Navigation: Loans > Loan Screens > Investor Reporting Screen Group > Sell Loan To Investor Screen > Setup tab >

Account Information field group

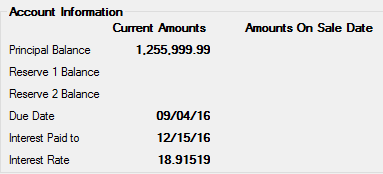

Each field in this field group displays two values. The first value pertains to current account information (Current Amounts column) while the second value pertains to account information as it existed on the loan sale date (Amount On Sale Date column, if applicable).

These fields are not file maintainable and are for informational purposes only.

The fields in this field group are as follows:

Field |

Description |

The principal balance of the account, as pulled from the Loans > Account Information > Account Detail screen. |

|

The reserve balances of the account, as pulled from the Loans > Account Information > Reserves > Reserve Analysis screen. |

|

The due date of the account, as pulled from the Loans > Account Information > Account Detail screen. |

|

The interest paid to date of the account, as pulled from the Loans > Account Information > Account Detail screen.

Amounts On Sale Date A transaction, run as the loan is sold, will post prepaid interest to a custodial account. The amount of interest posted will be calculated from the interest paid to date at the sale date to the current interest paid to date.

The interest amount is not posted to the custodial account immediately, but it is set up to post in the afterhours along with all other autopost transactions. In the afterhours, the interest amount will post to the investor's deposit account. Transaction Origination Codes 88 and 89 will post the interest amount to designated accounts in the General Ledger.

If you want to post the interest directly to a custodial account in the General Ledger instead of the deposit account, you must set up the loan autopost with transaction 30.

The following example illustrates how this transaction can be helpful.

On 5-20 a loan is closed. The customer pays prepaid interest to 6-1. The Date Interest Paid To field on the Account Detail screen shows the date to which the interest is paid (06-01-08). On 5-21 the loan is sold with the sell a loan function. This function will collect interest from 5-1 to 5-21 by using the effective paid-to-date of 5-01-08. The new transaction calculates the interest already paid from 5-1 (the date of the sale) to 6-1 (interest prepaid on this loan). It applies this amount to a custodial account for the investor.

For payment method 0 and 7 loans only, if a loan has been sold to an investor, any time a principal decrease (tran code 510) or correction (tran code 518) is processed, the system will write the Date Interest Paid To to history. This date is not changed but is written to history so that for scheduled/scheduled reporting, the system can use this date as the payment date for the curtailment. |

|

The accrual interest rate of the account, as pulled from the Loans > Account Information > Account Detail screen. |