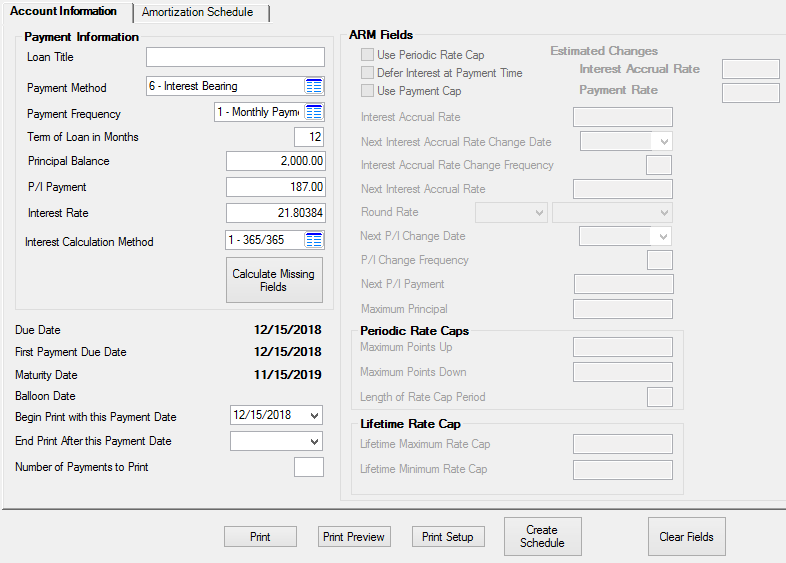

Navigation: Loans > Loan Screens > Account Information Screen Group > Amortization Schedule Screen >

This tab contains fields used to enter information about the amortization schedule being created. See Creating a Schedule for an overview about creating amortization schedules using this screen.

|

Note: If creating a schedule for an account that uses ARM fields, the ARM Fields field group will appear on the right side of this tab. Otherwise, this field group will not be visible. These fields will be unavailable for file maintenance unless the indicated Payment Method is 7 (it can also be 6 if the account has the Use ARM Fields checkbox marked). |

|---|

Clicking the <Calculate Missing Fields> button will calculate any missing data in the Payment Information fields on this tab. See below for examples of how this button can be used.

•If you want to see what the P/I Payment would be if the Interest Rate were lower, you could clear the P/I Payment, change the Interest Rate, then click this button. The new P/I Payment would be displayed.

•If you want to calculate the remaining term after a customer paid a large principal decrease, you would change the Principal Balance to the lower amount, clear the Term of Loan in Months field, then click this button. The new Term of Loan in Months would be displayed.

•To calculate several fields for a new loan, click the <Clear Fields> button to clear all file maintainable fields on the screen. Now you can enter the applicable data (principal balance, interest rate, payment method, term, etc.) then click this button to display the P/I Payment. |

Changes made on this screen do not permanently affect the loan. When a user exits this screen, all fields default to their values on the actual loan as indicated on other Loan screens.

Once all necessary information is entered in the fields on this tab, click <Create Schedule>. The system will calculate an amortization schedule based on the indicated information and display it on the Amortization Schedule tab.

Loans > Account Information > Amortization Schedule Screen, Account Information Tab

The fields on the left side of this tab are explained in the table below. If the ARM Fields field group is visible (as seen in the example screenshot above and explained in the Note box at the top of this page), see help for that field group for more information about those fields.

Field |

Description |

|||||||||||||||||||||||||||||

|

Mnemonic: N/A |

Use this field to indicate what will be used as the title of the loan amortization printout. Anything entered in this field will appear on the printout of the loan amortization schedule as the title of that report. If this field is left blank, the borrowers name, address and loan number will be printed on the schedule.

