Navigation: Loans > Loan Screens > Account Information Screen Group > Amortizing Fees And Costs Screen >

Loan Information field group

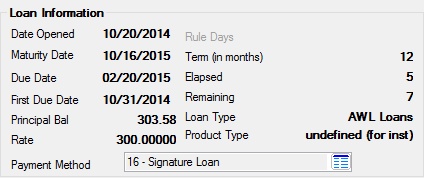

The fields in the Loan Information field group on the Amortizing Fees and Costs screen contain miscellaneous information about the loan. See the following field descriptions:

The fields in this field group are as follows:

Field |

Description |

||||||||||||||||||

|

Mnemonic: LNOPND |

This field displays the date the loan was opened or funded. It is pulled from the Date Opened field on the Loans > Account Information > Account Detail screen. |

||||||||||||||||||

|

Mnemonic: LNMATD |

This field contains the date the last payment is due and the loan should be paid off. It is pulled from the Maturity Date field on the Loans > Account Information > Account Detail screen. |

||||||||||||||||||

|

Mnemonic: LNDUDT, LN1DUE |

The Due Date is the date the next regular payment is due. It is pulled from the Due Date field on the Loans > Account Information > Account Detail screen.

The First Due Date field displays the first payment due date on this loan in MMDDYY format. It is pulled from the First Due Date field on the Loans > Account Information > Additional Loan Fields screen. |

||||||||||||||||||

|

Mnemonic: LNPBAL |

This field displays the unpaid principal balance of the loan. It is pulled from the Principal Balance field on the Loans > Account Information > Account Detail screen. |

||||||||||||||||||

|

Mnemonic: LNRATE |

This is the annual interest rate. It is pulled from the Interest Rate field on the Loans > Account Information > Account Detail screen. |

||||||||||||||||||

|

Mnemonic: LNPMTH |

This field displays the payment method code. The payment method code determines how to calculate interest and what rules to follow in processing the loan account. Once the payment method has been set up on a loan, it should not be changed. Loans use fields differently for different payment method codes. This field is pulled from the Account Detail screen.

In addition, other screens pertain to specific payment methods, such as the Loans > Account Information > ARM Information and Precomputed Loans and Loans > Line-of-Credit Loans screens. Fields on these screens are important to the proper processing of the loan.

Click the list icon to view and select the payment method for this loan.

|

||||||||||||||||||

|

Mnemonic: LN78DR |

This field displays how you control the monthly amortization of interest to the General Ledger, as well as how rebated interest is calculated at the time of payoff. It is pulled from the Rebate Rule Days field on the Precomputed Loans screen.

|

||||||||||||||||||

|

Mnemonic: LNTERM |

This field contains the term of the loan in months. It is pulled from the Term in Months field on the Loans > Account Information > Additional Loan Fields screen. |

||||||||||||||||||

|

Mnemonic: N/A |

This field is calculated. It displays the number of months that have elapsed since the loan was opened. This field is affected by the Refund Rule field. |

||||||||||||||||||

|

Mnemonic: N/A |

This field is calculated. It displays the remaining term of the loan in months and is used for all amortization calculations. |

||||||||||||||||||

|

Mnemonic: LNTYPE |

This field displays the loan type and description. The loan type is defined by your institution and set up at the top of origination. |

||||||||||||||||||

|

Mnemonic: LNTYPC |

This field displays the loan type and class description for the loan. The type and class are defined by your institution and are set up using GOLDTrak PC. |