Navigation: GOLD Services > GOLD Services Screens > Check Reconciliation Screen Group > Check Detail Screen > Search fields > Buttons/Dialogs >

The External Source feature provides the ability to offer reconciliation services to customers who have checking accounts at your institution. If your customer supplies your institution with a file of check records (either an Excel file or some other tab-delimited file), your institution can upload and post the file into the Check Recon system for specifically marked customer accounts.

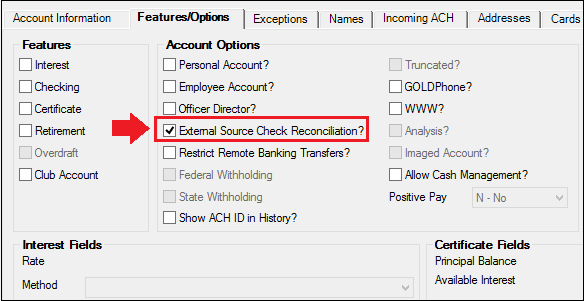

To mark the accounts that allow external accounts in Check Recon, check the External Source Check Reconciliation (DMXSCR) box on the Deposits > Account Information > Account Information screen, Features/Options tab in CIM GOLD. See External Source Check Recon in the Deposits in CIM GOLD manual for more information.

As checks clear on the marked accounts, they are also added to the Check Recon system by the inclearing process. If the check is already on file, it is only updated.

|

Note: The account number for the checks is added to the reconciliation record at the time the inclearing items post. If an account number already exists, there is no update.

It may be easier to reconcile checks using the Positive Pay product rather than using Check Recon. See the Deposits > Account Information > Positive Pay Checklist screen in CIM GOLD for more information about Positive Pay. |

|---|

The following is an example of the Account Information screen where the External Source Check Reconciliation option is found.

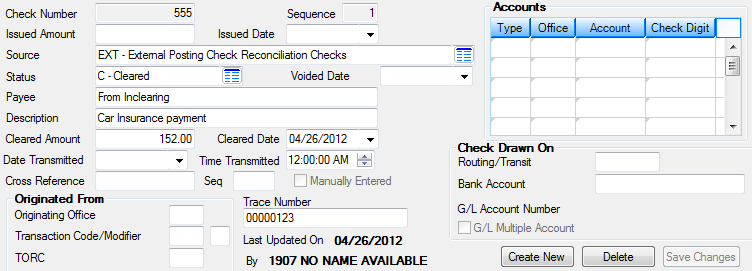

When a check posts against a deposit account that has the External Source Check Reconciliation option set, the check record is sent to Check Recon with the following information: Description (if current description does not exist), Status of "C - Cleared," Source (if no source exists), Cleared Amount, Date Cleared, Trace Number, and Account Number.

When posting external check records, the system checks to see if the cleared check matches the Check Number, Issued Amount, and the Status that was uploaded in the file. If the check number is already cleared or voided, or the check number and/or issued amount do not match the check number and cleared amount, the system will generate a new check number or check sequence with no issued amount or issued date. See the following example.

GOLD Services > Check Reconciliation > Check Detail Screen