Navigation: Loans > Loan Screens > Account Information Screen Group > Additional Loan Fields Screen > Classification/Purpose tab >

Loss Mitigation field group

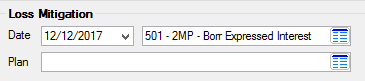

Three fields on the Classification/Purpose tab are used for establishing a loss mitigation plan for a customer account: Date (mnemonic QALSDT), Loss Mitigation (QALMIT, to the right of the Date field), and Plan (QAPLAN). Use these fields to indicate the Date a loss mitigation plan for the account was chosen as well as classification codes for the plan.

Loss Mitigation classification codes are added to CIM GOLD by GOLDPoint Systems. Examples of loss mitigation plans include loan modification, repayment plan, reinstatement, short sale, and government programs (HAMP, HAFA, 2MP). See below for more information about the types of Loss Mitigation classification codes available in this field.

•RPY (code 100-112) - Use these codes to indicate that the loss mitigation process for the account involves a repayment plan.

•MOD (code 201-221) - Use these codes to indicate that the loss mitigation process for the account involves modifying the existing payment plan on the account. If your institution is using HAMP guidelines to modify a loan, use HMP codes instead (see below).

•DIL (code 301-314) - Use these codes to indicate that the loss mitigation process for the account involves a Deed In Lieu of foreclosure (DIL). In a DIL disposition, a customer voluntarily deeds collateral property in exchange for a release from mortgage obligations. This option is generally not used for customers who can actually meet their financial obligations.

•SS (code 401-415) - Use these codes to indicate that the loss mitigation process for the account involves a short sale. A short sale occurs when your institution accepts a payoff that is less than the principal balance of the loan in order to allow the customer to sell the collateral for its actual market value. This generally applies to customers who owe more than their property is worth.

•2MP (code 500-509) - Use these codes to indicate that the loss mitigation process for the account involves following the guidelines of the Second Lien Modification Program as provided by the United States government. This program is available to second lien customers corresponding with first liens that have been modified under HAMP (see below).

•REIN (code 601-606) - Use these codes to indicate that the loss mitigation process for the account involves a reinstatement of the loan. A reinstatement occurs when a customer brings their delinquent account current with one payment, which results in all payment information on the loan returning to its pre-delinquency settings.

•HMP (code 700-711) - Use these codes to indicate that the loss mitigation process for the account involves following the guidelines of the Home Affordable Modification Program (HAMP) as provided by the United States government. This program is available to first lien customers in need of a modification to their payment plans. Second lien accounts need to make use of the 2MP codes instead (see above). Loan modifications that don't follow HAMP guidelines should use MOD codes (see above).

•HAFA (code 801-814) - Use these codes to indicate that the loss mitigation process for the account involves following the guidelines of the Home Affordable Foreclosure Alternatives program (HAFA) as provided by the United States government. This program is available to customers who are eligible for HAMP (see above) but cannot secure a permanent loan modification. |

Loss mitigation Plan codes are institution-defined and must be set up on the Loans > System Setup Screens > Loss Mitigation Plan screen before they can be selected in this field. Your institution is responsible for determining which accounts are eligible for loss mitigation plans. The description of the loss mitigation plan is used on the regulatory-required Delinquency Notice (FPSRP317). Regulations for consumer mortgage loans require that the loss mitigation plan a borrower has agreed to be displayed on the delinquency notice.

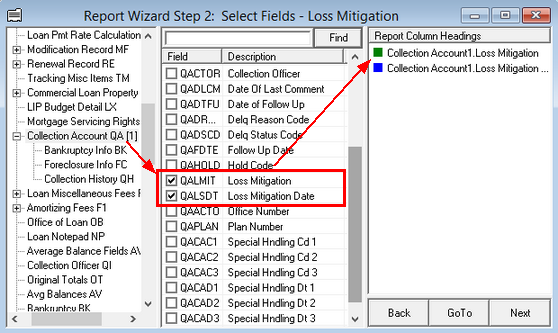

You can also create a GOLDWriter report that collects all accounts with a loss mitigation plan. To do so, include the Loan Master (LN), then Collection Account (QA) records, then check the boxes next to Loss Mitigation (QALMIT) and Loss Mitigation Date (QALSDT) (see example below). You could then set up other specifications for the report, such as pulling only those accounts with a Loss Mitigation Date from a certain date range. See the GOLDWriter User's Guide for more information.

|

Tip: Consider creating a Loss Mitigation Plan Comment Code for your institution using the Loans > System Setup Screens > Collection Comment Codes. Use this code to enter in the Comment Code field when processing loss mitigation information on an account. |

|---|

|

WARNING: Once a loss mitigation plan description has been assigned, it should not be changed. When a loss mitigation plan number is assigned to an account, that number is stored on the record, but the description is not stored. When a screen is accessed or the delinquency notice is printed, the program uses this table to look up the description. If the description has been changed, incorrect descriptions would be displayed on the screen and delinquency notices. |

|---|

|

GOLDPoint Systems Only: Loss Mitigation classification codes are listed in IMAC Table 255 LOSSMITI (Loss Mitigation). |

|---|