Navigation: Loans > Loan Screens > Insurance Screen Group > Policy Detail Screen >

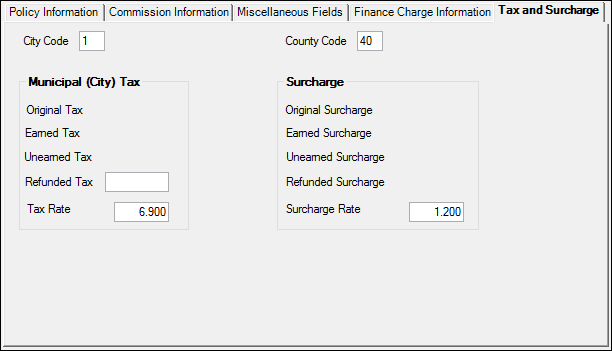

Use this tab to designate tax rates and surcharges for specific cities, counties, and states.

•The Municipal tax rate is applied by the city for that particular Insurance Type (some city tax rates vary from other city tax rates, county tax rates, and state tax rates).

•The Surcharge is an extra charge applied by the insurer or local government. For example, a surcharge may be added by the city to property insurance to help pay for city improvements. A surcharge can be a flat fee or a percentage.

Most of the fields on this screen are populated when insurance policies are placed or canceled on loans during loan origination, through the Force Place screen, or through GOLDTeller transactions (e.g., Force Place VSI Insurance, tran code 2870-00 or Cancel VSI Insurance, tran code 2910-00). However, some fields are file maintainable on this screen.

Your institution's G/L needs to be set up to credit and debit the taxes and surcharges. Use the GOLD Services > General Ledger > Setup G/L and Commissions screen to set up the General Ledger numbers for your institution. Contact GOLDPoint Systems if you need additional assistance setting up the General Ledger.

Loans > Insurance > Policy Detail Screen, Tax and Surcharge Tab

Use the City Code and/or County Code fields at the top of this tab to indicate the city and/or county codes depending on what kind of taxes apply to the selected insurance policy. These codes are required when certain insurance policies are set up on the loan. Loans with a Kentucky state code will have municipal tax and surcharge amounts calculated for them. These amounts are added to the principal and, if a finance charge is calculated, it is included in the finance charge amount. The rate for city, county, and state codes are set up on the Miscellaneous > Tables > Tax Rate Detail screen.

The field groups on this tab are as follows:

Municipal (City) Tax field group