Navigation: CIM GOLD What's New > What's New in Version 7.20.4 >

Enhancement |

Description |

|---|---|

|

CMP: 15356

CIM GOLD version 7.20.4 |

The ACH Funding project is now available in CIM GOLD. This project allows loans to be funded via ACH through the FPAE record (ACH Funds Distribution) instead of the Accounts Payable system. Before you can use this feature, GOLDPoint Systems must set up some options for you, and your GOLDTrak PC programs may need to be adjusted. Currently, this only works for one institution who uses a third party to originate loans, then connects with our APIs to finalize funding in CIM GOLD using the Loans > Check Printing > Checks screen.

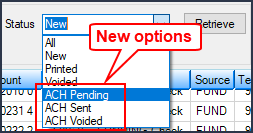

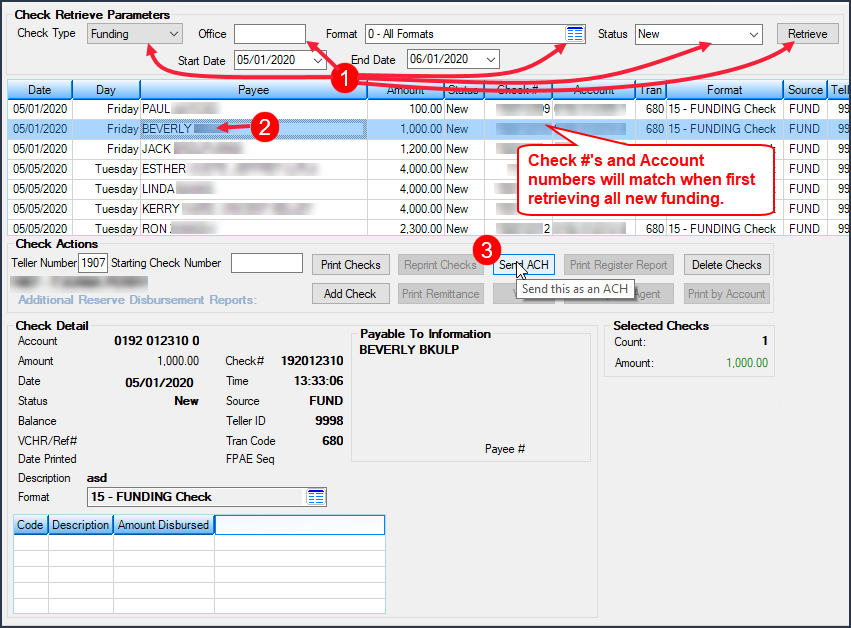

We have added the ability to view ACH funding on the Checks screen. In the Status field, you will see three new options: ACH Pending, ACH Sent, ACH Voided, as shown below:

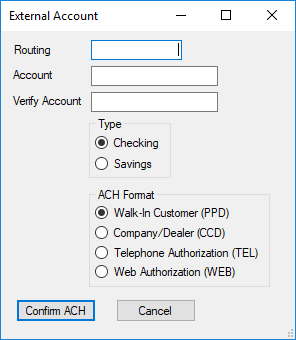

You can send a check record that hasn't been printed an ACH funding transmission instead of a check. To do so, complete the following steps:

1.On the Checks screen, select all new funding checks that haven't been issued a check yet, as shown in Figure 1 below. 2.Select the payee in the list-view table for whom you want to send an ACH transmission instead of a check. 3.Click the <Send ACH> button. This button is not available until you select a new funding payee in the list-view table. (Note: Institution option FACH (Send ACH in CIM) must also be set up for your institution in order to see the <Send ACH> button.)

