Navigation: GOLD Services > GOLD Services Screens > IRS GOLD Screen Group > Forms Screen >

IRS GOLD is a year-end processing tool accessed in CIM GOLD. You can use IRS GOLD to process certain year-end forms that are required by the IRS to be sent to your customers at year-end. For specific questions about the IRS forms and field entries, please refer to the IRS website at https://www.irs.gov/forms-instructions.

IRS GOLD provides your institution with an easy way to create, edit, and print original and corrected IRS forms. After year-end processing, many year-end forms can be printed from GOLDView Plus and sent to your customers by the IRS deadline of January 31st. After that deadline if you find mistakes or corrections that need to be made, you can use IRS GOLD to create corrected forms to be sent to your customers. GOLDPoint Systems will then send the corrected information to the IRS.

Some forms, such as 1099-C, you will need to manually create in IRS GOLD, then print and send to your customers.

Each form is described in the IRS Deposit Forms and IRS Loan Forms sections. Form record retention periods can be set up for your institution on the Deposits > Definitions > System History Retention screen.

Additionally, for year-end processing your institution needs to complete the year-end request form. This form is sent to you in PDF format each September. It should be filled out, signed, and returned to us by October 15. This form gives us the needed information to properly set up the end of year processing.

|

|

The following forms are automatically generated and available in GOLDView Plus after year-end processing but do not appear in IRS GOLD. These forms are not printed by GOLDPoint Systems, unless you have indicated you want GPS to print these forms for you and send them to you or your customers. This is indicated on the year-end PDF form sent to you in September. However, if your customers have issues with the information or there were errors found after the final year-end run, you can use IRS GOLD to create a corrected form that is sent to the IRS, and you can print the customer a new copy for their records.

•1098 for mortgage loans.

•1099-INT; from GOLDTeller for bond cashing as they are entered using tran code 1480-00.

•5498

•1042-S; generated at year-end from Deposits.

•1099-MISC; originated from Accounts Payable for accounts with specific settings. See also: Appendix D: Year-end in the Accounts Payable manual.

These last forms will need to be manually entered in IRS GOLD at year-end:

•1099-INT; from CIM GOLD Loan Assumption screen as they are entered.

•1099-S; from GOLDTrak® PC as they are entered.

•1099-C; from the Loans > IRS Form 1099-C screen as they are entered.

•If you have assumed a mortgage loan sometime in the year, you will need to manually create a 1098 form in IRS GOLD. Information for assumed loans is found on the Loan Assumption screen.

GOLDPoint Systems forwards the current-year forms that are entered into the system to the IRS at scheduled intervals during the year, based on the IRS deadlines for fines. The first transmission is in February; additional transmissions are processed every month, with the final transmission in July. You are responsible to make sure that you audit and review the forms and transmittals and get them signed and back to GOLDPoint Systems by the due date in order to avoid the IRS fines. Original and corrected forms are sent to the IRS with each process. An afterhours report (FPSDR029) should be used to audit these forms, especially before the scheduled pulls for the IRS. Special requests for transmissions not following the schedule or for prior years must be requested by submitting a work order.

See the following links for more information concerning year-end:

•Accounts Payable 1099-MISC Year-end

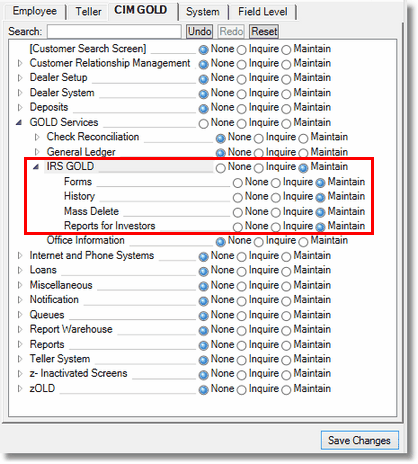

Your security officer must give each user security approval in order to use IRS GOLD. With the appropriate CIM GOLD screen security, your employees can view forms entered into the system at any time. The following screen example shows which IRS GOLD security options are available:

