium amount is then included in the Earned Premium (see above).

See the Refund Rule, Min Refund Amount, and Do Not Refund fields above to learn about options that may affect whether or not a customer is eligible for insurance premium refunds. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Mnemonic: INCMB1 |

Use this field to indicate whether the unearned premiums for all policies on the customer loan account will be added together and compared against the Min Refund amount (see above). If the combined unearned premiums are below the Min Refund amount, the unearned premium will be included in the Earned Premium (see above).

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Mnemonic: INAGNO |

Use this field to indicate the code number of the insurance agent for the selected policy. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Mnemonic: INDNRF |

Use this field to indicate whether any remaining funds for this insurance policy should be returned to the customer at payoff or cancellation.

See the Refund Rule, Min Refund Amount, Do Not Refund, and Return All/Within Days fields in this field group to learn about options that may affect whether or not a customer is eligible for insurance premium refunds. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Mnemonic: INTRTNA/INDYS |

Mark the Return All fields to indicate whether the full premium will be refunded if payoff occurs, then use the Within Days field to indicate the number of days within the payoff date this refund must be issued.

See the Refund Rule, Min Refund Amount, and Do Not Refund fields above to learn about options that may affect whether or not a customer is eligible for insurance premium refunds. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Mnemonic: INCONO |

Use this field to indicate enter the company number of the selected insurance company.

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Mnemonic: INPRRT |

Use this field to indicate the interest rate used to calculate the selected insurance premium. This value is generally either the loan rate or the APR rate. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Mnemonic: INRPTN |

Use this field to indicate whether the selected insurance policy will be reported to any insurance company. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Mnemonic: INSTCD |

Use this field to indicate the state where the selected insurance policy has been issued. Some insurance policy Types (see above) require a state code. See the Tax and Surcharge tab for more information.

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Mnemonic: INPRDN |

Use this field to indicate your institution’s producer number assigned by the selected insurance company. |