If you enter data in this field, the information you entered will be displayed on the printed copy of the amortization schedule. The customer name, address and loan number will not be displayed. This allows you to create hypothetical schedules that may or may not be directly tied to the account from which you accessed the screen. For example, if non-customers request that you create a schedule for them, you could access this screen from any loan and create and print a schedule. Exiting this screen clears this field. |

|||||||||||||||||||||||||||||

|

Mnemonic: N/A |

Use this field to indicate a payment method code to use in the amortization schedule. This code determines how to calculate interest and what rules to follow in processing the loan. Amortization schedules can only be printed for the following types of loans:

*See Note box at the top of this page. |

|||||||||||||||||||||||||||||

|

Mnemonic: N/A |

Use this field to indicate a payment frequency code. Open the link below for more information.

|

|||||||||||||||||||||||||||||

|

Mnemonic: LNTERM |

This field contains the term of the loan in months. This information is automatically pulled from the Loans > Account Information > Account Detail screen. Open the link below for more information.

|

|||||||||||||||||||||||||||||

|

Mnemonic: LNPBAL |

This is the unpaid principal balance of the loan. The amortization schedule will begin with this balance. |

|||||||||||||||||||||||||||||

|

Mnemonic: LNPICN |

This field contains the portion of the regular payment that is divided between the amount to interest and amount to principal. The amortization schedule will begin with this payment. |

|||||||||||||||||||||||||||||

|

Mnemonic: LNRATE |

This field displays the interest rate of the loan as found on the Balances & Dates tab of the Account Detail screen. For ARM loans* it is known as the payment rate. If the loan is an ARM, the accrual rate (LNAMRT) is used in the interest calculation.

*See Note box at the top of this page. |

|||||||||||||||||||||||||||||

|

Mnemonic: N/A |

Use this field to indicate the interest calculation code. This information is automatically pulled from the Account Detail screen.

Possible interest calculation codes are as follows:

|

|||||||||||||||||||||||||||||

|

Mnemonic: LNDUDT |

This is the date the next regular payment is due. The amortization schedule will begin with this date. |

|||||||||||||||||||||||||||||

|

Mnemonic: LN1DUE |

This field displays the first payment due date on this loan. This is displayed for informational purposes only. The schedule begins with the current due date. |

|||||||||||||||||||||||||||||

|

Mnemonic: LNMATD |

This field displays the date for when the last payment is due and when the loan should be paid in full. The amortization schedule will display payments up to the maturity date and a message "Maturity Payment xx/xx/xxxx" will be displayed. For example, if the maturity date is 5/1/2018, the message will appear after the 4/1/2018 payment. Even if the principal balance isn’t zero at that time, no more payments will be displayed; however, the outstanding principal balance is still shown in the Remaining Balance column on the Amortization Schedule tab.

|

|||||||||||||||||||||||||||||

|

Mnemonic: N/A |

This is the date a balloon payment is due (action code 1). The amortization schedule will display payments up to the balloon date and a message "Balloon Payment xx/xx/xxxx" will be displayed. For example, if the balloon date is 5/1/2018, the message will appear after the 4/1/2018 payment. Even if the principal balance isn’t zero at that time, no more payments will be displayed; however, the outstanding principal balance is still shown in the Remaining Balance column on the Amortization Schedule tab.

Be aware that if a loan has a balloon payment, most institutions set up the maturity date and the balloon date to be the same. The message in those instances will be the balloon message.

|

|||||||||||||||||||||||||||||

Begin Print with this Payment Date

Mnemonic: N/A |

If you want the schedule to display payments prior to or after the current due date, enter the applicable date in this field and print the schedule. If this field is left blank, the system will calculate this date for you. This field defaults to the current loan due date.

|

|||||||||||||||||||||||||||||

End Print After this Payment Date

Mnemonic: N/A |

If you want the schedule to print payments up to a date earlier than the default dates, enter a date in this field. For example, for a 30-year mortgage you may only want to print a schedule for 3 years, and you would enter that date here. |

|||||||||||||||||||||||||||||

|

Mnemonic: N/A |

Use this field to indicate the specific number of payments you want the schedule to print. For example, if you want to print a schedule for 24 payments for a 30-year mortgage, you would enter "24" here.

If this field is left blank (default), the schedule will be printed to the earliest of the maturity date, balloon date, next interest rate or P/I payment change date. |