Security > Setup Screen, CIM GOLD Tab

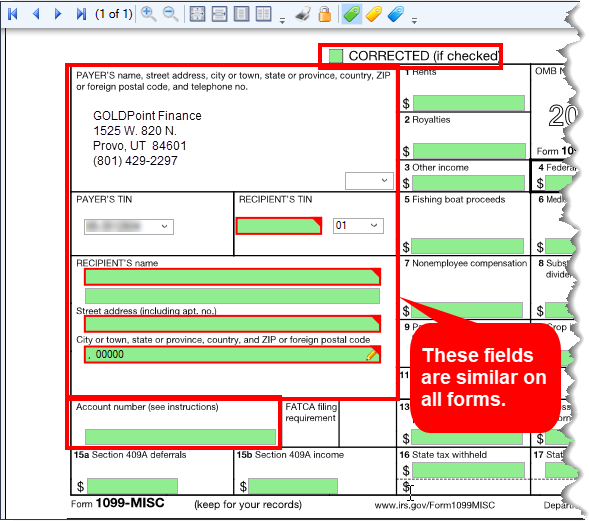

The following paragraphs describe fields found on every IRS GOLD form. Some of the information in these fields is automatically populated as forms are created. See the following example of these fields, followed by descriptions.

|

Note: You can build a report in GOLDWriter or GOLDMiner using any of the fields found in the IRS GOLD forms. Use the fields found in the FPIR record (IRS Information Returns) to build your report. For more information, see the IRS Information Returns record in the GOLDWriter Mnemonic Dictionary. |

|---|

Sample of Form 1099-INT. The highlighted fields in red are found on most IRS forms.

Common Field Descriptions

Field |

Description |

||||

|---|---|---|---|---|---|

Institution's (Payer's) Name, Address, Phone Number, and Federal Identification Number

|

Your institution's name, address, and Federal ID number (EIN) are defaulted on each form automatically for you as you create new forms. The information is retrieved from institution options that have been set up for your institution. Institution option FEIN stores your institution’s Tax Identification Number (TIN) and is defaulted in the appropriate field.

If your institution needs to report other federal tax numbers and business names (such as subsidiaries), you can submit a work order to have GOLDPoint Systems add the name, address, phone, and EIN to your institution options. Once they are added, they will be present on each form in a drop-down selection, as shown below. When a different TIN is selected on a form, the name and address for that business will be used on the form.

If your institution uses a different EIN number for retirement forms 1099-Q, 1099-R 1099-SA, 5498, 5498-ESA and 5498-SA, you must also send in a work order to get it added to the drop-down list.

For reporting 1099-A and 1099-C information for Freddie Mac and Fannie Mae, refer to those forms in the IRS Loan Forms section.

Institutions are required to include the telephone number of a person to contact on certain statements to recipients. This number must provide direct access to an individual who can answer questions about the form. Telephone numbers can be changed by your GOLDPoint Systems account specialist. |

||||

Payer's Social Security Number or Recipient's Identification Number

Mnemonic: IRCSSN, IRREINB, or IREMPX |

This field name changes based on the form you are using, but the information that is entered in this field is the same. Use this field to enter the recipient’s or payer's identification number. This can be either their Social Security number or their Employee Identification number. This number and name are used by the IRS to compare to the individual's tax returns and must be correct. The SSN or EIN must belong to the IRS owner of the account(s). This must be a valid number already set up in CIM GOLD (usually on the Customer Relationship Management > Households screen). If this is not a valid number, the form cannot be saved.

For sole proprietors, you must use the account owner’s SSN if they do not have an EIN number associated with their business name. The person is considered the IRS owner of the account if the business does not have an EIN number. You will get a B notice if you report the business name and the person's SSN. For IRS owners that do not have a SSN, you must set up the account appropriately for IRS reporting. Interest must be reported on every account even if it does not have a TIN. Refer to the 1099-INT information in the IRS Deposit Forms section. Form 1042 does not require a recipient identification number; it requires an account number.

|

||||

Payer's/Borrower's Name

Mnemonic: IRPAYE, IRPYE2

|

This field displays the payer's or borrower's name as pulled from CIF (Households screen) in CIM GOLD. All co-borrower names are also included on this form. If you are creating a new form, enter the name of the borrower in this field. You can also make changes to this field directly. |

||||

Street address (including apt. no), City, state, and ZIP code

Mnemonic: IRPADR, IRPCTY, IRSTAB, IRPZIP, IRPZP4 |

These fields display the address, city, state, and ZIP code of the borrower, as pulled from CIF (Households screen) in CIM GOLD. If more than one person with different addresses are tied to this account, only the first address of the IRS owner will be displayed. |

||||

Account Number

Mnemonic: IRACTO, IRACTA, IRCKDG |

The account number field is 16 digits long (or 18 if you leave spaces). The format of the account number is xxxx xxxxxxxxxx xx. We recommend that you enter spaces between the branch, account number, and check digit; if an account number is less than the formatted size, sections of it will be filled with zeros. Note: Account numbers are not verified against loan or deposit accounts.

Deposits - The account number for the deposit forms 1099-INT, 1099-Q, 1099-R, 1099-SA, 5498, 5498-ESA, 5498-SA is required and is reported to the IRS. If corrections are made, this number must be the original account number that was sent to the IRS. When correcting information on forms created in year-end processing, you must have the original form in order to send the required information back to the IRS so they can match it against what was previously sent. 1099-INT forms that are created at year-end combine all accounts for the same IRS owner on one form. The lowest account number is sent to the IRS. Refer to the GOLDPoint Systems publication in CIM GOLD > DocsOnWeb > Deposits > Deposit Year-End for more information on deposit year-end processes. Deposit forms use the deposit phone number linked to your institution's information.

Loans – The account number for loan forms 1098, 1098-E, 1099-A, 1099-C, 1099-MISC, and 1099-S is recommended but not required. Loan forms use the Loan phone number linked to your institution's information. |

||||

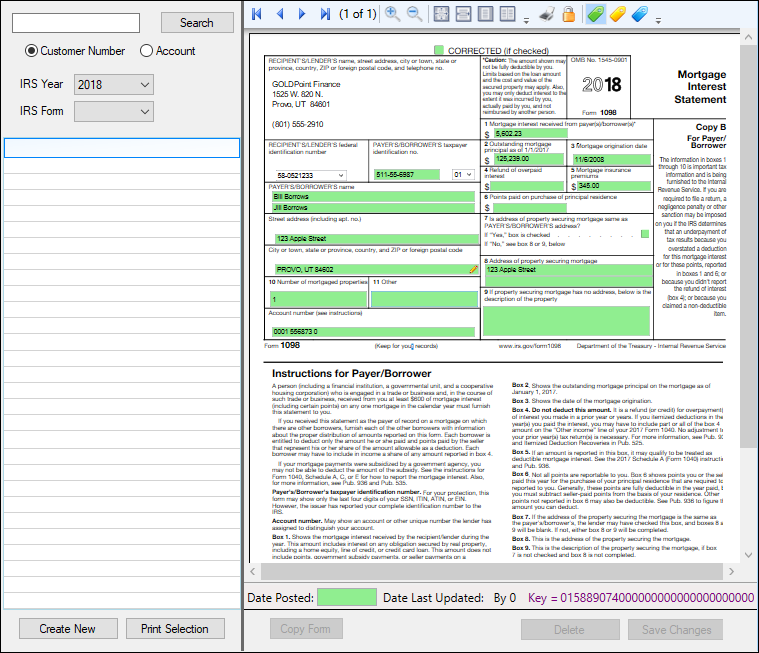

Date Posted/Date Last Updated

Mnemonic: IRDTPT, IRDTLU |

Below the form and instructions are the Date Posted and Date Last Updated fields. The Date Posted field is the date the form was added to the transmission file to be sent to the IRS. Once a date is entered in this field, the form will not be reported again. This date can be cleared under specific situations if you need to resend the form. Once cleared, the next pull (transmission) will pick it up again. Enter six or eight numbers for the date—no other characters. The date will be automatically formatted this way: MM/DD/YYYY.

