Navigation: Loans > Loan Screens > Payoff Screen > Adjustments tab >

Description

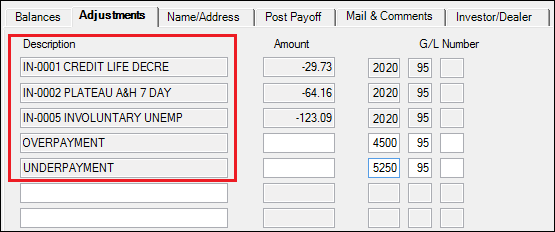

Description fields indicate basic descriptions of additional amounts that will be subtracted from the Payoff Amount automatically once the payoff is processed on the Post Payoff tab.

Most adjustment descriptions are calculated and entered automatically by the system. You should rarely ever need to enter additional adjustments, and if additional adjustments need to be made, you must have the proper security clearance. Adjustments can include such items as recording fees, legal fees, Prepayment fees, unearned interest on precomputed accounts, and insurance rebates, as shown in the following example:

Each Description corresponds to an Amount and G/L Number. This Description will transfer to the General Ledger system when the loan is paid off.

The OVERPAYMENT and UNDERPAYMENT descriptions automatically appear on this screen once the payoff is processed on the Post Payoff tab. If an underpayment or overpayment does exist after the payoff is posted, the relevant amounts will be displayed on this screen. Their applicable G/L accounts are Payoff Overpayment and Payoff Underpayment set up on the GOLD Services > General Ledger > G/L Account By Loan Type screen. See the Over/Under Payments Report (FPSRP297) for more information.

The REFUND 5 PERC FEE description appears if your institution has enabled a 5% fee refund for its non-GILA customers. This refund is enabled using the Refund 5 Perc Fee (TF_5_PERC FEE REFUND) field in GOLDTrak. Contact GOLDPoint Systems if your institution wants to enable this refund.

Prepayment Penalty

If a "PREPAYMENT PENALTY INT" description is entered from the Prepayment Code field, the system will display the prepayment penalty description in this field. If you want the penalty to apply, the appropriate General Ledger account number must be displayed in the G/L Number field. This number must match the number set up in the Pre-Payment Penalty or Minimum Interest G/L account field on the G/L Account By Loan Type screen.

If the penalty should not be reported as interest on the 1098 Mortgage Interest Statement, you must change the wording of the prepayment description entered on this screen. The wording “PRE-PAYMENT PENALTY INT” should be changed to read “PRE-PAYMENT PENALTY FEE.” Notice that the word INT is changed to FEE. If the description reads “PRE-PAYMENT PENALTY INT,” the transaction amount will be added to the YTD Interest field on the Loans > Account Information > Account Detail screen. This amount is reported to the IRS at year-end and included as mortgage interest for the customer on the 1098 form.

Unamortized Portions of Insurance Policies

Any unamortized portions of insurance policies will also be adjusted by the system. The unamortized insurance amount will be credited to the principal amount due. The General Ledger account that will be credited is found in the Unearned Interest (Payoff/Force Place Ins) on the G/L Account By Loan Type screen. The insurance descriptions will appear in this field.

The text of the insurance description begins with “IN” (indicating that it came from the insurance record on the Loans > Insurance > Policy Detail screen) and the sequence number for the insurance policy. For example, a policy titled “life insurance” would appear as “IN-0001 Life Insurance.” The Customer Quote shows the information entered in this field (IN-0001 does not appear).