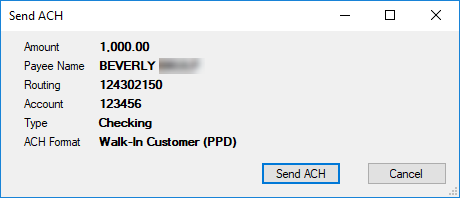

4.Enter the preferred bank's routing number and account number for this payee. 5.Enter the Verify Account field by re-entering the account number; select the type of account it is (checking or savings); and designate the ACH format (for a walk-in customer; an ACH transmission to an authorized company/dealer; an ACH transmission authorized via telephone; or an ACH transmission authorized via the web). 6.Click <Confirm ACH> and a dialog box similar to the following will appear, showing the details of the ACH funding:

7.Click <Send ACH> and the system will queue the ACH funding to be sent when the system sends ACH transmissions (in the afterhours).

If the ACH funding has not been sent yet, and you need to void it, you can set the Status field to "ACH Pending," click <Retrieve>, then select the payee for whom you do not want to send the funds via ACH, and click the <Void> button.

If the ACH funding payment is not shown when ACH Pending Status is selected, that means the funding has already been sent (change the Status to "ACH Sent" and you should see it), and you'll need to use other means to try to retrieve the funding if it was sent in error.

ACH funding payments will not show in Check Reconciliation.

Create ACH Transmission from Checks Screen

Users can also create ACH transmissions from the Checks screen by first clicking <Add Check>, entering the applicable information in the provided fields on the Add Funding Check screen, then clicking <OK>. Then the user would need to repeat the steps outlined above to send an ACH instead of a check.

G/L Transactions

The ACH payments are posted to General Ledger accounts set up in the Autopost using transaction code 271. These will post to the following amount fields in the Autopost:

•G/L debit to L-23 •G/L credit to L-3

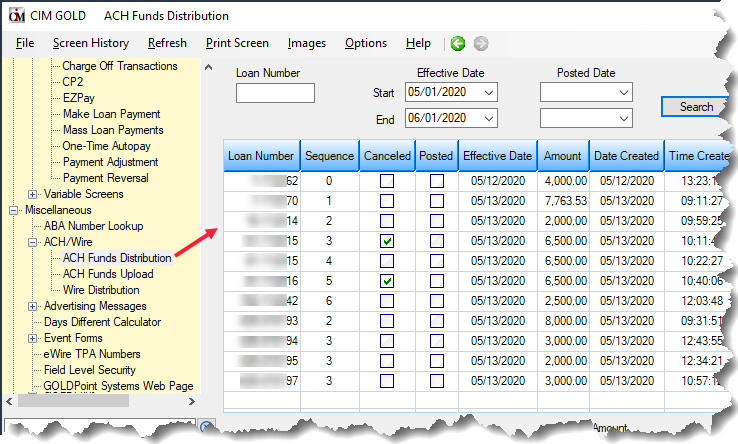

Note: You can also view the success of ACH transmissions using the Miscellaneous > ACH/Wire > ACH Funds Distribution screen. This screen shows an accounting of all ACH funds that have been distributed from a selected date range. See Figure 2 below. |

