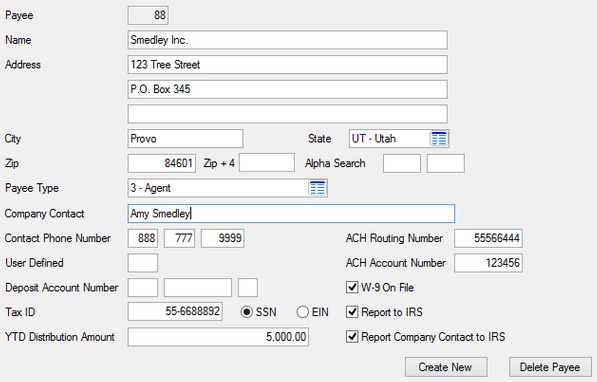

Navigation: Loans > Loan Screens > Payee Information Screen > Detail tab >

Payee Information fields

Use these fields to view and edit basic contact, search, and tax information for the individual or institutional payee being created/edited. If an existing payee is being edited, the Payee field will not be available for file maintenance.

Use the Payee field to indicate the institution-defined ID number of the payee being created.

|

Note: A payee's Payee number cannot be changed, but their Name information can. CIM GOLD uses the currently indicated Name information when displaying all history or statements for a payee, regardless of whether the Name information was changed following the history or statement date. Therefore, the payee's Name should rarely (if ever) be changed. |

|---|

The fields on this tab are as follows:

Field |

Description |

|||

|

Mnemonic: CANUMB |

This field indicates the institution-defined payee number of the selected Payee. |

|||

Name/Address/City/State/Zip/Zip + 4

Mnemonic: CACOMP, CAA401-3, CACT40, CASTAB, CAZIP5 |

Use these fields to indicate contact information for the selected Payee.

|

|||

|

Mnemonic: CASRCD |

Use these fields to indicate two three-letter alphabetic codes to assign the selected Payee. These codes are used to make the process of searching for the Payee in the system easier.

GOLDPoint Systems suggests using the first three characters of the first and last names of the Payee. |

|||

|

Mnemonic: CAPAYT |

Use this field to indicate the type of payee. Possible selections in this field include:

1 - Attorney 2 - Payee 3 - Agent 4 - Company 5 - Contractor 6 - Trustee 7 - Tax Entity |

|||

Company Contact/Contact Phone Number

Mnemonic: CACCON, CAPHNE |

Use these fields to indicate the name and phone number of the contact person for the selected Payee (if the selected Payee is a company). |

|||

|

Mnemonic: CAACC2 and CACKDG |

Use these fields to indicate the routing and account numbers for the checking account that will produce payments from the payee being created/edited. |

|||

|

Mnemonic: CAMETH, CAANBR |

Use this field to indicate any institution-defined organizational data necessary for the selected Payee. |

|||

|

Mnemonic: CAACC2, CACKDG |

Use this field to indicate the savings or checking account number of the selected Payee. Credits to certificates or club or retirement accounts are not allowed, and error messages appear if the account type is invalid. Both the LIP disbursement and the credit to the deposit account are processed as “journal” transactions. |

|||

|

Mnemonic: CASSN#, CASTAT |

Use this field to indicate the 9-digit Social Security (SSN) or employee identification (EIN) number for the selected Payee. Use the adjacent radio buttons to indicate the type of ID this number represents. This field is required if the Report to IRS field is marked below. This data feeds to the IRS GOLD System for 1099-MISC forms. |

|||

|

Mnemonic: CAYTDF |

Use this field to indicate the total amount disbursed to the selected Payee by the LIP Disbursement transaction for which a check and the check register has been printed during the current calendar year. See below for more information.

|

|||

|

Mnemonic: CAABNK, CAANBR |

Use these fields to indicate the Routing and Account Numbers of the selected Payee. |

|||

|

Mnemonic: CAW90K |

Use this field to indicate whether your institution has a W-9 (Social Security number verification) on file for the selected Payee. |

|||

|

Mnemonic: CARIRS |

Use this field to indicate whether the YTD Distribution Amount above should be reported to the IRS on form 1099-MISC at year-end for the selected Payee. This data feeds to the IRS GOLD system.

|

|||

|

Mnemonic: CACCNT |

Use this field to indicate whether the Company Contact name (see above) will be fed to the IRS GOLD system as the IRS owner instead of the selected Payee Name (see above). When using this field, be sure that the Company Contact name and Tax ID Number (see above) identify the same person and that the Report to IRS field above is also marked. |