Navigation: Loans > Loan Screens > Loan Assumption Screen > Seller Information tab >

Seller Name & Address Information field group

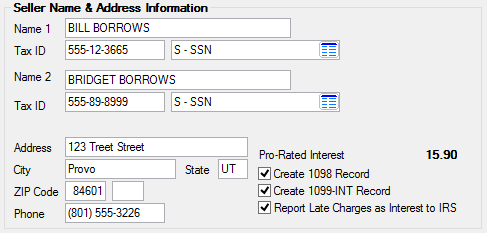

Use this field group to view and edit basic contact information about the seller(s) of the loan being assumed by the buyer. This information is pulled from CIF and up to two seller names can be designated.

|

WARNING: Buyer Information must be set up before entering information on any other tabs on this screen. |

|---|

Besides basic Name, Tax ID, and contact information fields (mnemonic LAPAYE, LASSN1, LAPYE2, LASSN2, LAPADR, LAPCTY, LASABR, LAPZIP, LAPZP4, LABPHN) this field group contains four additional fields:

•The Pro-Rated Interest field (mnemonic LAIRSI) displays the seller's portion of the interest paid. See the Buyer Loan Fields help page to learn more about how this value is calculated.

•Use the Create 1098 Record and Create 1099-INT Record fields (mnemonic LA1098, LA1099) to indicate whether the system should create the relevant tax records at the time of assumption. If these fields are marked, the seller's Address must be their current mailing address, so that accurate IRS information is reported. Institutions are responsible for printing 1098 and 1099-INT forms through IRS GOLD and sending them to their customers. The 1098 record is created from this screen and sent to IRS GOLD, so be sure the names, social security numbers, etc., are correct. Corrections can be made to this information through IRS GOLD.

•Use the Report Late Charges as Interest to IRS field (mnemonic LALIRS) to indicate whether the system should report the amount in the Late Charges Collected field to the IRS as interest paid. At the time a loan assumption is processed, the system includes the late charge amount with the year-to-date interest paid when sending information to IRS GOLD (if the seller has paid late charges during the year). To do this, this fields and the Create 1098 Record field must be marked. WARNING: The Late Charges Collected field is only updated at monthend. If the seller pays a late charge in the same month that the assumption is processed, the late charge amount paid that month will not be included; the amount of interest paid will need to be adjusted in IRS GOLD.