Figure 1: Loans > Check Printing > Checks Screen

Figure 2: Miscellaneous > ACH/Wire > ACH Funds Distribution Screen

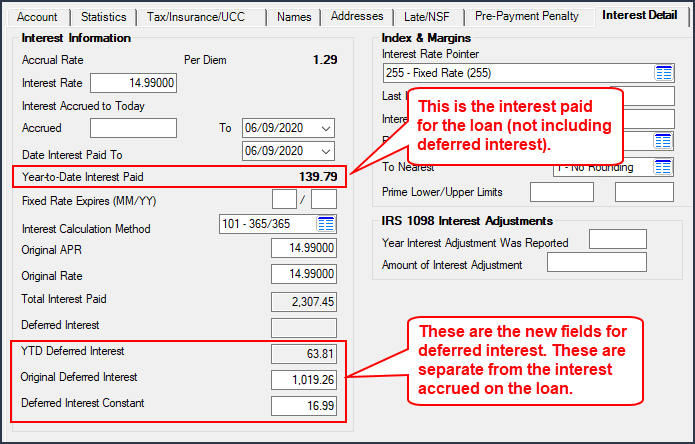

Loans > Account Information > Account Detail Screen > Interest Detail Tab

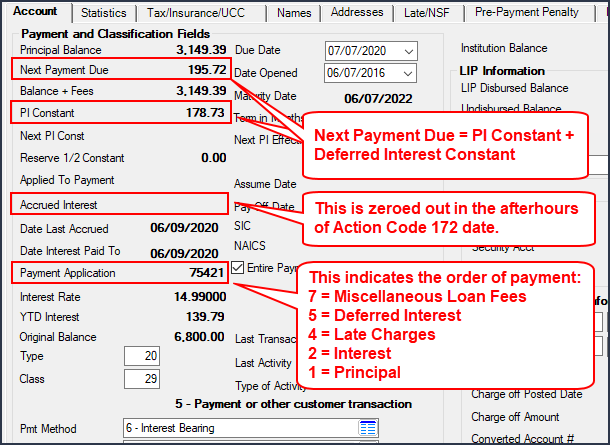

Loans > Account Information > Account Detail Screen > Account Tab

Enhancement |

Description |

||

|---|---|---|---|

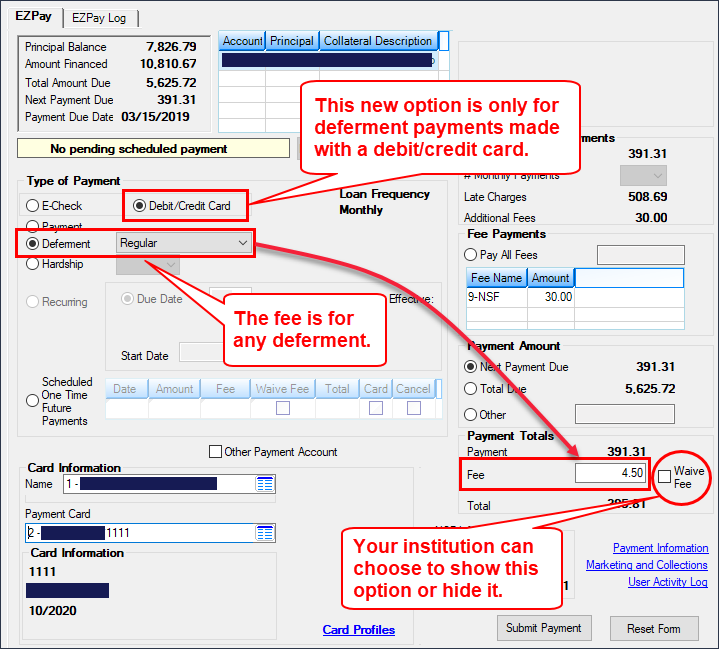

New EZPay Option: Charge Convenience Fee on Deferments

CMP: 15035, 15363, compatible with Core Services released in May 2020

CIM GOLD version 7.20.4 |

A new EZPay option is available that allows institutions to charge convenience fees when credit/debit cards are used for deferments in EZPay. The amount of the fees charged when deferments are processed will depend on your institution’s settings for card payment fees.

Some institutions use options set up on the EZPay IMAC table, while others set up their own fees based on loan type and classification on the Loans > System Setup Screens > EZPay Convenience Fees screen. (The Use Convenience Fee Table option must be set for you in the EZPay IMAC Table for the fees on the EZPay Convenience Fees screen to work.)

This amount is applied to any type of deferment run through the EZPay screen except hardship (regular, holiday, override deferments allowed). We can also set up the Waive Fee option if you want to allow users to be able to waive the fee, based on the user’s security authorization. See the Fees topic in the EZPay User’s Guide for more information.

Note: If fee amounts are set up on both the EZPay IMAC Table and the EZPay Convenience Fees screen, the system uses the fee amounts established on the EZPay Convenience Fees screen.

