Navigation: Loans > Loan Screens > Account Information Screen Group > Amortization Schedule Screen > Account Information tab >

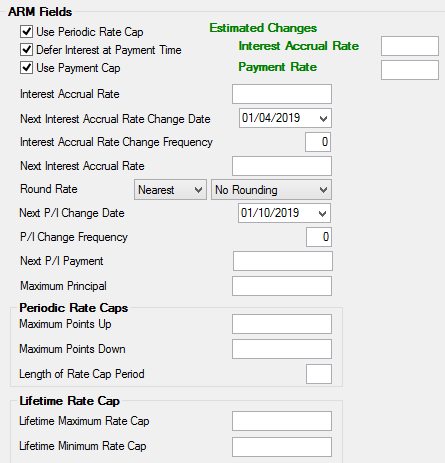

If this field group is available on the Account Information tab (see the Note box below), use this field group to indicate ARM information for the amortization schedule being created. See Creating a Schedule for an overview about creating amortization schedules using this screen, including a section specifically discussing ARM loans.

|

Note: If creating a schedule for an account that uses ARM fields, this field group will appear on the right side of the Account Information tab. Otherwise, this field group will not be visible. These fields will be unavailable for file maintenance unless the indicated Payment Method is 7 (it can also be 6 if the account has the Use ARM Fields checkbox marked). |

|---|

Changes made on this screen do not permanently affect the loan. When a user exits this screen, all fields default to their values on the actual loan as indicated on other Loan screens.

Once all necessary information is entered in the fields on this tab, click <Create Schedule>. The system will calculate an amortization schedule based on the indicated information and display it on the Amortization Schedule tab.

The fields in this field group are as follows:

Field |

Description |

|||||

|

Mnemonic: LNRCAP |

The periodic rate cap sets a limit on the interest rate for the loan. The interest rate is not allowed to adjust above or below this cap. For example, a loan that guarantees the rate will increase no more than 2% per year has a periodic rate cap. |

|||||

Defer Interest at Payment Time

Mnemonic: LNDFIM |

Use this field to indicate whether interest will be deferred at payment time in the amortization schedule being created. Deferring interest means that if a P/I does not cover all of the accrued interest owing with the payment, the remaining unpaid interest is added to the loan principal balance and to the Deferred Interest field on the Loans > Payoff screen. |

|||||

|

Mnemonic: LNPCAP |

Use this field to indicate whether a payment cap will be used in the amortization schedule being created. See below for more information.

|

|||||

|

Mnemonic: ESTRCH |

Use these fields to indicate estimations for changes in the Interest Accrual Rate and Payment Rate on the account for the amortization schedule being created. Enter the percentages that the interest accrual and/or payment rates would be increased or decreased on each rate change date.

If these fields are used, Lifetime Rate Caps must be indicated in the fields below (in order to prevent artificially high rates being used in calculations).

|

|||||

|

Mnemonic: LNAMRT |

Use this field to indicate the rate at which interest will accrue on the loan for the amortization schedule being created. |

|||||

Next Interest Accrual Rate Change Date

Mnemonic: LNAMDT |

Use this field to indicate the first date that the Interest Accrual Rate (see above) will change for the amortization schedule being created. All rates will roll automatically in accordance with the Interest Accrual Rate Change Frequency (see below) and this date. |

|||||

Interest Accrual Rate Change Frequency

Mnemonic: LNAMFQ |

Use this field to indicate the frequency (in months) at which Interest Accrual Rate (see above) will change for the amortization schedule being created. All rates will roll automatically in accordance with the Interest Accrual Rate Change Date (see above) and this frequency. |

|||||

|

Mnemonic: LNAMRT |

Use this field to indicate the next rate to be used in the amortization schedule being created. This rate will becomes effective with the payment due on the Next Interest Accrual Rate Change Date above.

|

|||||

|

Mnemonic: LNRDUP |

Use these two fields to specify how rates are rounded each time a new rate is calculated for the amortization schedule being created.

Use the left field to determine whether the Interest Accrual Rate (see above) will be rounded Up, Down, or to the Nearest value indicated in the right field. Possible options in the right field are No Rounding, 1/8th, 1/4th, 1/16th, and 1/10th. |

|||||

|

Mnemonic: LNPIEF |

Use this field to indicate the payment due date for the new P/I in the amortization schedule being created.

This is the date the Next P/I Payment amount (see below) will replace the current P/I. This field is used in conjunction with the Next P/I field above. Enter the date using MMDDYYYY format, or use the drop-down calendar to select the date. See below for more information.

|

|||||

|

Mnemonic: LNAMPC |

Use this field to indicate the frequency (in months) at which the P/I will change in the amortization schedule being created. |

|||||

|

Mnemonic: LNPICN |

Use this field to indicate the next P/I payment amount that will replace the current P/I in the amortization schedule being created. |

|||||

|

Mnemonic: LNPICN |

Use this field to indicate the maximum amount the loan principal balance can be increased due to deferred interest for the amortization schedule being created.

This field is mainly used with deferred interest loans and renegotiable loans where the principal balance can increase. This is a required field for all ARM loans. |

|||||

|

Mnemonic: LNAMRU, LNAMRD, LNAMLP |

Use these fields to indicate the Maximum Points Up and Down per period that the loan accrual rate can be adjusted in the amortization schedule being created, as well as the Length of the Rate Cap Period in months. |

|||||

|

Mnemonic: LNAMHI, LNAMLO |

Use these fields to indicate the Lifetime Maximum and Minimum rates allowed on the loan for the amortization schedule being created. |