Navigation: Loans > Loan Screens > Credit Reporting > Credit Reporting Screen >

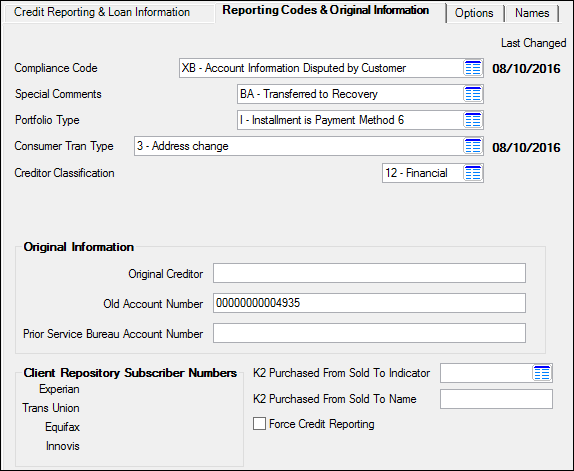

The Reporting Codes & Original Information tab on the Credit Reporting screen is used to enter Credit Bureau reporting codes and view Credit Bureau subscriber numbers.

See the following example of this tab, followed by field descriptions:

The fields on this tab are as follows:

Field |

Description |

||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

Mnemonic: BUCMCD |

See Compliance Codes are more information. |

||||||||||||||||||||

|

Mnemonic: BUDT08 |

This field shows the date file maintenance was performed on the Compliance Code. |

||||||||||||||||||||

|

Mnemonic: BUSPCM |

See Special Comment codes for more information. |

||||||||||||||||||||

|

Mnemonic: BUDT09 |

This field shows the date file maintenance was performed on the Special Comment Code. |

||||||||||||||||||||

|

Mnemonic: BUPOTP |

This drop-down list indicates the portfolio type and is determined by the payment method at monthend. See below for more information.

|

||||||||||||||||||||

|

Mnemonic: BUCTTY |

This field is no longer used in Credit Reporting. As of 2016, the Credit Reporting Resource Guide sent out by the Consumer Data Industry Association says the Consumer Transaction Type is obsolete. Remove any information in this field. If information is not removed, it will be ignored by the system when the Credit Report and transmission are generated.

The consumer transaction type is user-entered. The consumer transaction type provides a way to notify the repositories that a correction of name, address, or social security number was made on the account that month. This will allow the repositories to make file changes. These codes notify the credit repositories that changes are occurring to the file. File maintenance to this field writes to loan history.

Valid types on the drop-down list are as follows:

If institution option OP28 CCTT (Clear Consumer Trn Type on Credit Report) is enabled, this field will be cleared. The transaction type will also not appear on the Credit Report (FPSRP184) and will therefore not be reported to Credit Bureaus. |

||||||||||||||||||||

Consumer Tran Type Last Changed

Mnemonic: BUDT11 |

This field shows the date file maintenance was last performed on the Consumer Tran Type (above). |

||||||||||||||||||||

|

Mnemonic: BUCRCL |

This field identifies the type of lending institution that originated the loan. The default is “8” for the banking industry. |

||||||||||||||||||||

Original Information field group |

See Original Information field group for more information. |

||||||||||||||||||||

Client Repository Subscriber Numbers field group

Mnemonic: BUEXPN, BUTUNN, BUEQFX, BUCCA |

Use this field group to view your institution's subscriber numbers associated with the main four credit repositories. These numbers are entered through institution options set up by your GOLDPoint Systems account specialist. If the subscriber number field is blank, no information will be supplied to that credit repository. The four credit repositories represented in this field group are Experian (OPT EXPR), Trans Union (OPT TRNS), Equifax (OPT EQUI), and Innovis (OPT CCA3). |

||||||||||||||||||||

K2 Purchased From Sold To fields |

See K2 Purchased From Sold To fields for more information. |

||||||||||||||||||||

|

Mnemonic: BUCRBO |

When the Force Credit Reporting option is checked on charged-off accounts, those accounts will be included on the Credit Report and transmission (FPSRP184) sent to the credit bureaus to which your institution reports. The account will continue to be reported until you uncheck the box. See below for more information.

|