The Date Last Updated field is automatically updated by the system anytime someone changes any information on the IRS form.

See the following example of where to find these fields on the bottom of the form:

|

||||

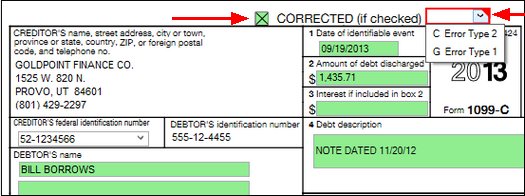

Corrections

Mnemonic: IRCORR |

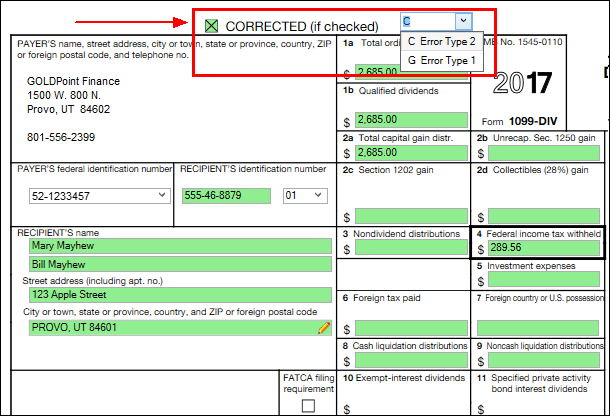

At the top of each form is the Corrected checkbox. Check this box if you are returning a corrected form to the IRS. Once you check this box, a drop-down box appears to the right that allows you to indicate what type of correction you are submitting, as shown below:

Depending on the type of correction being made, you can modify the form previously sent to the IRS if it is in the IRS GOLD system, or you can create a new form. Every correction requires a type: Error Type 1 (G) or Error Type 2 (C). The IRS requires specific types based on the type of information that needs to be fixed for the form.

The IRS Corrections instructions are listed below.

Error Type 1 (G) A Type “G” correction is a single-entry correction that requires only one IRS form. Mark the Correction check box and select "Error Type 1 (G)." This type is used if the original form was filed with one of the errors below:

•An incorrect payment amount code was entered in the Payer "A" Record. •An incorrect payment amount was entered in the Payee "B" Record. •An incorrect code was entered in the Distribution Code field in the Payee "B" Record. •An incorrect payee address was entered. •An incorrect direct sales indicator was entered.

Error Type 2 (C) (G) A type "C" correction requires two entry correction forms. It should be used if the original return was filed with one or more of the following errors:

•No Payee TIN was entered. •An incorrect Payee TIN was entered. •An incorrect Payee name was entered. •The wrong type of return indicator was used.

The first form indicates that the previously submitted form was incorrect. This notifies the IRS to mark their records accordingly. The information on this form must be exactly the same as it was on the original submission, with the following exceptions: The Correction check box is checked, the Error Type 1 (G) field must be selected, and all payment amount fields must be blank.

The second form is used to report the correct information. This second form is marked as a correction, and Error Type 2 (C) must be selected.

For example: Form 1042-S was submitted, and it should have been prepared as a 1099-INT form. In this case, a new form 1042-S with the original information would be filed with a "V" in the Type field. A corresponding "C" record would not be necessary. |

General information for making changes to a form:

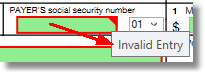

•If you have file-maintenance access, you can make changes to data in the green boxes on the form; if a field is not green, it cannot be changed.

•If incorrect data is entered, the field will be highlighted with a red box, and an error message is displayed. Placing your cursor over the top-right corner of the red box displays the error message, as shown below:

•For all but 1042-S forms, if a TIN is incorrect, you must delete the form and set up a new one. For 1042-S forms, if the account number is incorrect, you must delete the form and set up a new one.

