Navigation: Loans > Loan Screens > Loan Assumption Screen > Buyer Information tab >

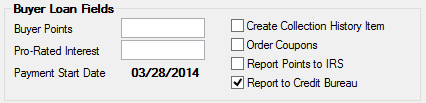

Buyer Loan Fields field group

Use this field group to view and edit basic information about the buyer assuming the loan.

|

WARNING: Buyer Information must be set up before entering information on any other tabs on this screen. |

|---|

The fields in this field group are as follows:

Field |

Description |

||

|

Mnemonic: LAPNTS |

Use this field to indicate any points paid by the buyer to the IRS on the 1098 form. This field is used in connection with the Report Points to IRS field. |

||

|

Mnemonic: LAIRSI |

Use this field to indicate the seller's portion of the interest paid. This amount is subtracted from the buyer's year-to-date interest and reported to the IRS at year-end.

Example: The Payment Start Date is 3/1/15 and the total interest due with that payment is $600.00. The assumption was completed on 2/20/15. The settlement indicated that the seller's portion of interest to 2/20/15 was $400.00. Since interest on the loan is paid in arrears, $400.00 of the interest to be paid with the 3/1/15 payment was actually paid by the seller. $400.00 would be entered in this field. The $400.00 will be added to the seller's portion of interest for all payments through the 3/1/15 payment, and will be the amount reported on the IRS 1098 form for the seller. The amount is shown in IRS GOLD. For the buyer, the system will subtract $400.00 from the year-end Year-to-Date Interest field (on the Loans > Account Information > Account Detail screen) and report that amount on the IRS 1098 form.

|

||

|

Mnemonic: LADTNP |

This field displays the date of the first loan payment which the buyer pays. The system will use this date to start gathering year-to-date information from the history used in IRS year-end reporting for the buyer (see the IRS GOLD User's Guide for more information). This date must match the Due Date before the assumption can be processed. |

||

Create Collection History Item

Mnemonic: LACHST |

Use this field to indicate whether a Collection Comment history item should be created at the time of assumption. The history item will indicate that the loan has been assumed. Important: If the account has never been sent to the Collection system (Queues > Collection > Collection Queues screen), no history item will be generated. |

||

|

Mnemonic: LACPNS |

Use this field to indicate whether payment coupons should be ordered for the buyer. This will enter an action code 100 in the action fields (on the Actions/Holds/Events tab of various CIM GOLD screens) at the time the assumption is processed. |

||

|

Mnemonic: LAFIRS |

Use this field to indicate whether the dollar amount contained in the Buyer Points field should be reported to the IRS for the buyer. |

||

|

Mnemonic: LACRBU |

Use this field to indicate whether the associated field on the Credit Reporting screen should be marked when the assumption is processed. |