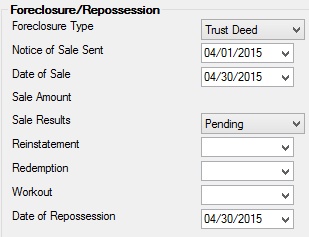

Navigation: Loans > Loan Screens > Bankruptcy and Foreclosure Screen Group > Foreclosure, Repossession and Judgment Information Screen > Notices and Sale tab >

Foreclosure/Repossession field group

Use this field group to view and edit information about any foreclosures, sale of security, repossession, or reinstatement of the customer loan account. Many of the fields in this field group are automatically populated when the Repossession transaction and/or Sale of Security transaction are run. See the following topics in the Transactions manual for more information on those transactions:

•Repossession transaction (tran code 2203-00)

•Sale of Security transaction (tran code 2510-03)

•Sale of Security with Taxes (tran code 2510-06)

•Sale of Security for Cards (tran code 2510-09)

•Sale of Security Full Write-off (tran code 2510-12)

The fields in this field group are as follows:

Field |

Description |

||

|

Mnemonic: FCSTYP |

Use this field to indicate the type of foreclosure on the customer loan account. Possible selections in this field are Trust Deed, Judgment, and Judicial Sale. |

||

|

Mnemonic: FCCSND |

Use this field to indicate the date the Notice of Sale (NOS) was filed and sent to the customer. |

||

|

Mnemonic: FCSALD |

Use this field to indicate the scheduled foreclosure sale date on the customer loan account. This field is automatically populated when one of the Sale of Security transactions is run. See the Sale of Security topics linked above for more information about these transactions.

|

||

|

Mnemonic: FCSLOS |

This field displays the amount of any collateral sold to pay down the principal balance on the customer loan account.

When the Sale of Security transaction (tran code 2510-03) is processed from GOLDTeller, the amount of the transaction is entered in this field. If an amount already appears in this field when another Sale of Security transaction is run, the transaction amount will be added to this amount. The Sale Amount field totals the amount of all Sale of Security transactions processed for this account.

This also applies to corrections, when the Sale Amount field will be reduced by the amount entered on the Sale of Security correction transaction. |

||

|

Mnemonic: FCSALS |

Use this field to indicate the result of a sale of security (collateral) on the customer loan account.

Possible selections in this field are:

•Pending: A sale of security has been instigated and is pending final approval. •REO (real estate owned): A property is owned by your institution after an unsuccessful sale at a foreclosure auction. •Claim: The sale of security is being reviewed by claims, such as VA Post-Foreclosure claims, HAMP claims, partial claims, etc. |

||

|

Mnemonic: FOCRID |

Use this field to indicate the date the customer loan account was last reinstated. This field is also populated when the Reinstate Loan transaction (tran code 2800-00) is processed for the account. |

||

|

Mnemonic: FCPSRD |

Use this field to indicate the final date on which the pre-sale redemption expires on the customer loan account in foreclosure, if applicable.

Not all states provide statutory rights of redemption for pre-sale foreclosures (also known as sheriff sale). If the loan originated in your state does allow a pre-sale redemption time period, enter the date it expires in this field. |

||

|

Mnemonic: FCRMPD |

Use this field to indicate the final date on which the redemption period expires on the customer loan account in foreclosure, if applicable.

The redemption period varies for each state and allows homeowners additional time to live in their property without the danger of being evicted. Your institution cannot continue with the foreclosure process during this period of time. The exact terms and length of time of the redemption period is determined by the state foreclosure laws, and not all states have a redemption period. |

||

|

Mnemonic: FCWKOD |

Use this field to indicate the date an arrangement for payment has been reached to resolve the foreclosure process on the customer loan account. |

||

|

Mnemonic: FCRPOD |

Use this field to indicate the date the collateral on the customer loan account was repossessed. This field should be used for cars, boats, televisions, etc. Collateral is stored using the Loans > Collateral Detail screen in CIM GOLD.

This date is updated any time the Repossession transaction (tran code 2203-00) is processed on the account. |