Contact GOLDPoint Systems for more information about this option. See the following example of the EZPay screen showing the fee amount for running a deferment.

|

Loans > Transactions > EZPay Screen

Before:  |

After:  |

Enhancement |

Description |

|---|---|

Distinguish Between Credit and Debit Cards for Third-Party Fees in EZPay

CMP: 14439, 14440

CIM GOLD version 7.20.4 |

Programming has been added to EZPay so that third-party convenience fees for credit and debit cards can be properly distinguished and defined separately from each other. This means that when a card payment is processed through EZPay, the system will look at the card type (credit or debit) in the Card Profile and apply the appropriate third-party fee for the indicated card and payment type.

Three separate third-party fees (immediate, recurring, one-time) can be defined for each card type (credit or debit), for a total of six distinct third-party card convenience fees.

Not all institutions establish third-party fees for credit or debit card payments. For those institutions who do, remember that GOLDPoint Systems sets up and defines third-party fees in the EZPay IMAC Table. An option is also available that allows front-end tellers to waive the third-party fee, but use caution if you want to set that option. Third-party processing fees are still charged to your institution, whether you allow the fee to be waived or not. Contact your account manager for more information.

Note: This also applies to payments made through your payment website, whether you use GOLD AccountCenter or our payment APIs. |

EZPay Discover Card Correction

CMP: 15105

CIM GOLD version 7.20.4 |

An error was preventing Discover from being a selectable credit/debit card company in the EZPay Card Profile. This error has been corrected. |

Bankruptcy Comments Error Correction

CMP: 12312

CIM GOLD version 7.20.4 |

An error was causing CIM GOLD to close if the Loans > Bankruptcy and Foreclosure > Bankruptcy screen > Comments tab was opened for multiple customers in succession. This error has been corrected. |

Marketing and Collections Account Switch Error Correction

CMP: 15497

CIM GOLD version 7.20.4 |

An error message was appearing when users would try to switch to a different customer account while viewing any tab (besides Delinquent Payments) on the Loans > Marketing and Collections screen. This error has been corrected. |

Updates to Cards and Promotions Screen

CMP: 15701

CIM GOLD version 7.20.4 |

We have updated the Cards and Promotions screen so an error message appears when users click the <E-Statement> button, instead of crashing CIM GOLD. If statements are tied to that button, statements will appear. But if the institution does not use e-statements and a user clicks that button, the following error message will be displayed instead of crashing CIM GOLD:

Additionally, users no longer needing to click <Refresh> after information is added to the Marketing and Collections screen > Cards and Promotions tab to show updated information on the screen. |

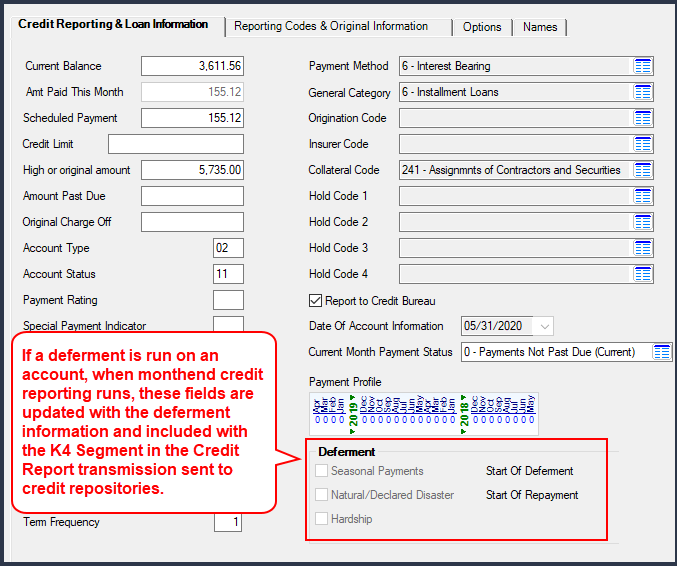

Deferment Fields Added to Credit Reporting Screen

CMP: 15672

CIM GOLD version 7.20.4 |

The Deferment field group has been added to the Credit Reporting & Loan Information tab of the Credit Reporting screen. These fields are for informational purposes only. You cannot make changes to these fields. These fields display whether the loan is currently in deferment due to seasonal payments, natural/declared disasters, or hardship. For more information about deferments, see the Deferment Transactions in the Transaction Manual in the CIM GOLDTeller User's Guide.