•To change your institution's name and address, select the appropriate federal identification number from the list. Note: If you have multiple businesses to report for; such as subsidiaries, this information must be set up before you can access it on any form. (GOLDPoint Systems sets this up for your institution in Institution Options.) The business name, address, EIN, and phone number need to be added. Submit a work order to have additional EINs added for your institution. The institution's main EIN and address are taken from Institution Options.

•To delete multiple forms, you must have access to the Mass Delete screen in the CIM GOLD tree.

•You can print the information shown in the list view by right-clicking with your mouse. The list will print in the order shown on the screen. The list view default is type of form, year, then TIN number. You can re-sort the list by clicking on the heading. When you leave the form, the system default returns.

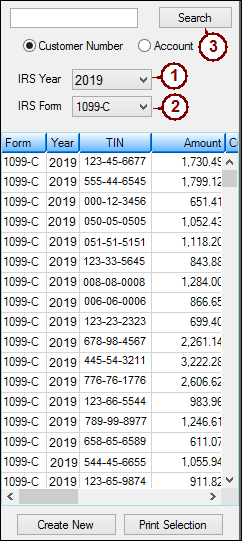

To see all forms of a specific type, complete the following steps.

1.In the IRS Year field, select the applicable year. (It is defaulted to prior year until August. Then it is defaulted to the current year.)

2.In the IRS Form field, select the applicable form.

3.Click <Search>. All forms of that type for that year will be displayed in the list view, as shown below.

To access an individual form in the list view, double-click on it.

To find a specific form for a customer, complete the following steps.

1.Enter the Customer Number or Account number in the box at the top left. The Customer Number is the same as the Social Security number or Employee Identification number (displayed on the Customer Relationship Management > Households screen). This number is also referred to as the TIN (tax identification number).

2.Select the Customer Number or Account radio button (it defaults to Customer Number).

3.Using the drop-down list, select the IRS Year you want to search. If you leave the year blank, all years of that type of form for the customer will display.

4.Using the drop-down list, select the type of IRS Form; if no form is selected, all types of forms for the customer will display.

5.Click <Search>. All forms matching the criteria entered will display in the list view.

6.Click on an item in the list view to access that form.

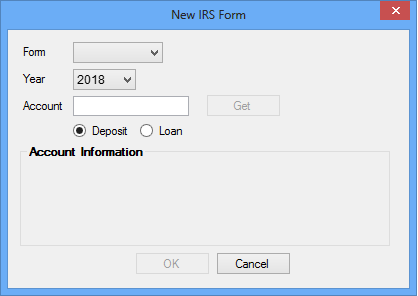

1.Click <Create New> to create a new form. A dialog box will be displayed so you can select the form and year (as shown below).

2.Enter the account number in the Account field and click <Get> to retrieve the name and address information for the IRS owner you are creating the form for. This function will copy the account’s IRS owner name, mailing, and tax ID information to the new form. The name and address information that will be used on the new form will display in the Account Information box. Only the name of the IRS owner is retrieved; if there is information on the second name line, such as C/O, you must enter that on the form manually.

3.Deposit or Loan radio buttons - Below the account number box are two radio buttons: Deposit or Loan. This tells the system where to look for the account, based on the type of form the system defaults to (deposit or loan), but you can change it.

4.Click <OK> and the designated form will be displayed with the account information, as shown below. You can make changes to any fields highlighted in green.

<Print Selection>

Click <Print Selection> to print the selected forms from the list view. The forms, including instructions, will print to your specified printer. If you select Duplex, you can print the 1042-S and 1099-R instructions on the backs of the forms. In addition, 1099-R forms will print a Copy C and Copy B when federal or state withholding amounts are entered in the applicable boxes.

Only one form type can be printed at a time. For example, you can print 1098s only when you are on that screen; then you need to access a different form type to print those forms. Only forms that are highlighted (selected) in the list view will be printed. Press <Ctrl> + A to quickly select all forms of a specific type.

<Delete>

Select a form in the list view and click <Delete>. Only one form can be deleted at a time, and you must have maintenance security for the button to be enabled. To delete multiple forms, use the Mass Delete function in the CIM GOLD tree.

