Navigation: Loans > Loan Screens > Cards and Promotions Screen > Fees and Charges tab >

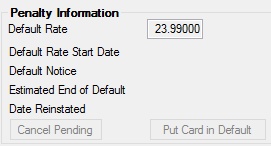

Penalty Information field group

This field group displays information about a customer loan account in default.

Click <Put Card in Default> to designate the account as in default. This will cancel all promotions on the card and activate the Default Rate on the account. When an account is in default, the name of this button will change to <Reinstate Card>. The button can be clicked to remove the default status on the account and move it to the Standard Rate.

The loan can be cleared of its penalty status (and restored to its Standard Rate) if the customer makes a designated number of payments on time (Institution Option CMRP designates this number).

The fields in this field group are as follows:

Field |

Description |

|

Mnemonic: LNLPRT |

This field displays the rate that is used to accrue interest while the account is in default. Cards will automatically go into default when a late payment or partial payment is made (unless the Opt Out Of Auto Default field is marked). |

|

Mnemonic: LZPTID |

This field displays the date the account began its default status. |

|

Mnemonic: LZPNDT |

This field displays the date a default notice was sent to the customer. |

|

Mnemonic: N/A |

This field displays the date an account's default status will end (assuming the customer makes a certain number of payments on time). |

|

Mnemonic: LZRSTC |

If the account is no longer in default, this field displays the date the account's default status was removed. |