Note: These fields will not show the deferment information until the monthend credit reporting process has run.

If the loan is in deferment, the K4 Segment will be included on the Credit Report and transmission (FPSDRP184).

See the Deferment field group help in DocsOnWeb for more information concerning these fields. The following is an example of the Credit Reporting screen showing these fields. |

Loans > Credit Reporting Screen > Credit Reporting & Loan Information Tab

Enhancement |

Description |

|---|---|

Email Message No Longer Shows for Special Monthly Payments

CMP: 15309

CIM GOLD version 7.20.4 |

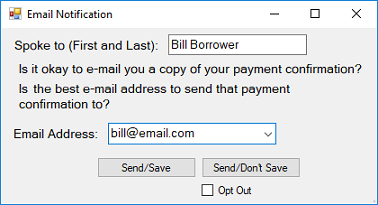

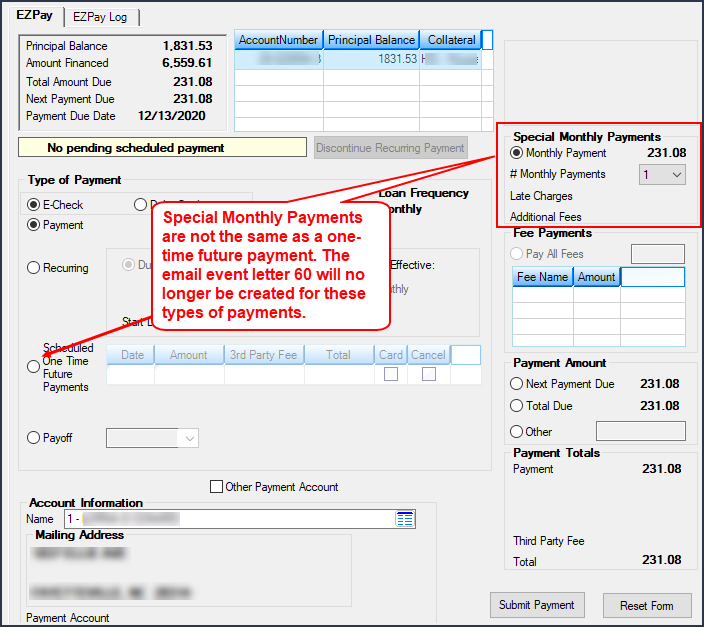

For those institutions that email a notice to customers after making a one-time payment transaction from the EZPay screen, we have updated the system to not show the Email Notification dialog box when a Special Monthly Payment is made.

The Special Monthly Payment was never intended to send an email when the email notification option was created (see CMP 11581 in the CIM GOLD version 7.9.11 release). This option should only be for one-time future payments. However, users found that the Email Notification dialog box (see below) would show after processing a Special Monthly Payment, and when the email was generated, it would be blank. Therefore, we have removed the dialog box from appearing for Special Monthly Payments.

Email Notification dialog box

The following example of the EZPay screen shows where the Special Monthly Payment is found: |

Loans > Transactions > EZPay Screen

Enhancement |

Description |

|---|---|

Amortization Schedule Error Corrections

CMP: 13971

CIM GOLD version 7.20.4 |

Errors were preventing users from accessing and using the Loans > Account Information > Amortization Schedule screen with a customer account open. These errors have been corrected and the screen can be accessed properly. |

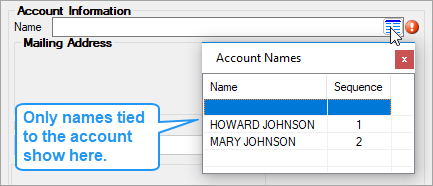

Names Not Tied to Account No Longer Show in EZPay

CMP: 14207

CIM GOLD version 7.20.4 |

We have corrected an error that showed all names in a household when users clicked the list-view icon on the EZPay screen. It has been fixed to now only show names connected to the account, not the entire household (see below).