Each October a yearly afterhours deletion will be processed for each institution. All forms older than seven years will automatically be deleted. You can manually delete more forms if you want.

<Save Changes>

Click this button or press the <Enter> key when changes have been made to a form and you want to save them.

<Copy Form>

Click this button to copy a new form from an existing one. You can only copy the same type of form and personal information to a new form. This is helpful if you have a form that is consistently created for the same customers each year.

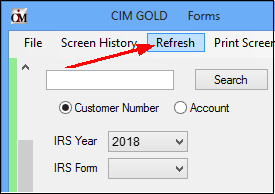

<Refresh>

Clicking the <Refresh> menu button (located in the menu bar at the top of CIM GOLD, as shown below) removes all search criteria, and IRS GOLD will appear as it does when you first access it.

You should submit a correction to the IRS to correct an IRS form previously submitted to, and processed by, the IRS which contained incorrect information.

If a correction to data that has been transmitted to the IRS is necessary, the information must be entered using a new IRS form selected in IRS GOLD.

Two types of corrections are available:

See also Form 1042-S Corrections at the end of this topic for information about sending corrected 1042-S forms.

If you need to make a correction, depending on the type of correction being made, you can modify the form previously sent to the IRS if it is in the IRS GOLD system, or you can create a new form. On the form, check the Corrections checkbox. Once this box is checked, the Type fields become file maintainable. You must also mark the type of correction: "C" or "G."

WARNING: If you modify the original IRS form, delete the date in the Date Posted field. This field indicates that the information was already sent to the IRS. When GOLDPoint Systems pulls IRS forms to transmit to the IRS, it skips all forms with a date posted. We recommend that rather than modifying the form, you create a new form. Refer to the "Modifying A Form" section in this user’s guide for further information.

If the Date Posted field is blank, GOLDPoint Systems has not sent this information to the IRS. |

|---|

See the following example of an IRS form with the Corrected box checked and showing the two possible correction options:

A type "C" correction requires two return entries and should be used if the original return was filed with one or more of the following errors:

1. No payee TIN (tax ID number) was entered.

2. An incorrect payee TIN was entered.

3. An incorrect payee name was entered.

4. The wrong type of return indicator was used.

Two return entries (two IRS forms) are required, and all information must be on both forms.

•The first form indicates that the previously submitted form was incorrect. This notifies the IRS to mark their records accordingly. The information on this form must be exactly the same as it was on the original submission, with the following exceptions: the Correction checkbox and Type G fields must be marked and all payment amount fields must be blank.

•The second form is used to report the correct information. This second form is marked as a Correction. Mark the Type field as "C," and enter the correct dollar amount.

|

Note: Transmissions for other than the current year require that you send a work order to GOLDPoint Systems. |

|---|

A type "G" correction is a single-entry correction and requires only one return entry (one IRS form). This should be used for any correction needed other than those listed above for type "C."

Type "G" corrections should be submitted if the original return was filed with one or more of the following errors:

1.Incorrect payment amount codes were entered in the Payer "A" Record.

2.An incorrect payment amount was entered in the Payee "B" Record.

3.An incorrect code was entered in the Distribution Code field in the Payee "B" Record (Forms 1099-R and 1099-SA).

4.An incorrect payee address was entered.

5.An incorrect direct sales indicator was entered (Form 1099-MISC).

For Form 1042-S corrections, valid entries are "V" for a void record and "C" for a correction record.

•A void record is an information return (Form 1042-S) that is submitted in order to delete a previously filed incorrect original return. A void record must be a duplicate of the original successfully processed return with the exception of a "V" in the Type field. The Posted field must also be blank. A void record can be filed with or without a corresponding "C" record.

For example, a Form 1042-S was submitted, and it should have been prepared as a Form 1099-INT. In this case, a new Form 1042-S with the original 1042-S information would be filed with a "V" in the Type field. A corresponding "C" record would not be necessary.

See Also:

IRS GOLD History Screen

IRS GOLD Mass Delete Screen

IRS GOLD Reports for Investors