Navigation: GOLD Services Screens > IRS GOLD Screen Group >

The IRS GOLD Mass Delete screen is used to delete a single IRS form or a group of IRS forms that have previously been created in IRS GOLD. IRS GOLD is a year-end processing tool accessed in CIM GOLD. You can use IRS GOLD to process certain year-end forms that are required by the IRS to be sent to your customers at year-end. To learn more about IRS GOLD (and how to navigate this screen), see the IRS GOLD Overview help page.

Records are kept in IRS GOLD for up to 8 years or until you delete them. Records older than 8 years can be archived, but you cannot search or find them in IRS GOLD once they are archived.

|

WARNING: Use extreme caution when deleting forms; once deleted, they are not in the file. We suggest that you give security to only a few employees of your bank to mass delete these forms. |

|---|

To search for forms and delete them on this screen, complete the following steps:

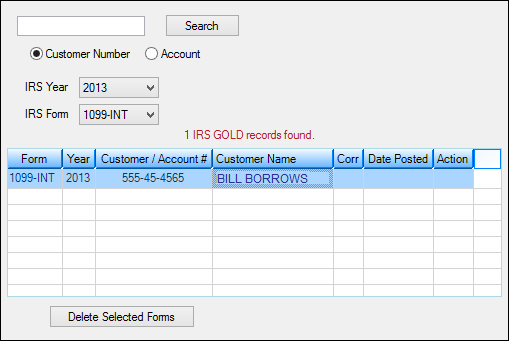

1.If you know the Customer Number or Account Number you want to find, select the appropriate radio button and enter the number in the Search Number field.

2.If you don't know the Customer Number or Account Number, narrow the search by IRS Year or IRS Form.

3.Click <Search>. All forms matching the indicated criteria will appear in the list view below.

4.Select all forms to be deleted in the list view.

5.Click <Delete Selected Forms> to delete the forms.

See the following example of this screen:

GOLD Services > IRS GOLD > Mass Delete Screen

See Also:

Forms screen

History screen

Reports for Investors screen

In order to use this screen, your institution must:

•Subscribe to it on the Security > Subscribe To Mini-Applications screen.

•Set up employees and/or profiles with either Inquire (read-only) or Maintain (edit) security for it on the CIM GOLD tab of the Security > Setup screen. |