Navigation: Deposit Screens > Account Information Screen Group > Funds Holds Screen > Uncollected Funds and Deposit Delay tab > Uncollected Funds field group >

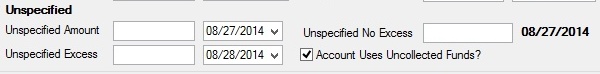

Unspecified fields

Use these fields to view and edit information about unspecified holds on the customer deposit account. Unspecified funds are also referred to as certified funds (travelers checks, government checks, etc).

Government regulations determine how long institutions can hold unspecified checks before allowing customers to use the funds. These options are based on where the check was from, how much the check was for, and the deposit history of the account owner. In order to access UCF options, the Account Uses Uncollected Funds field on this or the Deposits > Account Information > Additional Fields screen must be marked. To learn more about UCF, see the Uncollected Funds Types and Options help page. UCF are set up on customer accounts from this tab as well as the Uncollected Funds Options field group on the Additional Fields screen. Also, your institution must have values in the institution options that pertain to uncollected funds. To learn more about these institution options, see the Deposit Funds Holds Options help page.

In this field group, each Amount field corresponds to an Expiration field to the right. Each Expiration field is used to determine the calculated date on which the corresponding UCF hold Amount will expire. Holds drop the morning of the expiration date and are available for withdrawal on that date.The system will automatically delete uncollected funds records on the morning of their expiration dates.

The fields in this field group are as follows:

Field |

Description |

|---|---|

|

Mnemonic: DUCRAM, DUCTEX |

This field displays the amount of the unspecified check hold. This amount is entered when a Deposit transaction is run with the GOLDTeller Unspecified Amount field populated. See the Deposit Transaction Hold Setup help page for more information. This is the amount of the check that will be available to the customer on the morning of the corresponding Expiration date. |

|

Mnemonic: DUSLQA, WKDT06 |

This field is only used if your institution aggregates large deposits. If the teller leaves the GOLDTeller Excess field on the Deposit transaction blank, and enters an amount in the Unspecified Amount field, then that amount will be displayed in this field (minus the standard $200 to the Next Day No Excess Amount field). See the Deposit Transaction Hold Setup help page for more information. These funds need to be kept separate from the amount specified in the Excess Amount field below. |

|

Mnemonic: DULGAM, DULGEX |

This field is only used if your institution aggregates large deposits. If the teller marks the GOLDTeller Excess field on the Deposit transaction and enters an amount in the Unspecified Amount field that totals more than the Large Excess Amount option, the remaining amount will be displayed in this field. This field contains an amount that comes from a transaction that includes Unspecified deposits by one or more checks to the extent that the aggregate amount is greater than the amount specified by the Large Excess Amount institution option (see the Deposit Funds Holds Options help page for more information). If your institution does not aggregate, this field is not used. The expiration of this type of hold will use the Next Day Extended Days institution option.

For example, a customer deposits three unspecified checks totaling $9,000 into their account. The teller enters “9,000” in the Unspecified field and marks the Excess box. The system would hold the funds as follows:

$200 into Unspecified Next Day Amount would expire the next business day. $4,800 into Unspecified Amount Amount would expire in five days. $4,000 into Unspecified Excess Amount would expire in seven days. |