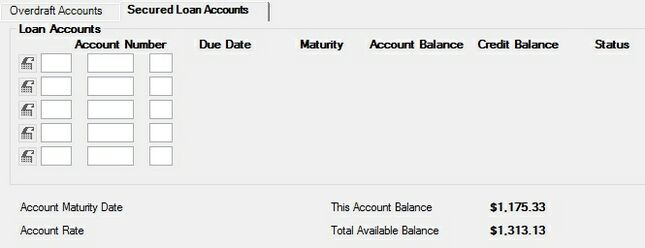

Navigation: Deposit Screens > Account Information Screen Group > Overdraft & Secured Loans Screen >

Use this tab to view and edit information about deposit loans secured by the customer deposit account.

Features for individual customer certificate accounts can be adjusted on the Certificate Fields tab of the Deposits > Account Information > Additional Fields screen as well as the Certificate Fields field group on the Account Information screen.

Interest features for individual customer accounts can be adjusted on the Deposits > Account Information > Interest Fields screen as well as the Interest Fields field group on the Deposits > Account Information > Account Information screen.

Deposits > Account Information > Overdraft & Secured Loans screen, Secured Loan Accounts tab

The fields on this tab are as follows:

Field |

Description |

|

Mnemonic: N/A |

Use these fields to indicate the account number(s) of the loan account(s) secured by the customer account. If valid values are entered in these fields, the button to the left becomes active. Click the button to be taken to the Loans > Account Information > Account Detail screen for the account specified in these fields. The information in the following fields comes from each account's Account Detail screen. |

|

Mnemonic: N/A |

The date the next regular payment on the loan account specified in the Account Number field is due. |

|

Mnemonic: N/A |

The date the last payment is due and the loan account specified in the Account Number field should be paid off. |

|

Mnemonic: N/A |

The current principal balance of the loan account specified in the Account Number field. |

|

Mnemonic: N/A |

The line-of-credit (LOC) limit on the loan account specified in the Account Number field. If the loan is secured by a floating pledge, this field will display the percentage from the Pledged Percent Available field on the Activity tab on the Loans > Investor Reporting > Line-of-Credit Loans screen. |

|

Mnemonic: N/A |

The current status of the loan account specified in the Account Number field. Possible account statuses are:

OPEN CLOSED UNOPENED INACTIVE DORMANT DROP

An asterisk (*) appearing beside a status indicates that the account owner is deceased. |

|

Mnemonic: DMMTDT |

This field contains the maturity date of the customer account if it is a certificate account (the Certificate field on the Deposits > Account Information > Account Information screen is marked). If it is not a certificate account, this field will be blank. |

|

Mnemonic: DMCRBL |

This field contains the current balance of the customer account. Only teller transactions can change this balance. |

|

Mnemonic: DMRATE |

This field contains the interest rate currently being paid on the customer account. This field is only valid on customer accounts using the interest feature (the Interest field on the Deposits > Account Information > Account Information screen is marked). |

|

Mnemonic: N/A |

This field contains the total balance available for use by the customer account. It is calculated by subtracting any unavailable funds from the This Account Balance field above. For example, if your institution requires a certain minimum balance in deposit accounts (from the Minimum Balance field on the Deposits > Account Information > Additional Fields screen), that amount would be subtracted from the account balance to calculate the value in this field. |

*Up to 5 secured accounts can be indicated using these fields.