Loans > Transactions > EZPay Screen |

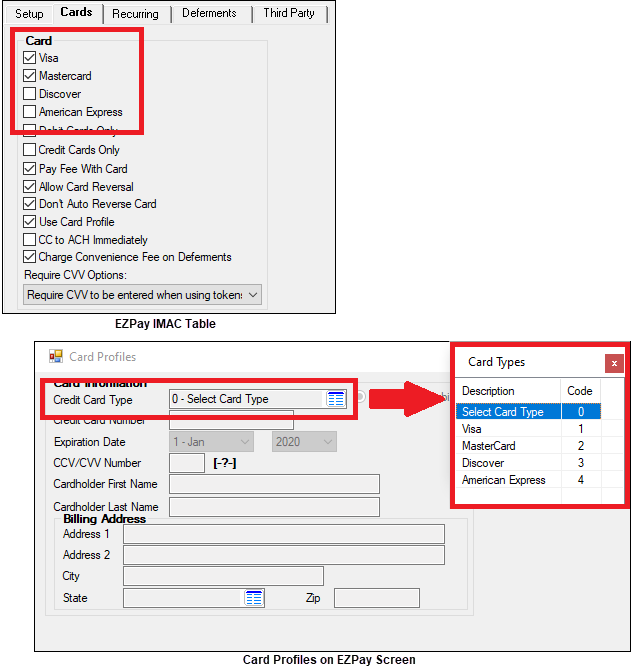

Card Profiles: Card Type Error Correction

CMP: 15398

CIM GOLD version 7.20.4 |

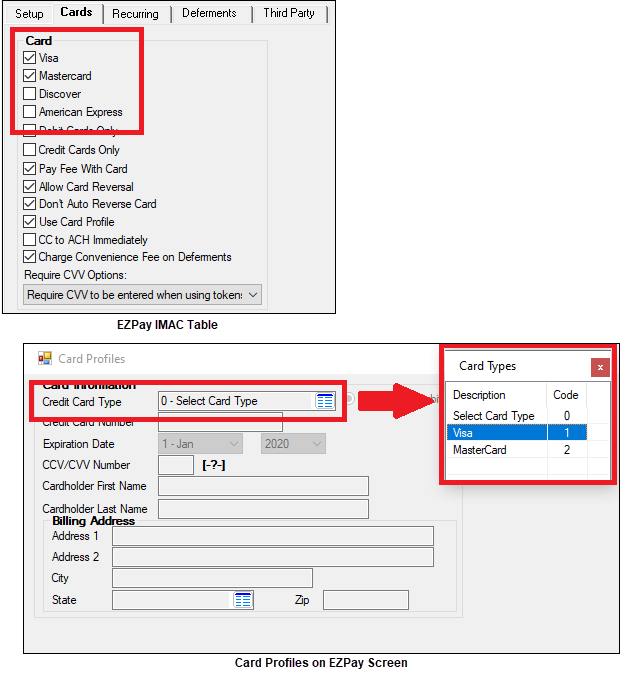

An error was causing all card types (Visa, Mastercard, Discover, American Express) to appear in Card Profiles regardless of which card types were restricted on the EZPay IMAC Table. This error has been corrected, and only card types designated by your institution will be available for selection in Card Profiles. Remember that the EZPay IMAC Table is maintained by GOLDPoint Systems on behalf of your institution, so you must contact your GOLDPoint account manager to add or restrict card types.

|

Before:

After: