Navigation: Miscellaneous Screens > ACH/Wire Screen Group >

The ACH Funds Distribution screen displays history of all ACH funds that have been distributed into customers' chosen savings or checking accounts. The official name of the ACH funds distribution record is the FPAE record.

This screen is only for institutions that fund loans and distribute ACH funds directly to the customer’s checking or savings account when loans are originated.

However, this screen also displays any ACH funds distributed to third-party accounts using the ACH Funds Upload screen (canceled and pending distributions also display on this screen depending on the search criteria). Reasons for using the ACH Funds Upload screen for ACH transmissions include:

•Returning any late charges or fees to an account owner.

•The account owner takes advantage of a promotion your institution is offering.

•A refund for an insurance cancellation.

•Funds for a referral the customer instigated.

Note: If using the ACH Funds Upload screen to distribute funds into a customer's account, the customer must be set up with recurring ACH payments (or an External Account) on the Loans > Transactions > EZPay screen. This is not a requirement if distributing funds through loan origination. The routing and account number used for ACH distributions on funded loans should be part of the loan application; though some institutions also designate a checking account for recurring payments at the same time the loan is funded.

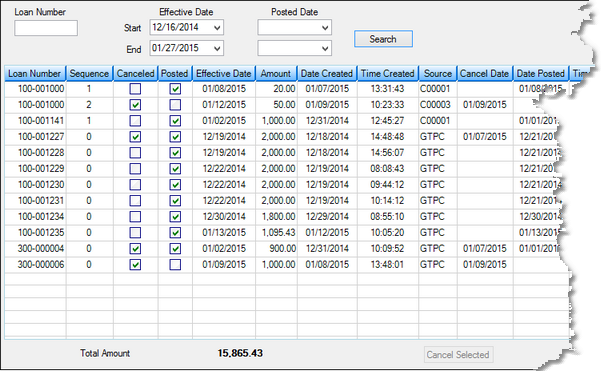

The list view on the ACH Funds Distribution screen displays a record of all ACH transmissions sent to third-party institutions, as shown in the example below. See ACH Funds list view details to learn more about the information displayed in this list. The fields above the list view can be used to indicate search criteria. If the <Search> button is clicked, only transmissions matching the indicated criteria will be displayed. See below for more information about these search fields.

![]() ACH Funds Distribution search fields

ACH Funds Distribution search fields

Use the Loan Number field to only display transmission information for one loan account.

A range of dates can be indicated in the Start and End fields for both the Effective Date and the Date Posted of transmissions. Only transmissions that occurred within the indicated date ranges will appear in the list. Both posted and non-posted transmissions will be displayed if you use the Effective Date fields but leave the Posted Date fields blank. If the Posted Date fields are used, transmissions that have not been posted during the date range selected will not be included in the list.

•If you only enter a Start date for Effective or Posted, the system will search for all records from the date you entered to all future effective dates. •If you only enter an End date for Effective or Posted, the system will search for all records from the start of history to the date entered in the End date field. •If you leave the Search fields blank and click <Search>, the system will return all ACH distribution records ever created from your institution.

Once <Search> is clicked and the transmissions matching the indicated criteria are displayed in the list, the Total Amount field below displays the total amount of ACH funds distributions displayed in the list view. |

Miscellaneous > ACH/Wire > ACH Funds Distribution Screen

Posting and Canceling Funds

The system automatically posts the funds to your customers' designated checking or savings accounts after a loan is funded from loan origination. Funds are posted as designated by your institution. Some institutions send ACH transmissions every five minutes; other institutions send ACH transmissions just once a day. Contact your GOLDPoint Systems account manager for how often your institution wants to transmit ACH funding.

Institution option ACOF (ACH Disbursement Cutoff Time) determines the cutoff time of when they system no longer allows ACH funding for the day. Any loans opened after the cutoff time will be funded in the next business day's ACH transmission.

Once the ACH funding transmission is sent, the system updates the Date Posted field for the account at that time. Canceling funds once the Date Posted is entered is not allowed.

You can cancel funds that haven't yet posted by checking the Canceled checkbox in the list view, and then clicking ![]() . This must be done before the funds have been posted (in other words, before a date is shown in the Date Posted column). Once funds have been posted and deposited into accounts, you likely can't get the funds back (institutions can contact GOLDPoint Systems to inquire about changing a distribution, but GOLDPoint Systems cannot guarantee that a change will be possible).

. This must be done before the funds have been posted (in other words, before a date is shown in the Date Posted column). Once funds have been posted and deposited into accounts, you likely can't get the funds back (institutions can contact GOLDPoint Systems to inquire about changing a distribution, but GOLDPoint Systems cannot guarantee that a change will be possible).

Do not attempt to cancel funds distributions after the Date Posted contains a date.

When loans are funded, the system sends an ACH transmission to the customer’s bank, which then distributes the funds into the account. Sometimes those transmissions are rejected by the bank due to various reasons, such as the account not existing or the account being closed. When the system receives a rejected transmission file back from the bank, the system automatically closes the loan as paid in full (loan retraction).

However, Institution Option SLAR allows you to choose what should be done with the loan. The loan is not automatically retracted (tran code 2800-01). Instead, someone at your institution can call the customer and ask for a new account to distribute the money into or ask if they would like a check mailed to them instead. Or you may choose to also close the loan. The option allows you to decide what happens with the loan.

For researching purposes, the Loans > Reports > ACH Returned Payments screen displays any returned ACH transmissions. You can use this screen to view any returned ACH transmissions and a brief reason as to why it was returned. This screen is very helpful if Institution Option SLAR is not on.

If Institution Option SLAR is on, you can view the GEM Exception Report (FPSDR096) to see which account transmissions were rejected.

If the customer would still like the loan and provides a new bank account number to deposit the funds into, you would need to complete the following steps:

1.First you would need to change the routing and account numbers to the new routing/account number the customer wants in the Recurring field group on the Loans > Account Information > Payment Information screen > Loan Information tab. Recurring payment fields can also be changed from the EZPay screen and Signature Loan Details screen (if applicable).

2.Then you would use the Miscellaneous > ACH/Wire > ACH Funds Upload screen to resend the funds. |

In order to use this screen, your institution must:

•Subscribe to it on the Security > Subscribe To Mini-Applications screen.

•Set up employees and/or profiles with either Inquire (read-only) or Maintain (edit) security for it on the CIM GOLD tab of the Security > Setup screen. |

|

Record Identification: The fields on this screen are stored in the FPAE record (ACH Funds Distribution). You can run reports for this record through GOLDMiner or GOLDWriter. See FPAE in the Mnemonic Dictionary for a list of all available fields in this record. Also see field descriptions in this help manual for mnemonics to include in reports. |

|---|

See also: