Navigation: Loans > Loan Screens > Account Information Screen Group > Signature Loan Details Screen >

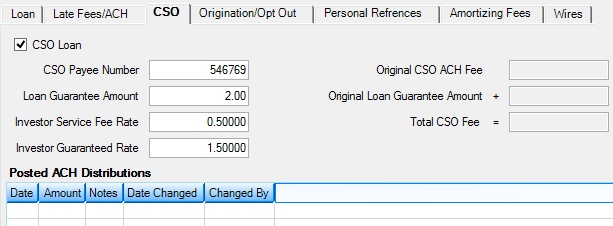

Information displayed on this tab is entered when a CSO loan is originated and transmitted through GOLDGateway. CSO loans are loans that are negotiated through a Credit Services Organization, sometimes also called Credit Access Businesses (CAB).

If your institution does not work with CSOs, this tab can be ignored. If your institution does work with CSOs to secure loans, mark the CSO Loan field to reveal any CSO information that was entered when the loan was opened.

For servicing a loan, CSOs require a guaranteed loan amount, as well as a monthly servicing fee. If the customer defaults on their loan and the loan is charged off, all remaining loan guarantee money is sent to the CSO, and the balance of the loan is paid by the CSO to the lender.

See the Setting Up CSO Payments help page for more information about how the system handles CSO accounts.

Loans > Account Information > Signature Loan Details Screen, CSO Tab

The Posted ACH Distributions list view at the bottom of this tab displays all ACH distributions made to the CSO. If a payment hasn’t been posted yet, you can right-click on the payment and select Cancel.

The fields on this tab are as follows:

Field |

Description |

|

|

Mnemonic: LN16CL |

If your institution works with CSOs to secure loans, mark this field to reveal any CSO information that was entered when the loan was originated. Generally, information in the fields on the CSO tab shouldn't be changed. CSOs provide low-credit customers options to help repair their credit and secure a loan. Marking this field makes the other fields on the CSO tab file maintainable. |

|

|

Mnemonic: LN16PY |

This field displays the CSO payee number as it has been set up on the Loans > Payee Information screen. The CSO must be set up on the Payee Information screen before ACH distributions can be made to the CSO. |

|

|

Mnemonic: LN16GA |

When loans are originated using a CSO, the CSO requires a guaranteed amount that they receive if the loan defaults. In return, the CSO pays your institution the remaining amount of the loan.

This amount reflects the remaining amount due back to the CSO for originating the loan. This field is updated by the system each time a payment is made.

The Original Loan Guarantee Amount field below displays the original amount of the guarantee when the loan was originated.

See help for the CSO tab for more information. |

|

|

Mnemonic: LNISVC |

CSOs require a monthly servicing fee as long as a loan is open. This field displays the percentage rate charged by the CSO for the loan. This field is set up at loan origination and should not be changed. See below for more information.

|

|

|

Mnemonic: LNIGRT |

This field displays the percentage rate used to calculate the amount of the payment sent to the CSO for the guaranteed amount. See below for more information.

|

|

|

Mnemonic: OTPPF1 |

This field displays the original amount of the CSO fee calculated when the loan was originated. The servicing fee is calculated as a percentage of the original balance. The Investor Service Fee Rate field above displays the percentage used to calculate this amount. |

|

Original Loan Guarantee Amount

Mnemonic: OTPPF2 |

This is the original guarantee amount on the loan that was set up when the loan was originated. This amount goes back to the CSO for negotiating the loan. This is the amount your institution guarantees to the CSO, and in return, if the loan defaults, the CSO pays the remaining amount due on the loan. |

|

|

Mnemonic: OTPPF1 + OTPPF2 |

This field displays the total CSO fee amount on the customer account. This value is calculated by adding the Original CSO ACH Fee to the Original Loan Guarantee Amount (see above).

|