Navigation: Loans > Loan Screens > Account Information Screen Group > ARM Information Screen > ARM Detail tab >

Periodic Rate Caps field group

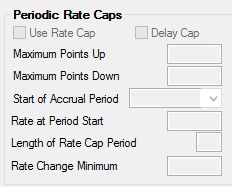

The Periodic Rate Caps field group, which appears on both the ARM Detail and Rate Caps & Negative Amortization tabs of the ARM Information screen, contains rate cap information for the account.

The fields in this field group are as follows:

Field |

Description |

|

|

Mnemonic: LNRCAP |

The periodic rate cap sets a limit on the interest rate for the loan. The interest rate is not allowed to adjust above or below this cap. For example, a loan that guarantees the rate will increase no more than 2% per year has a periodic rate cap. This checkbox defaults to unchecked. Place a checkmark in this field if a rate cap is to be used.

The other fields in this field group (excluding Delay Cap below) are needed in order for the rate cap to function properly. |

|

|

Mnemonic: LNDCAP |

If this checkbox is not checked (default), the periodic rate caps will be used when calculating new rates. If a checkmark is displayed, the system will ignore the periodic rate caps when calculating new rates until the calculation is for the rate effective on the date in the Start of Accrual Period field below. |

|

|

Mnemonic: LNAMRU, LNAMRD |

Use these fields to indicate the maximum and minimum points per period that the loan accrual rate can be increased. These fields will only work when there is a checkmark in the Use Rate Cap field above. |

|

|

Mnemonic: LNAMPD |

This is the starting date of the current rate cap period on this loan. This field is automatically updated based on the Length of Rate Cap Period field below and is only used when there is a checkmark in the Use Rate Cap field above. Enter the date using MMDDYYYY format, or use the drop-down calendar to select the date. See below for more information.

|

|

|

Mnemonic: LNAMSY |

This is the rate at the start of the rate cap period. Maximum and minimum points upward or downward will key off this rate for the rate cap period. |

|

|

Mnemonic: LNAMLP |

This is the length of the rate cap period and must be entered in months. This field is only used when there is a checkmark in the Use Rate Cap field. |

|

|

Mnemonic: LNAMCM |

This is a percent field. Enter “2.00000” for 2%. This is the minimum percentage by which the loan rate can be changed. (For example, if 2% is in this field, the new rate must be at least 2% higher or lower than the current rate or the rate will not change.) See below for more information.

|